BP’s chairman has assured investors that the oil giant has made “appropriate” changes to director pay following a shareholder revolt over chief executive Bob Dudley’s remuneration package last year.

Speaking at BP’s annual general meeting (AGM), Carl-Henric Svanberg said that the company’s entire board had worked to review the policy and had proposed a “balanced” alternative.

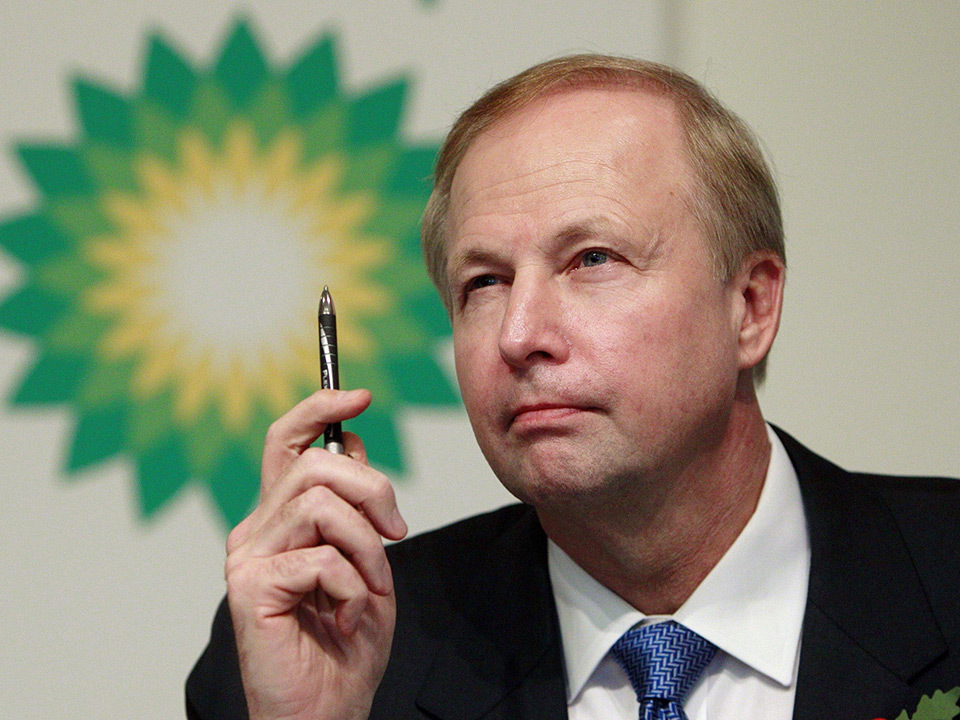

Mr Dudley has seen his pay package slashed by 40% for 2016 and his maximum earnings cut by $3.7 million (£3 million) over the next three years in hopes of seeing off a fresh shareholder rebellion.

Mr Svanberg said: “At our meeting last year, you, our shareholders, sent us a very clear message on how we approached paying our executive directors.

“We said we would listen and come back to you with a renewed policy for remuneration. You will have seen the steps we have taken this year and which we are proposing for the future.”

He added: “The remuneration committee have worked throughout the year, thoroughly to review our practices. This work has involved all of the board.”

Almost 60% of BP shareholders voted against a 20% hike in Mr Dudley’s pay to nearly 20 million US dollars (£16 million) last year after the group posted its largest annual loss for at least 20 years and axed thousands of jobs worldwide.

The group’s latest annual report revealed that Mr Dudley’s pay package was cut to 11.6 million US dollars (£9.3 million) last year.

BP’s climbdown on pay also comes after it remained in the red for a second year in a row in 2016, posting replacement cost losses of 999 million US dollars (£802 million) for 2016 as oil prices languished at a 12-year low of 44 US dollars a barrel.

The chairman added: “I believe that our approach is appropriate, that it is responsive and that it is balanced.

“I am pleased to see that we do have support for these new proposals and I would like to thank Ann and her committee for all the work which they have done during the year.”

Under the new pay proposals, Mr Dudley’s total potential annual earnings for the next three years, excluding pension payments, have been cut from $19 million (£15.2 million) to $15.3 million (£12.3 million).

This is largely after BP reduced his maximum payouts under the long-term incentive plan from a staggering seven times basic salary to five times, while targets for the annual bonus have also been made more stretching.

But the pay plans will have to be passed by shareholders at Wednesday’s annual general meeting.

The changes have been welcomed by shareholder Royal London Asset Management (RLAM), which holds a 0.73% stake in BP worth £670 million.

RLAM corporate governance manager Ashley Hamilton Claxton said: “BP’s remuneration committee has made the right decision to significantly reduce the total pay that Mr Dudley will be awarded going forward, proactively responding to last year’s shareholder revolt.

“Against the backdrop of a season of annual general meetings where companies have been doing the bare minimum to gain shareholder approval in 2017, BP has led the way and applied discretion to override the formulaic outcome of the pay policy.”

Recommended for you