Shell is expected to spend $1.5bn (£1.152bn) on decommissioning in the North Sea over the next six years, according to a new forecast.

Analysis from GlobalData shows the energy major tops the list of firms with decommissioning costs in the UK, with an estimated total of more than $3billion (£2.3bn).

Shell is followed by Apache, Total, ExxonMobil and BP.

Up to half the value is expected to be spent by 2025, with the Brent oil field being the main driver along with aging developments like Pierce and Curlew.

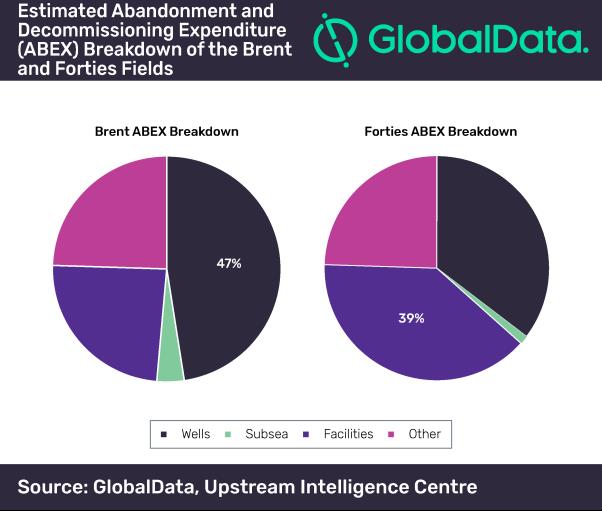

Brent is one of two fields with the largest abandonment and decommissioning expenditure (ABEX) along with the Apache-operated Forties field, with the combined total estimated to reach as much as $4bn (£3.6bn).

Forties is not expected to cease production until the 2030s but Brent is expected to cease next year.

Shell is expected to make large savings on Brent through its plan to keep the huge concrete legs of the three of the platforms in place, although that is being met with opposition.

Last week Germany’s environment ministry announced it has lodged an official objection with the Ospar Secretariat over issues relating to comparitive assessment for the decommissioning programme.

Daniel Rogers, upstream oil and gas analyst at GlobalData, said: “The total plug and abandonment expenditure alone for the Brent field could reach US$900m and spans from 2008 to 2020 with over 150 wells in total.

“The decision not to remove the Brent gravity based concrete structures weighing around 960,000 tons due to technical and safety concerns will come with significant cost savings; the decision, however, is being largely disputed by environmentalists and neighbouring countries.

“Despite the Forties Production System (FPS) pipeline not due for abandonment in the near future, the removal of the approximately 150,000 tons of platforms at the field could cost the participants some US$700m.

“This will weigh heavily on current operator Apache Corp and as a result places the company only behind Shell in terms of UK abandonment and decommissioning liabilities from producing assets.”

The study also showed growth in the number of UK asset retirement contracts issued since the 2014 oil downturn, but the number has remained relatively flat since 2016 after a sharp initial rise.

Improved oil prices and tax regime could further delay decom projects.

Mr Rogers added: “Given the recent stabilisation of oil price and a push by the UK government to maximize economic recovery from existing assets, the outcome will likely lead to project abandonment delays and rejuvenated investment at legacy fields.”

Recommended for you