The UK’s annual spending on decommissioning activities has been forecasted to go beyond £1.5billion within three years.

Analyst firm Rystad Energy made the prediction, stating that the UK currently has more than 50% of the global market share in offshore decom.

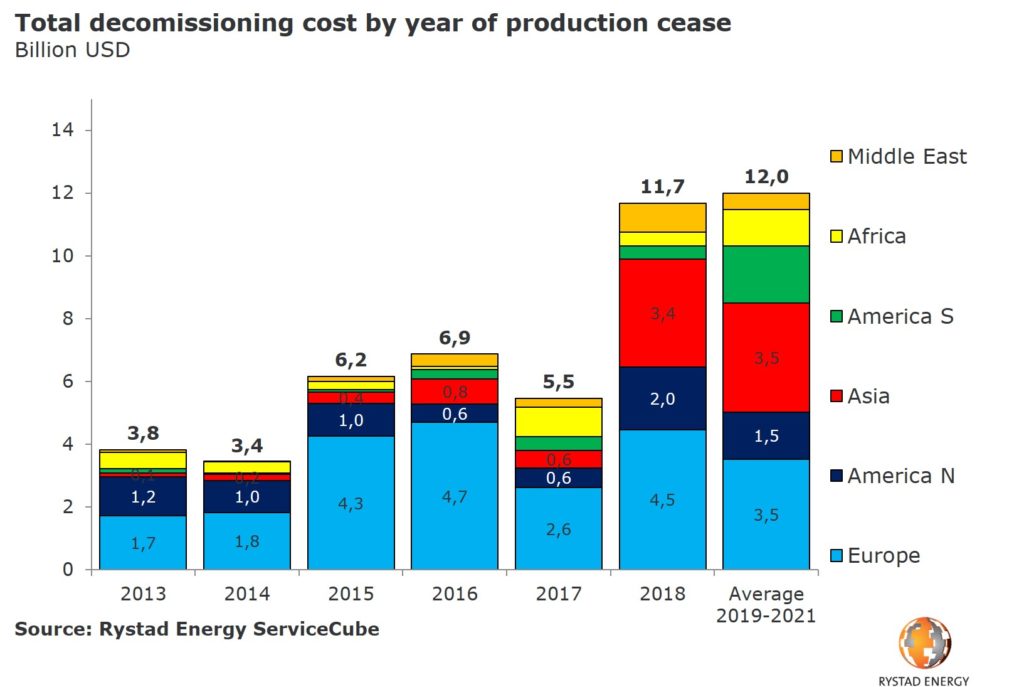

It comes amid a forecasted surge in activity globally, with the worldwide spend on decommissioning over the next three years predicted to be more than £27.5bn.

Decom obligations globally are expected to hold steady at around £9.1bn per year from 2019 to 2021, according to the analysts.

Rystad said around 9,000 wells globally are at fields struggling to stay profitable at $60 Brent crude oil prices.

Head of oilfield research, Audun Martinsen, said the boost in activity comes as operators realise the need to shut down “elderly uncompetitive assets”.

While Europe, driven by the UK, is accounting for a large chunk of the spend, regions like Asia and South America will also increase their decommissioning activity in coming years.

Mr Martinsen said: “In 2013 and 2014, when oil prices where high, very few operators initiated plans to decommission older assets.

“Instead, they sought to maximise returns from their producing assets. However, as oil prices dropped to painfully low levels in 2015 and 2016, many of these field life extension plans were deprioritised or scrapped altogether.

“Although oil prices have recovered to more sustainable levels, the elusive $100 dollar-barrel still seems like a distant dream for most operators.

“As a result, numerous operators have begun realising their obligations to decommission elderly uncompetitive assets.”

Recommended for you