Deltic Energy said the company is largely “insulated” from the impact of Covid-19 thanks to the financial benefits of Shell farm-outs last year.

The firm, formerly Cluff Natural Resources, has posted its first half interim results for 2020, showing a balance sheet of £12.8m.

Pre-tax losses for the firm, which is yet to receive production revenues, were £869,000, compared to £1.5m losses in the same period last year.

Farm-outs of the Selene and Pensacola prospects last year allowed Deltic to “successfully secure the financial future of the Company” according to CEO Graham Swindells, referring to subsequent fundraising activity of £15m.

He added: “These actions have insulated the Company from the worst of the current volatility within the capital markets brought about by Covid-19 and have allowed us to continue to act as a strong partner to Shell.”

Resources at the Selene prospect, one of which Shell farmed into, have recelty been increased by 44%, while Pensacola drilling is expected in the second half of next year.

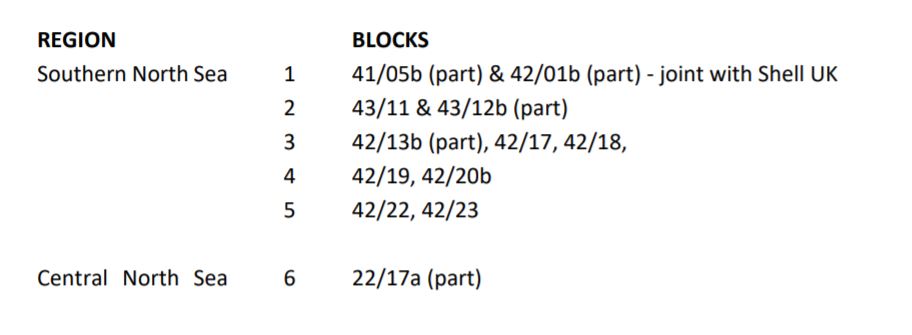

It comes as Deltic celebrates the award of six licences covering twelve full and part blocks in the OGA’s 32nd licensing round, increasing Deltic’s holding from seven to 13.

The awards primarily are in the Southern North Sea, along with another in the Central.

Mr Swindells added: “We are particularly pleased to have been re-awarded block 43/11 (formerly licence P2248) which contains the exciting Cadence prospect and to have been successful in our joint application with Shell over the area surrounding Pensacola.

“The licences awarded contain high quality prospects which can be rapidly matured and greenfield exploration opportunities which substantially diversifies the Company’s portfolio and have the potential to provide multiple new drilling opportunities over the coming years.

“With further evaluation we expect these awards to substantially increase the oil and gas resource base held by the company.”

Recommended for you