The “astonishing” changes in the world oil market have left the North Sea industry facing a “very tough” future, a top petroeconomist has warned.

Professor Alex Kemp, of Aberdeen University, said prevailing low oil and gas prices threatened to drive expenditure to “extremely low levels”, leave “lots of fields undeveloped” and cause production to fall “quite sharply”.

In a new report covering the period 2019-50, Prof Kemp stressed the sector’s future would depend on technology which can enhance productivity.

The goalposts have shifted considerably since he and colleague Linda Stephen published their last report in December, when Brent crude was above $60 per barrel.

Back then, they outlined North Sea industry’s prospects using $50, $60 and $70 per barrel price scenarios, but the new report is modelled on much lower levels – $25, $35 and $45.

It reflects a dramatic plunge in prices due to the coronavirus’ impact on demand, the collapse of an international production deal and storage concerns.

Prof Kemp warned low prices could prevail for “a long time ahead”, resulting in “capital rationing”.

With an oil price of $25 per barrel, development expenditure would total £28.9 billion over the period, compared to £35.4bn at $35 per barrel and £52.8bn at $45, he said.

Production of hydrocarbons (oil, gas and condensate) would total 7.2bn barrels of oil equivalent (boe) at $25, 8.3bn boe at $35 and 10.5bn boe at $45.

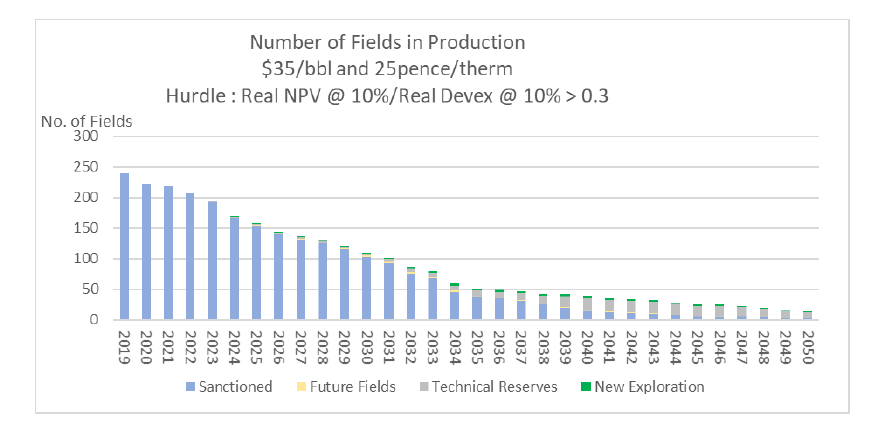

Under the $35 scenario, the number of producing fields would sink to around 50 in 2035, from well over 200 currently, and only 38 new field developments would go ahead over the next three decades.

Of the 411 fields classed as technical reserves, or discovered fields not currently being actively considered for development, 381 fail to get over the investment “hurdle”.

The previous report predicted field development expenditure of more than £110bn based on a $70 oil price, supporting total output of 14.5bn boe.

The UK Oil and Gas Authority has estimated that overall remaining recoverable resources range from 10-20bn boe.

Decommissioning costs would amount to £37-38bn, down from £43-47bn in the previous report, due to a reduction in new fields.

Prof Kemp said that while oilfields would stop production earlier at lower prices, decommissioning activity may be delayed by “cash-strapped” companies who will “think twice” about whether they can pay for platform removals and well abandonment work.

He believes the case for government intervention is strong, in light of banks’ current lack of enthusiasm for lending to oil firms.

Prof Kemp proposed advances on tax reliefs to stimulate investment in new field developments and save thousands of jobs.

“Government could help by giving, on a temporary basis, a field development tax credit,” he said, adding: “If a company develops a new field, they will get the tax relief on that investment advanced. It’s not a gift. It would be clawed back later.”

Oil and Gas UK (OGUK) market intelligence manager Ross Dornan acknowledged lower prices had created a “very uncertain outlook” and pressed companies into “difficult decisions”.

Last month, OGUK warned up to 30,000 UK oil industry jobs could be lost over the next 12-18 months without additional support measures.

Mr Dornan said: “Remaining as competitive as possible to attract investment, alongside innovative and flexible approaches and business models, will be required to ensure we can not only continue to meet as much of the UK’s energy needs from domestic oil and gas, but also prepare places like the north-east to fully capitalise on net-zero opportunities of the future.”

Dick Winchester, who is on the Scottish Government’s energy advisory board, said: “Prof Kemp has produced yet another clear, concise, well analysed but, on this occasion, very concerning report.

“If we add to this the potential impact of reductions in fossil fuel use due to climate change and changes in our habits following our positive experience of working from home during the Covid-19 epidemic, then we need to accept there is a major problem looming large for the Aberdeen supply chain and the UK Government given its commitment on decommissioning costs.

“Alex’s report is a strong warning that we need to get our act together on energy transition and diversification.”

North East Labour MSP and energy spokesperson Lewis Macdonald said Prof Kemp’s report highlighted a “real risk to jobs and energy security” and called for the UK and Scottish governments to invest in safeguarding jobs and infrastructure.

Mel Evans, senior climate campaigner for Greenpeace UK, said: “The only support the government should consider is funding a just transition to renewable energy, to help companies and workers leave oil behind and move into an industry that’s sustainable.

“Support must help workers to reskill and find good, well-paid jobs in sectors such as decommissioning and offshore wind.”

Recommended for you