A government report has revealed CNOOC was the biggest tax spender in the North Sea last year while energy giant Shell paid the least on balance after a reimbursement.

The “extractive industries transparency initiative” (Eiti) report highlights progress in getting UK-based oil, gas and mining companies to disclose their payments and receipts to and from government agencies.

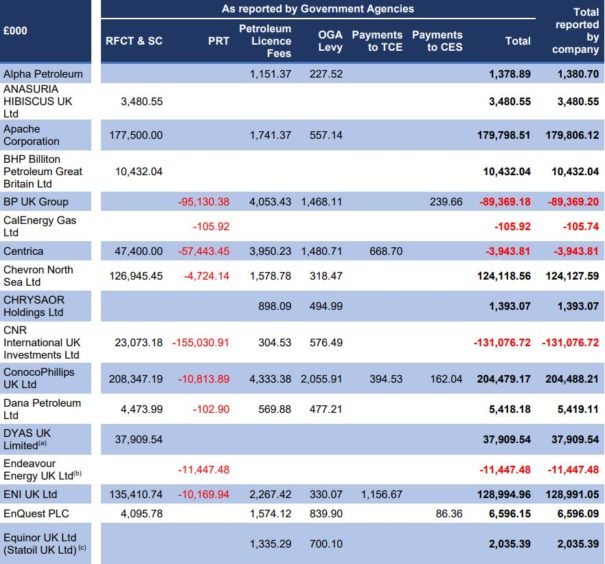

Chinese firm CNOOC – then known as Nexen in the UK – paid £465.2million to the government last year (see full tables below).

The payments cover £462m in ring-fenced corporation tax (RFCT) and supplementary charge (SC), as well as £5.9m in petroleum licence fees and £621,000 for the Oil and Gas Authority (OGA) levy.

This was partially offset by a Petroleum Revenue Tax (PRT) rebate of £3.3m.

The firm is the operator of Buzzard, which is the largest producing field in the UK North Sea.

Nexen changed its name last year after being taken over by China National Offshore Oil Corporation (CNOOC) in February 2013 in a £9.4billion deal.

At the other end of the spectrum was Shell – in receipt of £217.7m in PRT reimbursements.

This more than offset the £21.9m paid in RFCT and SC, along with a combined £4.4m for licence fees and the OGA levy and £222,000 paid to Crown Estate Scotland.

The firm said it comes amid heavy investment in new fields and infrastructure over the last decade, as well as spending on decommissioning older assets.

The UK’s tax regime, designed to encourage future investment, means that participators in certain older oil fields can carry-back losses, such as those arising from decommissioning, against profits previously made from them. This can lead to repayments of Petroleum Revenue Tax.

Shell, which employs more than 5,000 people in the UK has recently been carrying out a range of decommissioning works on its Brent field in the North Sea.

A spokesman said: “Shell in the UK has been investing heavily in new fields and infrastructure over the last decade, as well as starting the decommissioning of older field infrastructure.

“These investments and costs have substantially reduced recent taxable income. However, we expect the additional investment will generate greater taxable revenues in the future.”

Canada’s CNR International and energy giant BP were among the largest beneficiaries of receipts from the Exchequer, receiving £131m and £89m respectively after other tax payments.

Alongside CNOOC, big North Sea taxpayers in 2018 included Suncor Energy and ConocoPhillips, paying £295m and £204.4m respectively. US firm Apache paid £180m.

Chrysaor, which this year acquired ConocoPhillips’ North Sea assets to become one of the largest operators in the UK, paid £1.4m in 2018.

On balance, the UK government took in £1.17bn from oil and gas firms last year, up from £912.5m in 2017.

CNOOC declined to comment on the tax payments.