The world has been transformed in the past month since the COVID-19 pandemic took hold. The dramatic impact of COVID-19 on global oil demand and has been compounded by Saudi Arabia and Russia failing to agree production cuts to stabilise oil prices. With Brent trading well below US$30/bbl the resilience of the sector is once again being pushed to its limit. What does this mean for the UK and Norway upstream sectors?

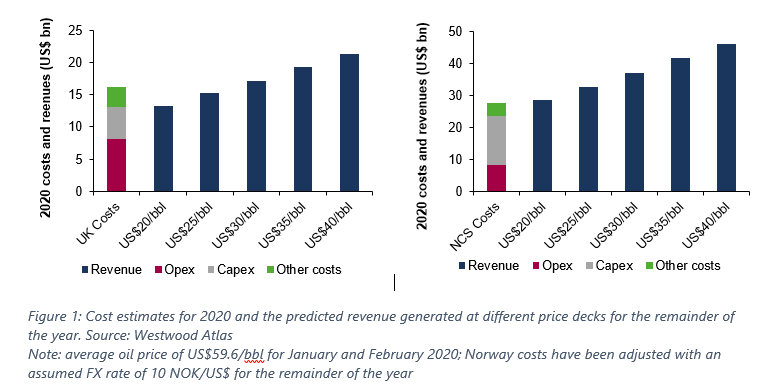

Westwood analysis (Figure 1) suggests that if the oil price remains below US$27/bbl for the remainder of the year, UKCS production is not generating enough revenue to cover both operating costs and the planned capital expenditure in 2020. Norway fairs better and even with an oil price below US$20/bbl for the rest of the year it can still cover its operating and capital costs. Meanwhile, companies are cutting discretionary spend and deferring expenditure where they can.

In the short-term, production is unlikely to be impacted significantly, though operations are being reviewed to minimise offshore activities which put people at risk of greater exposure to COVID-19. So, in many cases this will mean reducing staff offshore to the minimum level required for core operations. In addition, companies are reviewing projects and looking to defer non-essential work and build this back into their plans once the oil price recovers.

The UK sector worked hard to reduce costs post the 2014 oil price crash. Operating costs were reduced to an average well below US$20/bbl, and still are. However, there are some production facilities with costs above this level and some are likely to have their cessation of production date brought forward. On the whole these are the ultra-mature installations with lower production levels and these will need a more stringent review to reduce costs for the remainder of the year. Westwood estimates that 11% of UK forecast 2020 production comes from assets that have operating costs >US$20/bbl and 4% are in assets with opex/boe >US$30/boe. In Norway, less than 2% of production is from hubs with opex/boe costs >US$20/bbl and 0.6% is from assets with opex/boe costs >US$30/bbl.

In the UK at the start of 2020, 12 fields with 320 mmboe of reserves were expected to be sanctioned for development. Some operators have already announced delays to projects and Westwood has also taken a view on other field sanctions likely to slip. In total, 264 mmboe in seven fields has been deferred or removed. The largest deferred field development is Cambo, with its project sanction now officially delayed until 2H 2021. Only two developments involving five fields are still expected to be sanctioned in 2020.

In Norway, only three projects were expected to be sanctioned in 2020, with associated reserves of 269 mmboe. This has now been reduced to two expected sanctions, with the DNO operated Brasse field sanction, with 73 mmboe, expected to be delayed until 2021.

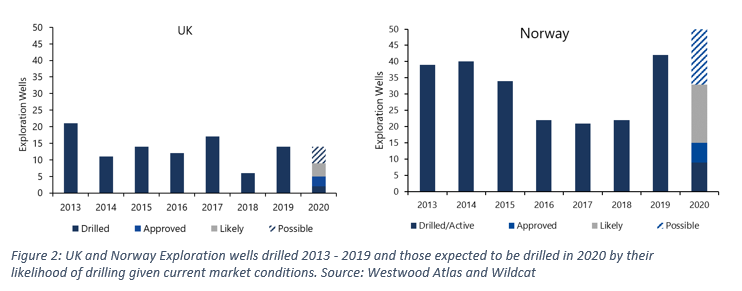

In previous oil price downturns, exploration and appraisal have been the areas hardest hit, and it is no different this time with 2020 plans being in a state of flux. At the start of 2020, Westwood estimated 66 exploration and 17 appraisal wells were in companies’ plans and were expected to be drilled this year in the UK and Norway. Currently, we are seeing decisions being taken to defer wells to limit workers’ exposure to COVID-19, and to defer wells as budgets are reviewed and agreements are reached between operators and respective regulatory bodies.

In the UK, the pool of potential exploration drilling has been reduced to 14 wells. Two wells have already completed this year, three have been approved to drill and four have firm commitments. There are a further five wells that will most likely be deferred to next year. In Norway, six exploration wells have been drilled to date and two are currently active. A further six have been permitted to drill and another 18 wells are currently still in company plans. A total of 17 exploration wells in Norway are likely to be deferred. Appraisal drilling is also being reviewed by companies with many likely to be postponed to 2021.

The current COVID-19 induced crisis is perhaps the greatest challenge yet to face our industry. With the oil price sub US$30/bbl, the UK is struggling to generate enough revenue to cover both operating costs and the planned capital expenditure in 2020. Norway can still cover its costs but Government will see tax revenues plummet. Deep spending cuts are inevitable and the focus will be on delaying and deferring capital projects, as there is little room for cuts in an already squeezed supply chain. It will undoubtedly hurt the industry and hasten abandonment for some assets. There are, however, some notable companies with low operating costs who may yet find opportunity in adversity.

Yvonne Telford is senior analyst, NW Europe, and Alyson Harding is technical manager, NW Europe, at Westwood Global Energy Group

Recommended for you