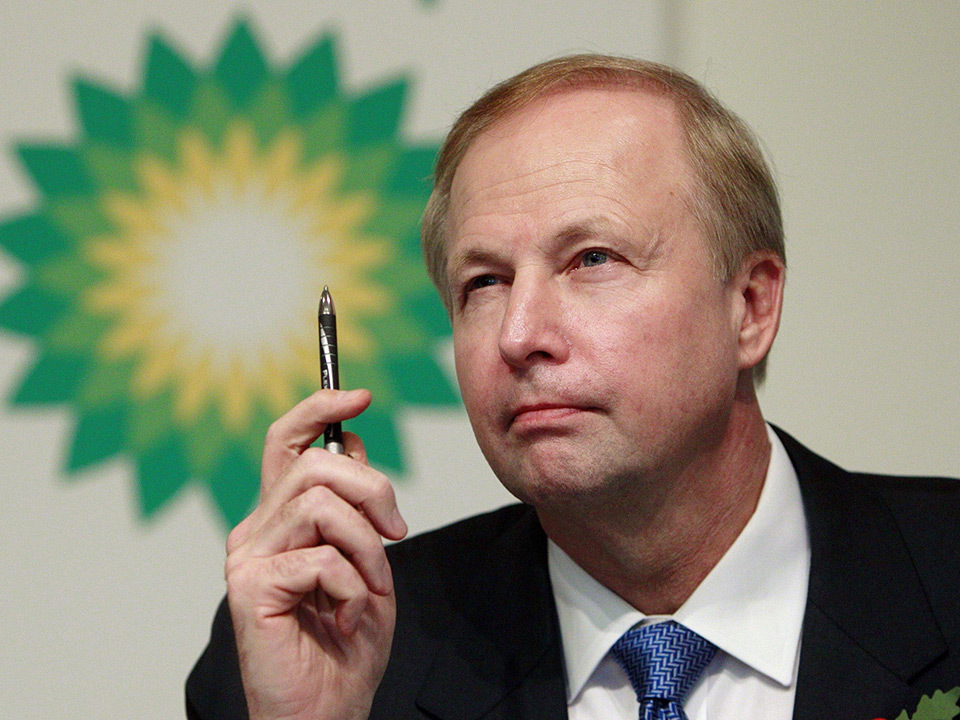

Energy giant BP has slashed chief executive Bob Dudley’s annual remuneration by almost $8 million in order to avoid a fresh shareholder rebellion.

The 40% reduction, revealed in the supermajor’s 2016 annual report, comes among a raft of cost-cutting changes, including a 25 per cent reduction in total bonuses handed out for hitting targets.

Dudley’s maximum yearly payout under the firm’s long-term incentive plan is to drop from a seven times to five times his basic annual salary of $1.9million.

Last year, around 59% of shareholders rejected a proposed increased pay and benefits package, including his pension, worth nearly $20million

Executive salaries and bonus cultures have come under increasing scrutiny in recent years following a string of corporate scandals such as the collapse of chain store BHS.

Shell’s chief financial officer Brian Gilvary’s total remuneration for 2016 dropped to £4.2 million from £5.1 million pounds in 2015.

BP said that from 2017, the proportion of annual bonus that must be deferred into shares will be increased from 33% to 50%.

However, it is expected that Dudley and Gilvary will maintain a shareholding of at least 250% of their salary for two years following retirement.

The changes will now need to be passed by shareholders at the group’s annual general meeting, set to be held on May 17.

Professor Dame Ann Dowling, chairwoman of BP’s remuneration committee, said: “After a thorough review and extensive shareholder engagement, we believe the new policy is simpler, more transparent and has strategic focus.”

The group said employees at a management level – representing around 22% of its workforce – saw their pay rise by 3.5% on average last year, while bonuses fell 7.6%.

In comparison, the boss of fellow oil giant Royal Dutch Shell (LON: RDSB) was handed a 54% hike in his pay package last year to £7.5 million despite sliding profits.

Chief executive Ben van Beurden’s pay deal came as he was awarded a potential £3.8 million under a long-term shares bonus scheme, according to the group’s annual report.

But his annual bonus was cut by nearly a third to £2.1 million after Shell saw annual profits drop 8% to a worse-than-expected £2.9 billion) in 2016, a year in which it also axed another 2,200 jobs.

Read more about it here.

One of BP’s major shareholders, Royal London Asset Management (RLAM) hailed the group’s pay policy overhaul as a “milestone” decision that should set an example for other companies.

Ashley Hamilton Claxton, corporate governance manager at RLAM, said: “We applaud the BP remuneration committee for being proactive in responding to the shareholder revolt last year and see this as a milestone in the engagement between companies and shareholders.

“In particular, the committee applied discretion to override the formulaic outcome of the pay policy, which is a welcome step in the right direction.”

Recommended for you