The Oil and Gas Authority (OGA) has warned UK decommissioning spending will fall short of estimates over the next two years, bringing concerns of a “significant impact” on suppliers.

Around £1.5billion of expenditure was forecast annually in 2020 and 2021, but the Covid-19 pandemic has hit operators’ plans, meaning the regulator “expects to see a reduction in activity”.

Speaking at a Decom North Sea webinar last night, the OGA’s head of decom, Pauline Innes, said it was an “understandable and reasonable” approach for operators, but expressed concern for those firms relying on the work.

She said: “I have to say I do have concerns that the reduction in decommissioning work over the next couple of years could have a significant and long-term detrimental impact on the supply chain

“Not only impacting on our ability to reduce decommissioning costs, it might also impact our ability to place the UK as being a world-class leader in decommissioning, and therefore limiting export opportunities.

“I’m concerned it might impact on skills that we have in the sector, reducing a skillset we need to deliver the energy transition, not to mention the loss of jobs at a difficult time in the market.”

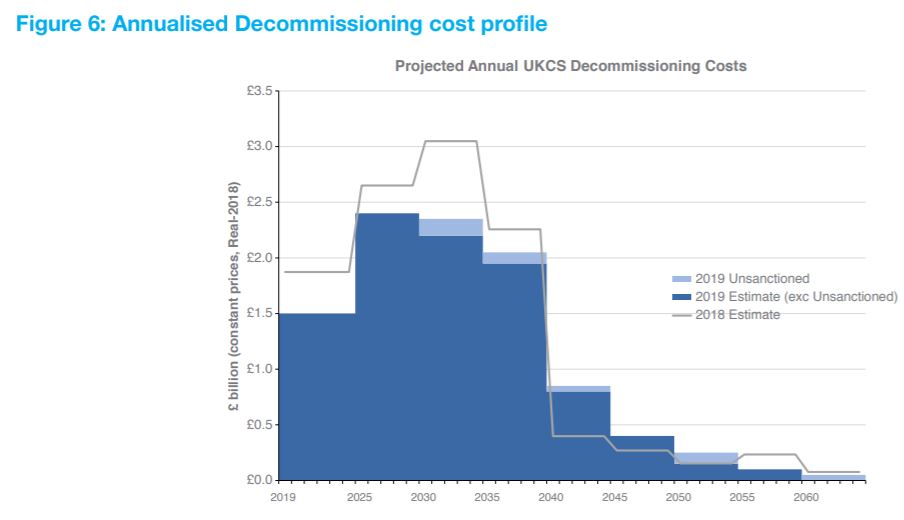

The £1.5bn had first been projected in a cost estimate report published by the OGA last year for the next five years, rising to about £2.5bn per year for the second half of the decade.

Ms Innes did not give a fresh estimate on spending, but said some operators are continuing with their plans, while others had deferred or were still considering next steps.

As decom is legally required it must take place, Ms Innes said, but the timing of the work “is the £59.7billion question”, referencing the total projected spend for the UK sector.

Ms Innes, who came to the role in December, said the regulator is aiming to improve the “visibility” of work available to help the supply chain better plan.

The OGA said last year it was halfway towards its goal of cutting the UK’s forecast £59.7bn decom bill by 35%, improving operators’ costs and benefiting the taxpayer by £8.6bn by reducing tax reliefs.

However that cost saving “mantra” might also be part of the problem, according to Jon Clark of accountancy giant EY.

On the webinar, he argued that operators’ main concern is being certain of their costs, avoiding overruns, while suppliers may be put-off by customers constantly seeking to cut spending.

“If the whole mantra of the industry is to keep cutting costs and get to a smaller number, that dis-incentivises anyone from wanting to invest,” Mr Clark said.

“Why would you want to invest into an industry when all of your customers are trying to cut what they spend?

“I think encouraging cost certainty and commercial models that allow that certainty, and control of the timing of activity to possibly sit more in the supply chain, could make a real difference.”

Mr Clark said that “bridging the gap” between cost certainty for operators and timing of the work for suppliers will require predictability on both fronts.

He added: “It’s not so much the absolute saving of cost, it’s managing the risk of cost overruns.

“I think if suppliers can deliver cost certainty, that will address a much bigger risk for operators.

“The last thing an operator wants to do is start a project in a capital constraint world and then it ends up costing more than they expected it to do, because once you start to decommission it’s very hard to pause mid-way through it.”

Recommended for you