Australian energy service firm WorleyParsons said today that revenues were “flowing” from its recently acquired Aberdeen operation in the last six months of 2018.

WorleyParsons bought Amec Foster Wheeler’s oil and gas business following the latter’s acquisition by energy service giant Wood in 2017.

The deal marked WorleyParsons’ entry to the UK North Sea market.

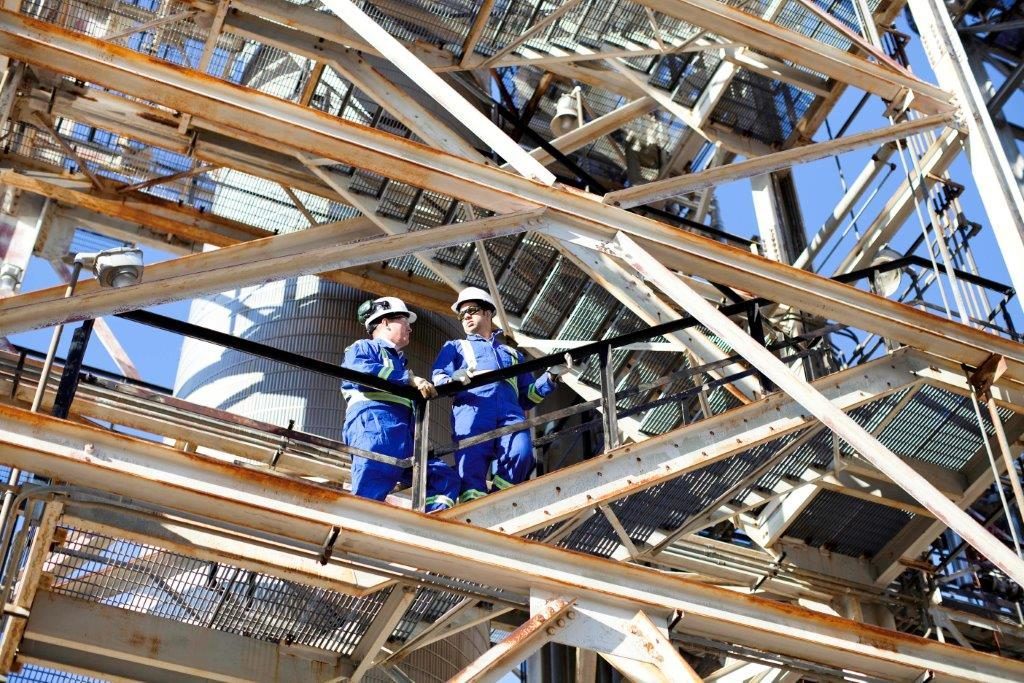

The Sydney-headquartered company said its UK Integrated Solutions (UK IS) division had provided a “step change” in its maintenance, modifications and operations offering.

WorleyParsons made the comment in its half-year results announcement, which revealed a 46.2% increase in pre-tax profits to £64 million (A$116.7m).

Revenues totalled £1.4 billion in the six months to December 31, up 9.8% compared to the same period in 2017.

The company said that growth was partly attributable to having the benefit of the UK IS business for the full period.

The firm’s hydrocarbons sector reported a revenue increase of 13% to £1bn.

WorleyParsons also said it acquisition of Jacobs Engineering Group’s energy, chemicals and resources division should go through in late March or April.

WorleyParsons chief executive Andrew Wood said: “Our business has continued to grow through a combination of our focus on the resources and energy sectors, cost reductions delivering operating leverage and improved market conditions. Aggregated revenue has now increased for the fourth consecutive six-month period.”

The company has about 2,500 employees in Aberdeen.