An oil industry veteran said it was good news that the UK Government has acknowledged the current decommissioning tax system isn’t working for North Sea industry.

In today’s Budget, Chancellor Philip Hammond repeated the Treasury’s earlier announcement that a panel of industry experts consider how tax reforms could ease the sale of mature oil and gas fields.

The Treasury also said the UK Government would publish a discussion paper on how to support the sector.

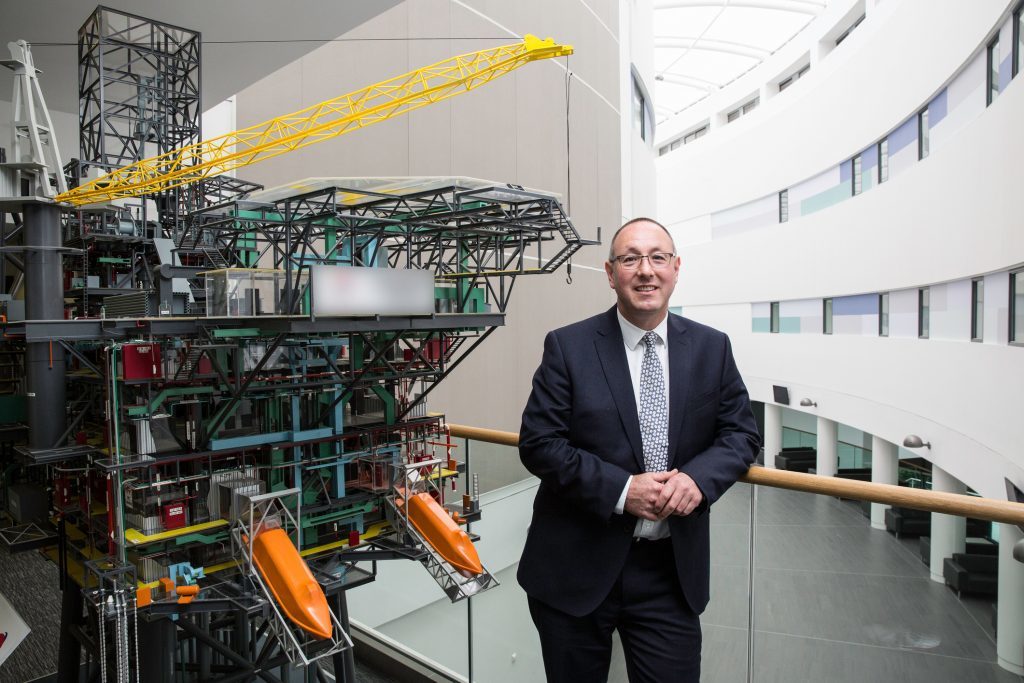

Professor Paul de Leeuw, director of Robert Gordon University’s Oil and Gas Institute, said: “What we all want as an industry is to stimulate more asset sales. The big gap in value is often around decommissioning liabilities.

“How decommissioning tax relief will work has to be resolved and the good news is that the UK Government realises this is getting in the way of progress.

“It’s a very complicated issue so putting experts with backgrounds in taxation, accounting and industry in a room to come up with solutions is part of getting the right outcome.

“If the outcome is more asset deals, then that can only be good for the North Sea and the Treasury.”

Mr de Leeuw also said he would like to see the panel finish its work in a matter of months.

“I do not know how they will implement this but it should be a 2017 activity,” he said.

In its Budget Statement, the Treasury said the review would report at Autumn Budget 2017.

Recommended for you