There is “hope” for a return of subsea project activity in UK waters next year and in 2022, a market analyst has said.

Henning Bjorvik, senior oilfield service analyst at Rystad Energy, said there is potential for 30 subsea tiebacks in UK waters based on discoveries available, which could be commercial at a $30 a barrel oil price.

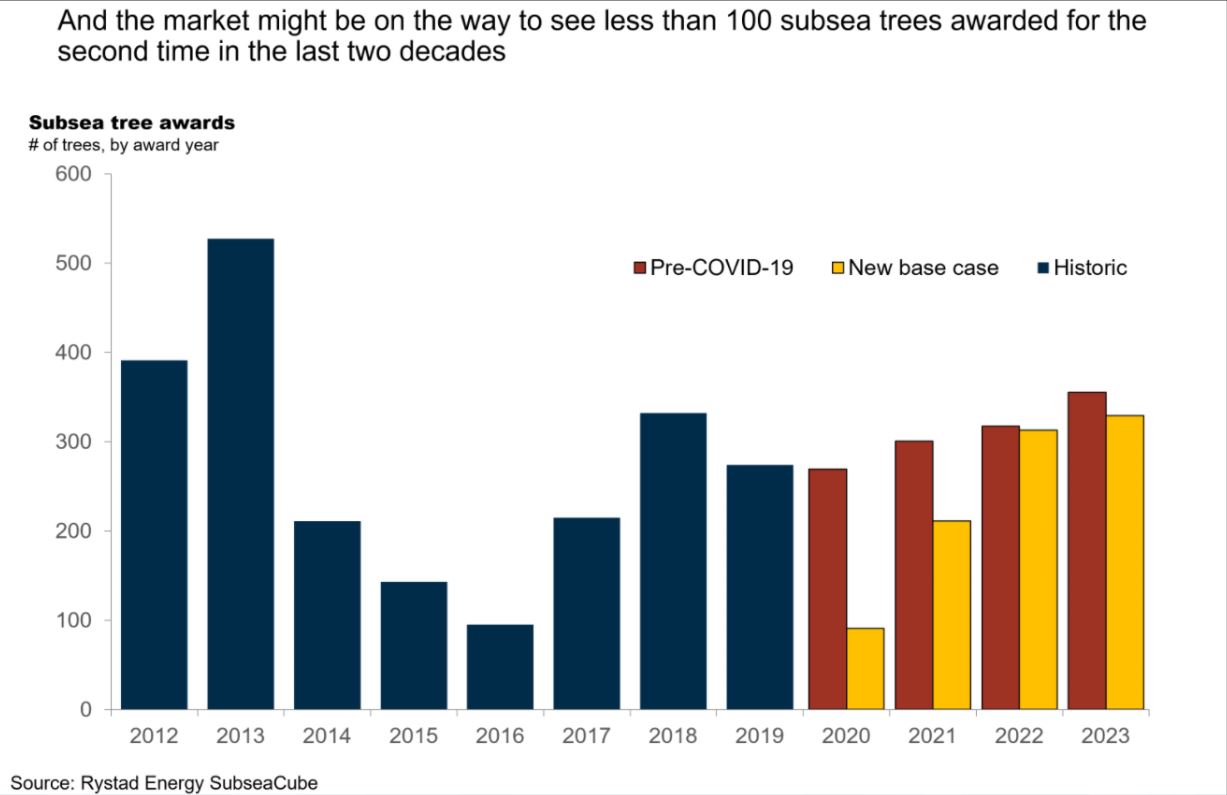

It comes as subsea xmas tree orders, a key performance metric for Tier 1 contractors like Baker Hughes, is expected to drop back to 2016 levels globally this year, the lowest since the turn of the century, at less than 100.

FPSO (floating production, storage and offloading) projects which drive these orders, such as Equinor’s Rosebank in UK waters, have been “pushed out” and “down the pipeline” Mr Bjorvik said, due to the oil price crash.

Speaking at a Subsea Expo Webinar, Mr Bjorvik said: “2016 is actually the lowest number of subsea trees we’ve seen being awarded since the turn of the century.

“So it is actually quite scary to see we’re now on track to revisit those numbers already after four years.”

However, looking globally, orders are expected to return to “more comfortable levels” by 2022, with “hot spots” remaining in Brazil and Guyana.

The UK may also see a return to service before long, although only a handful are expected to proceed this year.

Mr Bjorvik added: “From all the discoveries we see in the UK there are actually 32 projects which are below a breakeven on $30, and out of this, 30 are subsea tieback projects.

“So 30 out of these 32 are subsea tiebacks, what we class as low-risk in the UK so still there is hope for subsea tieback projects to come back in 2021 and 2022 on the UK side.”

Recommended for you