New figures have revealed that some North Sea operators have put off decommissioning oil and gas wells for more than 50 years.

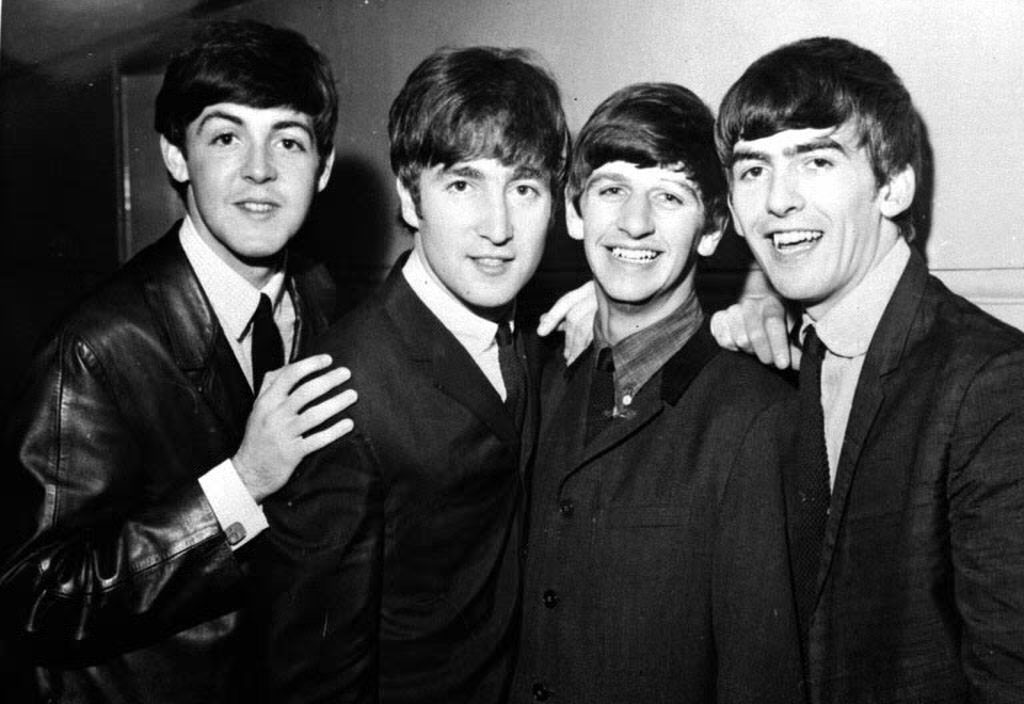

The earliest “suspended wells” date back to the time of the Beatles topping the charts with “Hello Goodbye” in December 1967, and from March 1969 – shortly after “Where Eagles Dare” hit cinemas.

The data from the Oil and Gas Authority (OGA) comes as the regulator seeks to crack down on companies deferring decommissioning wells, which would otherwise create work for the crisis-hit supply chain.

Perenco and Chrysaor own the two oldest wells, sitting idle for more than half a century.

A Chrysaor spokesperson said the firm has 10 suspended wells in UK waters and that all of those in the Southern North Sea will be plugged and abandoned as part of a multi-well campaign currently underway.

The firm has contracted two rigs for this work.

Perenco did not respond to a request for comment.

There are a total of 186 open water exploration and appraisal (E and A) wells in the sector, with an average age of nearly 25 years.

The OGA said it wants to see a “marked improvement” in the timing and cost of decommissioning these wells, though the stats have also brought into question the regulatory regime in the UK.

Stephen Jewell, managing director of Well Decom Ltd, said it shows “various regulators have failed to tackle the problem by taking operators to task” and it was “a case of letting sleeping dogs lie for over half a century”.

Although that includes regulators past and present, Mr Jewell said the work of the OGA has brought progress in recent years.

Since 2018, the number of E&A suspended wells has dropped from 240 down to 186.

Meanwhile, the regulator has since said it would generally only consider new well suspensions over a two-year period and urged action on historic wells that need decommissioned.

An operator may suspend a well if it plans to revisit it, such as when the well has struck hydrocarbons.

Suspension allows them to defer hefty decom costs, however the OGA has highlighted that decom work on these could be a vital lifeline for the supply chain as it grapples with the latest downturn.

The regulator has pitched a £100m loan fund to the UK Government, which it thinks could help bridge the gap.

Mr Jewell said: “The OGA has made a start on this problem but will need to be tenacious, if not ruthless, in the execution of its new suspended wells strategy if it is to make real progress. The very survival of the oil and gas supply chain may depend on it.”

Perenco has the highest number of E&A suspensions, however the largest overall portfolio of suspended wells belongs to Repsol Sinopec Resources UK, with over 100 development wells needing abandoned.

The latter has been contacted for comment.

A spokesperson for the OGA said: “The OGA wants to see a marked improvement in the timing and cost of decommissioning of wells and is engaging with licensees to establish and secure the development and delivery of clear decommissioning plans.

“We expect increasing collaboration between and amongst licensees and the supply chain to combine wells into decommissioning campaigns to achieve cost efficiencies and we also expect to see such a campaign approach to become standard practice.”

(Updated with Chrysaor comment 5/1/21)

Recommended for you

© PA

© PA