Aberdeen-based Plexus Holdings is to focus “100%” on proprietary technology following the sale of its wellhead exploration equipment and services business for jack up business to TechnipFMC.

Oilfield service giant TechnipFMC struck a deal to buy the segment for £42.5million back in October.

TechnipFMC said the unit would become part of its surface technologies division and that key staff members from Plexus would be transferred.

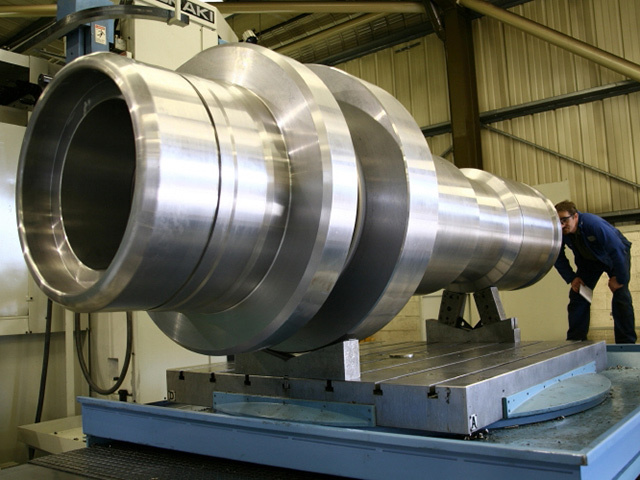

Plexus chief Executive Ben van Bilderbeek revealed yesterday that going forward the company would e looking to replicating the success it had with its POS-GRIP friction grip technology wellhead equipment.

The firm said it hopes to win new business with the model despite continuing subdued levels of exploration activity as a result of the extended period of low oil prices.

A collaboration agreement has also been set-up with TechnipFMC at completion to explore the development of new and existing products based on POS-GRIP, for roll-out into new markets within the wider energy sector which could extend to production, subsea, geothermal and fracking applications.

Mr van Bilderbeek said: “Going forward, Plexus will be 100% focused on replicating within the wider energy industry the success our proprietary POS-GRIP technology has had in jack-up exploration.

“This has seen our equipment deployed by blue-chip operators such as BP, Centrica, Maersk, Royal Dutch Shell, Statoil and Total on over 350 wells worldwide and in the process set new higher standards in terms of performance and safety.

“We already have a suite of POS-GRIP products designed for use in other energy sub-sectors and, with this in mind, the recent announcement of a first contract with Centrica to supply our production wellhead equipment bodes well for the future.”

He added: “Thanks to a cash rich, debt free balance sheet; a streamlined cost base; a fully paid up inventory of jack-up exploration wellheads; and long-standing relationships with a blue-chip customer base, Plexus has been positioned to withstand a lower oil price.

“Prior to the downturn, we had become the dominant supplier of HPHT wellheads in the North Sea jack-up exploration market with a near 100% market share, and had made inroads in other parts of the world, having won orders to supply operators with equipment for wells being drilled in geographies such as Asia, West Africa, Australasia, and Venezuela.

“Despite the drop off in activity, we have continued to win orders where there has been business to be won. Post period end, we were delighted to announce an order for a well to be drilled by Russian supermajor Rosneft in Vietnam, a double first for Plexus in terms of a new customer and a new geography.

“However, as the full year numbers demonstrate, there can be no doubt that the challenging trading conditions of the past two years have acted as a brake on our plans to position POS-GRIP as an enabling technology in the energy industry.”

Plexus employs about 50 people across two buildings in Dyce.

TechnipFMC is expected to take over the sub-lease for one of the buildings, with Plexus retaining the other.

The acquisition was not expected to result in any job losses..

The jack-up business contributed 99.7% of Plexus’ revenues for the year ended June 30, 2016, which totalled £11.2million.

Revenue for the year ending June 30 was £4.7million.

Loss before taxes amounted to just over £7million, compared to £6.9million reported for the previous year end.

Recommended for you