More than 200 oilfield services firms (OFS) across the UK and Norway are “set to become insolvent” due to the coronavirus outbreak, according to Rystad Energy.

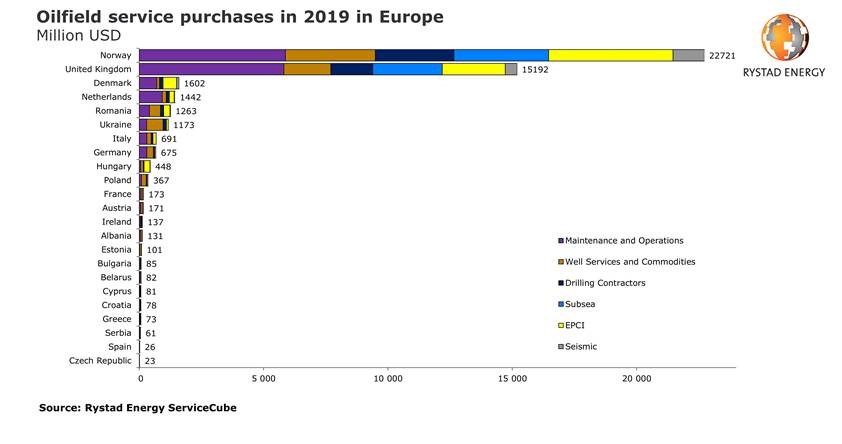

The spread of the virus- known as Covid-19 – has wiped £4.1billion of purchases from the OFS market, the consultancy said, mainly in maintenance and operations (MMO), drilling rigs and well services.

Rystad said “bankruptcies will have to follow”, with the crisis being worse than what these firms experienced following the last oil price crash.

There are more than 1,000 small and medium-sized suppliers in the UK and Norway and “as many as 20%, effectively more than 200 companies, could become insolvent”, according to head of OFS research Audun Martinsen.

He added: “This will have a pronounced effect on the European energy service market, which is heavily dependent on its international workforce and an efficient flow of goods and services between nations.

“For Europe, this crisis is worse than the one that OFS companies experienced in 2015 and 2016 after the oil-price fall.”

The number of bankrupt firms could swell beyond 200 when taking into account wider Europe, Rystad said.

Oil prices have been dramatically hit by the outbreak, combined with a series failed supply cut talks between major producing countries, dropping to below $30 a barrel earlier this week.

Rystad said cross-border travel limitations, supply insufficiencies, quarantines and capex reductions are only some of the market’s challenges.

A number of UK operators have reduced manning levels and activity offshore, while the oil price drop is also expected to push back M&A activity and approvals for new developments.

In Norway, Aker Solutions warned 6,000 workers earlier this week of potential job losses due to the impact of the virus. Rystad said a similar fate “could soon apply to many rival engineering houses in Europe as well”.