Shell snapped up the largest amount of North Sea oil in over a decade during the market’s main trading window for physical cargoes, underpinning signs of sharply tightening supplies.

Europe’s biggest oil company purchased five cargoes on Monday during a 30-minute period during which traders offer to buy and sell cargoes to determine benchmark crude prices published by S&P Global Platts. It made a further seven bids that didn’t find sellers, according to a trader monitoring the window. The Shell purchases were its largest in Platts’ so-called Market-on-Close in at least a decade, data compiled by Bloomberg show.

Even before Shell’s move, the oil market had been strengthening. Prices have been trading in a steep pattern known as backwardation — effectively meaning traders are willing to pay hefty premiums to get hold of immediate supplies. On Tuesday, Brent futures soared to a fresh 11-month high of more than $57 a barrel, buoyed by Saudi Arabia making deep unilateral cuts to its oil production in February and March.

Shell, the world’s largest physical oil trader, has made bold moves in the North Sea in the past, pointing out that it needs the barrels for its own giant global refining system and to satisfy demand from customers in Asia.

Shell bought Brent, Oseberg, Forties and two Ekofisk cargoes, the largest North Sea oil purchases by a single company since at least late 2008, according to data compiled by Bloomberg since then. It also sought Brent, Oseberg and Troll, as well as two each of Ekofisk and Forties. Collectively, the grades are known as BFOET — their initials — and they define a Platts assessment based on the most competitively priced of those grades.

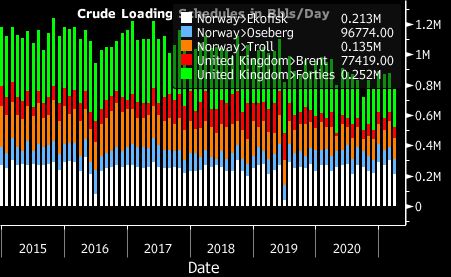

The purchases come at a time when BFOET shipments are set to drop. Combined flows of the five grades will fall to a six-month low of 774,000 barrels a day in March, according to loading plans seen by Bloomberg.

Key financial instruments tied to the North Sea market have surged in recent days. Dated-Frontline swaps have been trading at their strongest level since February, according to Bloomberg fair value data. So-called contracts for difference, which measure the strength of the market in the coming weeks, are also in backwardation.

Recommended for you

© Bloomberg

© Bloomberg