Efforts to reduce the UK’s offshore decommissioning bill last year were “largely negated” by 5% of operators who increased their costs by £1billion, according to the Oil and Gas Authority (OGA).

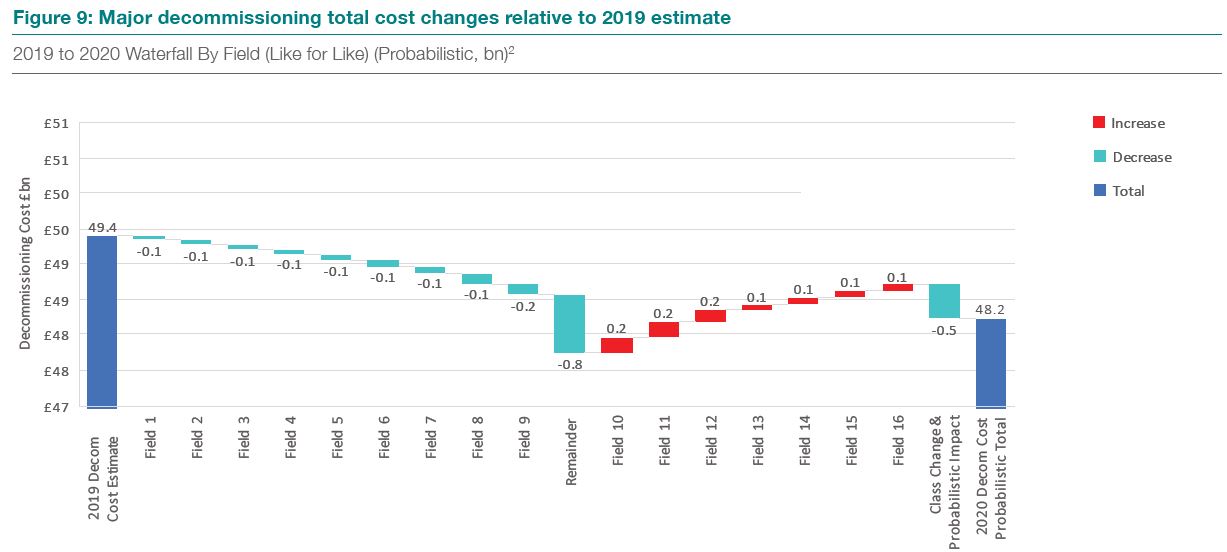

The OGA has published its latest decommissioning cost estimate for the industry, down 2% overall from 2019’s £49.4bn forecast to £48.2bn, based on 2017 prices.

However, “encouraging efforts” to reduce the bill were “partly compromised” as a small group increased costs by £1billion, offsetting what might have otherwise been a greater reduction.

Seven fields, “the large majority of which lie in the portfolios of just 5% of operators”, accounted for the increase.

The regulator praised improved project execution and planning, however “the projected performance of some already-high-cost operators has deteriorated even further”, it said.

Its part of the “tricky business” of figuring out future decommissioning costs, according to petroleum economist Alex Kemp of Aberdeen University.

Nearly a third of all decom estimates remain “highly uncertain”, according to the OGA.

Professor Kemp said: “You may have some ideas of what can be in the reservoir, the wells, the equipment generally.

“But when you actually do the work then unpleasant surprises can emerge of things that have to be done.

“You may find some nasties there which you hadn’t been anticipating, and that will inevitably increase the costs.”

However, the OGA’s goal to reduce offshore decommissioning costs by 35% from 2017 levels “looks possible” Kemp said, having so far achieved a 19% reduction from that £59bn baseline estimate.

The aim is to improve costs for North Sea operators and the UK Government, who provide relief against decom bills.

Decommissioning – who pays?

The unique nature of the industry is such that once all income from a field is gone and production stops, the heavy cost of decommissioning then needs to be met.

Under the UK regime, firms can claim relief on the tax rate paid on past years’ income, whilst the field was producing, to meet this burden.

“There’s nothing odd about that apart from the fact that it reflects the nature of the oil business,” Professor Kemp said, describing them as “very legitimate costs”.

“It’s just like getting relief for the investment costs you make when you develop a new field, so when you decommission it you should at least get the costs set against the tax you’ve paid at other times.”

Last year Derek Leith of EY said it was, in effect, a loan to the government on tax relief, reclaimed once decom costs are incurred.

However, should an oil firm fail to meet the costs then the burden falls on their project partners. If they should also fail, the UK government could be exposed to the full cost.

The government therefore has powers to require firms to set aside cash for decom.

The OGA estimates that 90% of decommissioning spend will be made over the next 20 years.

However, spending this year is expected to be “well below” initial forecasts of £1.3bn, the regulator added, as firms deferred spending amid the “extraordinarily tough” recent months around Covid-19.

Improvements in planning and execution of projects were widely attributed to the reduced costs, however the “depressed” supply chain lowering prices also had an impact.

There is a risk that more firms will fail in 2020 as work is deferred, ultimately increasing prices, the OGA warned.

Professor Kemp added: “There’s a considerable number of fields reached their Cessation of Production dates but activity on decommissioning is relatively subdued, primarily because operators are very cash-strapped.

“We need to take into account the position of the supply chain over the next number of years. Will they be continue to be as stretched as they are now or will there be some upward pressure if the longer-term activity does come up again?”

The report found that adoption of new commercial models and taking advantage of economies of scale to improve costs “remained low” among operators.

Pauline Innes, head of decommissioning at the OGA said: “Encouraging reductions in projected decommissioning costs continued into 2019, though these have been partly compromised by increases forecast by some operators.

“As to be expected, the decreased estimates of future cost are mirrored in reduced costs being incurred right now.

“The last few months have been extraordinarily tough for those working in the sector, including those in decommissioning, and in some cases project deferrals and uncertainties may have shifted focus.

“However, looking ahead, there’s more to be done to drive costs down safely and sustainably. We’ve seen how performance can be improved when learning and good practice are shared.”

Recommended for you