SSE has announced it is “taking active steps” to sell off its North Sea gas production business as it focusses on renewable energy sources.

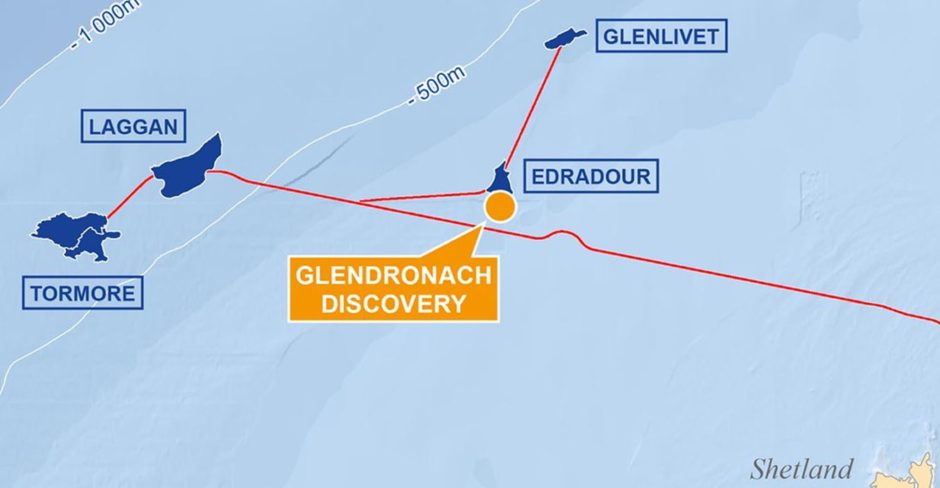

The energy supplier has stakes in a number of offshore fields in the UK, including a 20% interest in the Greater Laggan Area in the West of Shetland, operated by Total.

This includes the Glendronach discovery made last year, estimated to hold 175million barrels of oil equivalent.

In its full-year accounts for 2018, SSE said Glendronach was “clearly a positive development” which it is working with partners to extract full value from.

However, the firm added that gas production is “ultimately inconsistent with its focus on decarbonisation” and is taking steps to sell its interests but will only do so when it is in the interests of shareholders.

In November SSE said it would “seek different routes for securing value” from the production branch, with “disposal expected to be the most likely”.

In 2018, the gas production business had adjusted profit of £48.9m, up from £34m the previous year, mostly due to lower depreciation, higher gas prices and the absence of exploration write-offs.

For the wider company, SSE saw its profits drop by nearly 40% in 2018 as a result of “persistently high gas prices”.

Adjusted profit before tax was £725.7m, down from £1.1bn the previous year, while adjusted operating profit also dipped by 27% to £1.1bn, compared to £1.5bn at the end of 2017.

SSE said it reflects a £284.9milliion operating loss from its Energy Portfolio Management (EPM) business which came as a result of the “negative impact” of gas prices on its energy provision.

The firm said that while the results “fell well short” of its targets, it hailed significant progress in becoming a low-carbon energy company, including completion of the Beatrice Offshore Windfarm and the £1bn Caithness-Moray Transmission link.

SSE also stated that it has “held for disposal” its Energy Services business, which is not reflected in the results.

Chairman Richard Gillingwater said: “While our financial results clearly fell well short of what we hoped to achieve at the start of the year, we’ve made significant progress towards our ambition to be a leading energy company in a low-carbon world.

“We have continued to develop our core businesses of regulated energy networks and renewables; demonstrated our ability to create and unlock value from developing and operating, as well as owning, assets; and adopted clear long-term goals as we set up the business for long-term success.

“The fundamental strengths of our business and the strategic opportunities afforded by the transition to a low-carbon economy will support the delivery of our five-year dividend plan and creation of value for society as a whole.”

Recommended for you