Digitalisation is needed where the pain is “most unbearable”, an industry technology leader has said.

And according to Akselos chief executive Thomas Leurent, the pinch point most in need is the oil and gas sector.

“The term we use for our technology is tough tech,” he said.

“It’s not like an Apple or a smartphone. It is really much harder than that. When you bring something to market like that you are asking customers to exert some sort of effort to adopt. That effort must be dwarfed by the pain it is trying to solve. There must be a very high level of pain for people to come in and adopt a technology.”

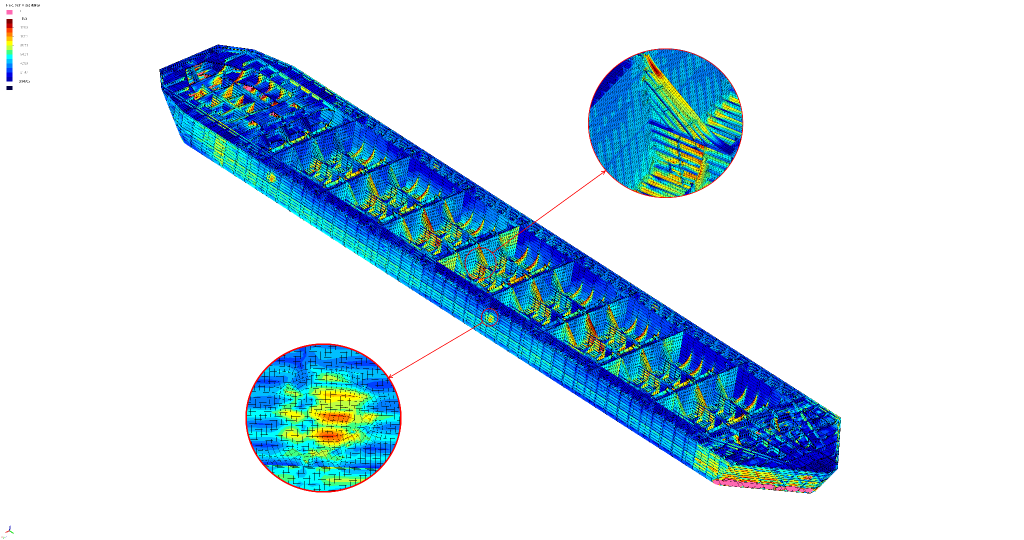

Akselos uses MIT-licenced technology to create the world’s most advanced engineering simulation technology – or digital twins. The tech is based on algorithms that are 1,000 times faster than those typically used in conventional design technology, enabling detailed and accurate structural simulations of large-scale operational assets.

The company’s vision is to combine the simulation software with sensors and big data analytics to create an exact virtual replica of an asset in its current environment, which the company describes as a Digital Guardian. This will allow operators real-time access to the condition of their asset from anywhere at any time and allow a move towards predictive and preventative maintenance. It will also better inform the decision-making process with Asset Life Extension, using data to reassure operators that assets are safe to continue operating beyond their design life.

Mr Leurent, who is a former US government scientist, has historically worked with the automotive and aerospace industries.

“But frankly, the cars run fine. The planes fly OK,” he said.

“You have to find an industry where the level of pain is just unbearable for the technology to be adopted and I think that’s where oil and gas is when it comes to the life extension of assets.

“You have to consider what it means to go outside design life by 20 years and what technology you can bring to make it safer and leaner.”

The MIT grad has since partnered with Industry Technology Facilitator (ITF) to investigate the potential to revolutionise asset management in the oil and gas industry.

But Mr Leurent insists digital transformation is more than just a technology buy-in.

“Digital transformation is not just about technology,” he said.

“It’s going to change the operating model for the operators and it’s going to change the business model for the technology providers. As you go digital you have a lot of the key expertise from the worldwide arena getting embedded into software, which can be used more effectively.

“This gets sold at a high margin and it also means that the business model for the service providers shifts towards selling software with high margins versus selling services per hour.”

He added: “From an industry perspective we hear a lot about the investment in big data and digitisation. Big data on its own won’t crack it.”

Unlike the Amazons of the world where a 51% predictability rate can still make a profit, the sector must hone its ability to leverage big data into a much higher predictability rate.

“In the oil and gas industry, the cost of testing a defect you have identified may exist, if it’s a subsea inspection, is going to be $2million. If you’re going to do an inspection based on big data you want a predictive power north of 90%.

“That’s not what big data can do for many reasons. It usually has a lower predictive power, because there’s too few data points. The data points you’re interested in aren’t all the

ones that get streamed from the sensors. It’s specifically the failure ones, when something fails you have a data point. When it runs fine you don’t. And things don’t fail often, which is good.

“Trying to provide big data where there isn’t a lot of relevant data to work with and the cost of testing your hypothesis is in the millions of dollars is not what big data was built for.

“A lot of big data has been sold as if it works for Amazon it will work for the oil and gas industry. It doesn’t. The models we bring create structure with a handful of data points.”

As well as changing the industry’s pace of response, digital will also change the scope of those responding, according to Mr Leurent.

“When cash machines were created people thought it would wipe out all sorts of jobs in the system, but it created higher value jobs,” he said.

“The same thing is going to happen as we go through this digital transformation. The jobs are going to change, but to say that jobs are going to disappear is not correct.

“We’re going to make things safer and make our infrastructure more sustainable and lower the industry’s carbon footprint.

“One thing we can’t ignore is that as the pace for innovation goes faster, the companies and the governments have a responsibility in making sure people can get retrained and ultimately do jobs that will be augmented by better tools and be more interesting.”

Recommended for you