Liquidators are closing in on the sale of one of the North Sea’s largest undeveloped discoveries.

FTI Consulting said they were “in advanced negotiations with a party” to sell the Bentley field licence.

But they warned the transaction would “not result in a return of any value to shareholders” of Xcite Energy Limited (XEL).

In their preliminary report to creditors published this week, the liquidators said they had received four offers but had whittled them down to one.

However, FTI said the negotiations were “not exclusive” and that they were prepared to listen to offers from any parties who could close out a deal in a “short timescale”.

Ian Morton and Chad Griffin of FTI were appointed liquidators of XEL last month.

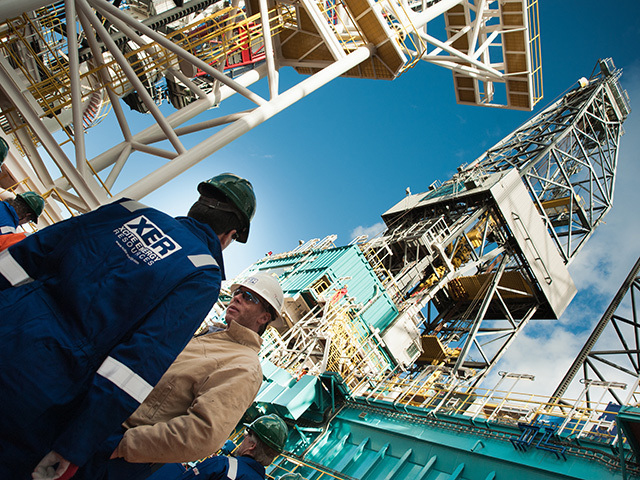

XEL holds 100% of the share capital in Xcite Energy Resources (XER), which has licences in four blocks in the UK North Sea, the most promising of which is Bentley.

The group got into trouble after XER issued £110million-worth of bonds to repay debts and pay for Bentley.

But the group was unable to secure extra funds to pay back the bonds, which matured in full on October 31, 2016.

Bondholders rejected a debt-for-equity swap and an application was filed to place XEL into liquidation.

FTI is working to an “accelerated timeframe” for closing the sale as the group is running out of money.

XER remains outside the insolvency process and is continuing to incur operating liabilities and professional fees associated with the restructuring.

FTI believes the interested parties have had “sufficient time to review the opportunity”.

It said they already had significant knowledge from previous interactions with Xcite, including “access to the dataroom and engagement with XEL in relation to potential funding opportunities”.

Bentley is located on the East Shetland Platform, five miles south-east of the Bressay field – operated by Statoil, with Shell as its partner – and nine miles east of the EnQuest-operated Kraken field.

In May 2014, XER entered into a collaboration agreement with Shell and Statoil which paved the way for the companies to share technical information “for the evaluation of potential synergies and collaboration between the Bentley and Bressay fields”.

Later that year, XER said it had reached an agreement with EnQuest and Statoil to share information for evaluating the use of common gas import infrastructure between Bentley, Bressay and Kraken.

Statoil and EnQuest said they would not comment on market speculation when asked whether they were in the running for Bentley. However, it is understood that Statoil is not the “party” referred to by FTI.

A spokesman for Shell could not immediately comment.

Recommended for you