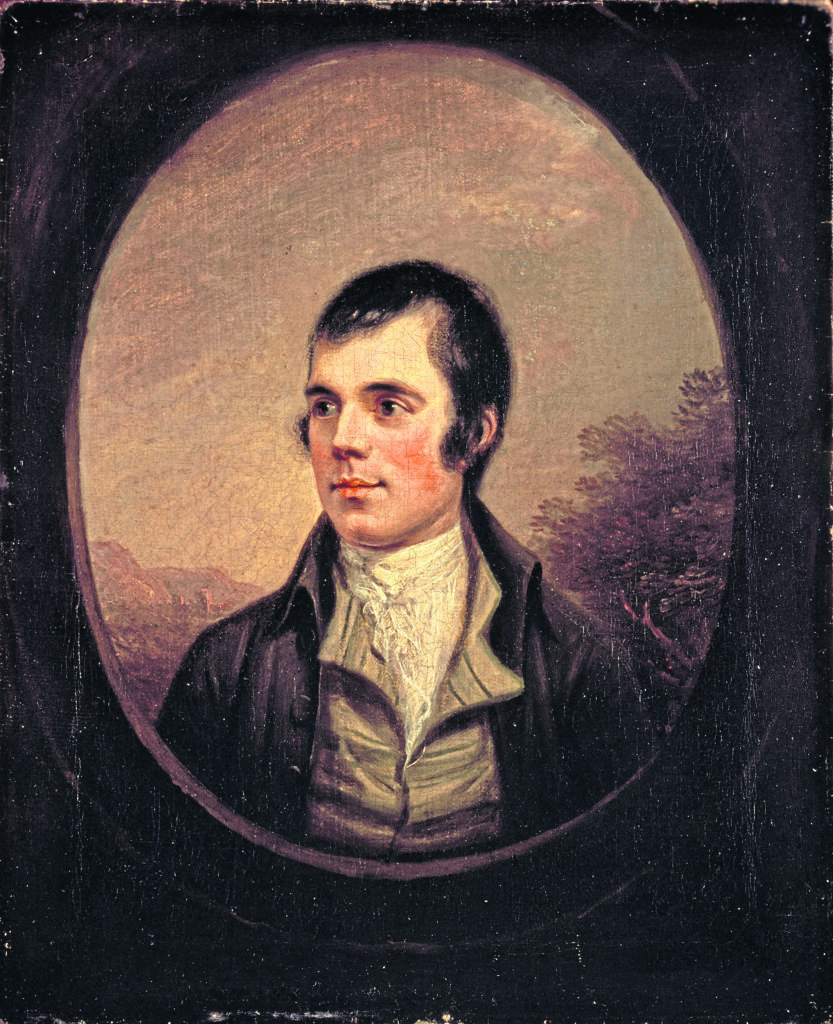

“O wad pow’r the giftie gie us, to see ourselves as ithers see us” – one of Robert Burns’ most well-known phrases offers insight to the UK’s oil and gas industry. To say it has changed in the last three years is a stretch to the farthest realms of understatement.

Operating costs halved as industry pursued its efficiency agenda, putting it in a better position to weather volatility in international oil markets.

A shared ambition to maximise economic recovery has been nurtured by industry, government and a new regulator.

A basin once known for being high cost, long return, has overhauled its reputation in the eyes of international markets.

The sense of cautious optimism prevails on the UK Continental Shelf. But those who claim we’re out of the woods would do well to speak to the supply chain, where revenue fell from £41.3 billion in 2014 to around £28 billion in 2017 and where conditions remain tough.

Our Business Outlook report identified up to 16 new greenfield or major brownfield developments which could unlock £5bn of investment this year. So far this year we have seen more major projects gain operator approval than the last two years combined.

This investment is badly needed to stimulate activity, and it’s been enabled because of our response to the downturn.

Shell’s decision to go ahead with the redevelopment of Penguins oil and gas field at the beginning of the year was its first major new UKCS project approval since 2012.

With a breakeven price of below $40 per barrel, the FPSO is expected to have a peak production of around 45,000 barrels of oil per day.

Following on from this, Shell also committed to developing the Fram field in the central North Sea. Cost improvements and innovative approaches will continue to be critical for majors looking to maximise economic recovery from the North Sea.

These factors have also spurred a new, diverse wave of entrants to the basin.

Neptune Energy recently announced it will acquire 35% of the Seagull development and 50% of the Isabella prospect, which it said would give it low cost, near-term development options near existing infrastructure in the central North Sea. In addition to this RockRose has acquired a 20.43% stake in the

Arran development and Chrysaor is extending the productive life of its Armada hub through a multi-well drilling campaign.

These all provide further signs of an industry in pursuit of maximising recovery from our mature basin. Innovation, collaboration and a sustainable cost profile are unlocking investment across the UKCS, from a diversity of players, and we need to maintain and build on this momentum.

In the frontier regions west of Shetland, there is a wave of new activity. There is exploration activity taking place by a number of companies and BP’s Alligin field will be tied back to the Glen Lyon FPSO vessel.

Expected to come on stream in 2020, it’s part of a two-prong campaign which also includes Vorlich, a two-well development in the central North Sea.

The innovative development of the Tolmount field confirmed in recent weeks will ensure that the southern North Sea continues to make a

significant contribution to the UK’s economy and energy supply for many years to come.

Oil & Gas UK’s Efficiency Task Force continues to seek out, promote and provide access to efficient practice.

Our subsea standardisation guidelines, developed with industry in partnership with stakeholders, will help realise significant savings by adopting a simplified approach to project execution, and through standardisation of subsea technology.

On September 11 Oil & Gas UK will publish its Economic Report, which will consider the drive to improve the UK’s position as an internationally competitive investment proposition.

It will look to the future to consider how industry will need to continue to adapt and evolve in order to position itself to achieve its full potential, as set out in Vision 2035.

The report will offer valuable insight into the UK’s performance relative to other mature offshore basins and assess the case and

outlook for much-needed new

investment in the basin.

Ross Dornan is Oil & Gas UK’s market intelligence manager

Recommended for you