Equinor has confirmed it is revising plans to develop one of the largest untapped oil fields in the UK North Sea.

The Norwegian firm is considering ditching previous operator Chevron’s plan to develop the Rosebank field west of Shetland, estimated to hold 300million recoverable barrels of oil.

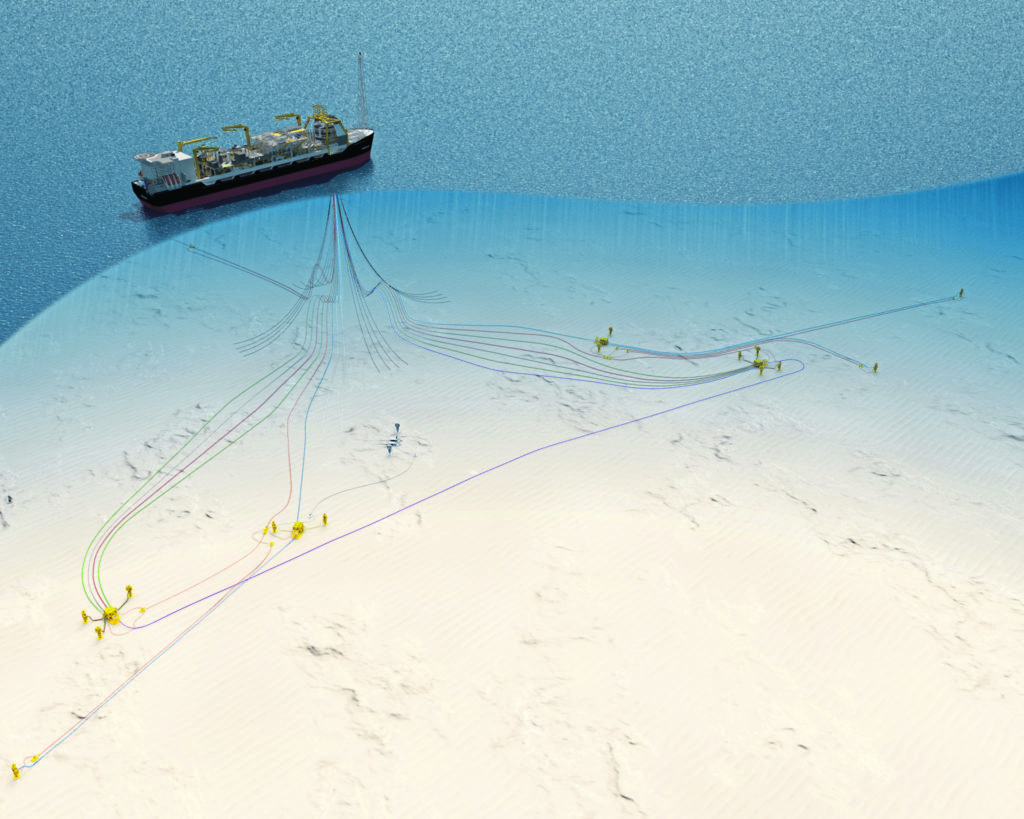

It is instead looking at a leaner floating production, storage and offloading unit (FPSO) based on its Johan Castberg project in Norway.

Last month Equinor wrapped up the acquisition of Chevron’s 40% operated stake in Rosebank.

The project has stuttered since its discovery in 2004.

Consultancy Wood Mackenzie estimates it will cost around £4.5billion to develop, producing up to 20 wells.

Equinor is aiming to take learnings from the development of its Johan Castberg project, an FPSO in the harsh waters of the Barents Sea, which is due to start up in 2022.

In order to make Johan Castberg economic during the 2014-15 oil price crash, Equinor re-engineered it to cut costs by around 50% through work with suppliers.

The firm said it is seeking to use the “value improvements” of that project to improve the plans for Rosebank.

Equinor is 40% owner-operator, along with partners Suncor (40%) and Siccar Point (20%)

The firm also confirmed they are in “ongoing discussions” with the Oil and Gas Authority (OGA) on a potential extension to the main Rosevank license (P1026) which is due to expire on May 31.

A spokesman for Equinor said: “We are taking some time for a detailed assessment of the current concept, seeking to leverage experience from our next generation portfolio and value improvements made to recent project concepts such as Johan Castberg.

“Any extension to the current licence will be part of ongoing discussions with our partners and the Oil and Gas Authority.”