Western Europe’s maintenance, modification and operations (MMO) market will likely take a major hit in 2020 a Rystad Energy impact analysis has revealed, thanks to severe spending cuts and Covid-19 transportation restrictions. Spending in Norway is expected to fall to $3.4 billion this year – an 18-year low – while UK spending is on track to fall to $2.9 billion, the lowest level seen since at least 1990.

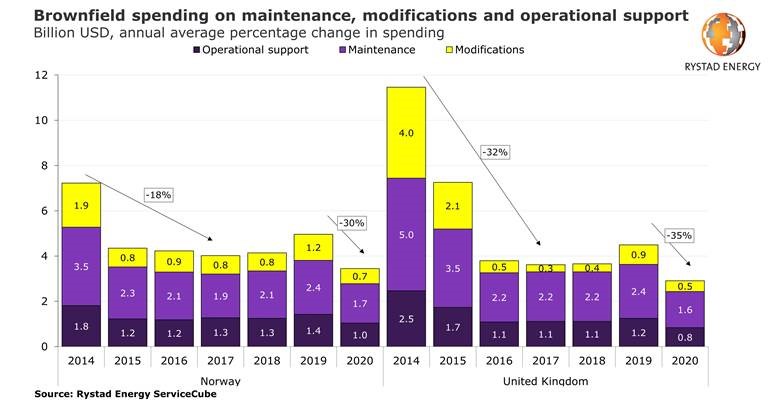

This year we expect brownfield-related MMO support to drop by 30% in Norway and 35% in the UK. Oil and gas prices are expected to improve from the second half of the year, and with that, brownfield budgets are set to slightly improve in 2021. However, if companies need to continue with minimum manning and operations for a prolonged period, spending in the region is likely to be even lower for 2020 as a whole.

“We expect a drastic decline in MMO manhours ahead as operators reduce activity and handle a greater share of such jobs with their own staff, as seen in the previous downturn. The swift oil price decline is coupled with coronavirus regulations and operators are forced to adjust,” says Rystad Energy’s Lein Mann Hansen, an analyst within Energy Service Research.

This will boost the potential for insourcing maintenance and operations jobs and will result in significant cuts in operator expenditures. However, even though oil prices and weak market activity in the medium term will send operators into survival mode, they cannot expect significant cost cuts within the supply chain as there aren’t many additional productivity improvements to be found.

Multiple fields that were expected to come on line in Norway and the UK this year have recently been delayed to 2021, reducing brownfield services revenues for service providers. In Norway, the fields impacted by delays are Martin Linge, the Njord Future redevelopment, Hyme, Bauge, Yme and Tor. Restrictions to curb the spread of Covid-19 played an important role for some of these delays.

Norway joins other oil producing countries in cutting production in the second half of the year, and some of Norway’s contribution to this decrease will come by delaying the start-up of some new fields, including Yme.

In the UK there has been no direct communication about potential start-up delays at new field developments, but we may see delays to 2021 for BP’s Vorlich and Shell’s Fram projects.

“As contracts come up for renewal, MMO suppliers are, yet again, in a position of weaker bargaining power. All providers will do everything they can to win these contracts and secure activity and visibility in uncertain times. One thing is clear – suppliers will now face tougher competition, and the operators hold better cards,“ adds Mann Hansen.

Recommended for you