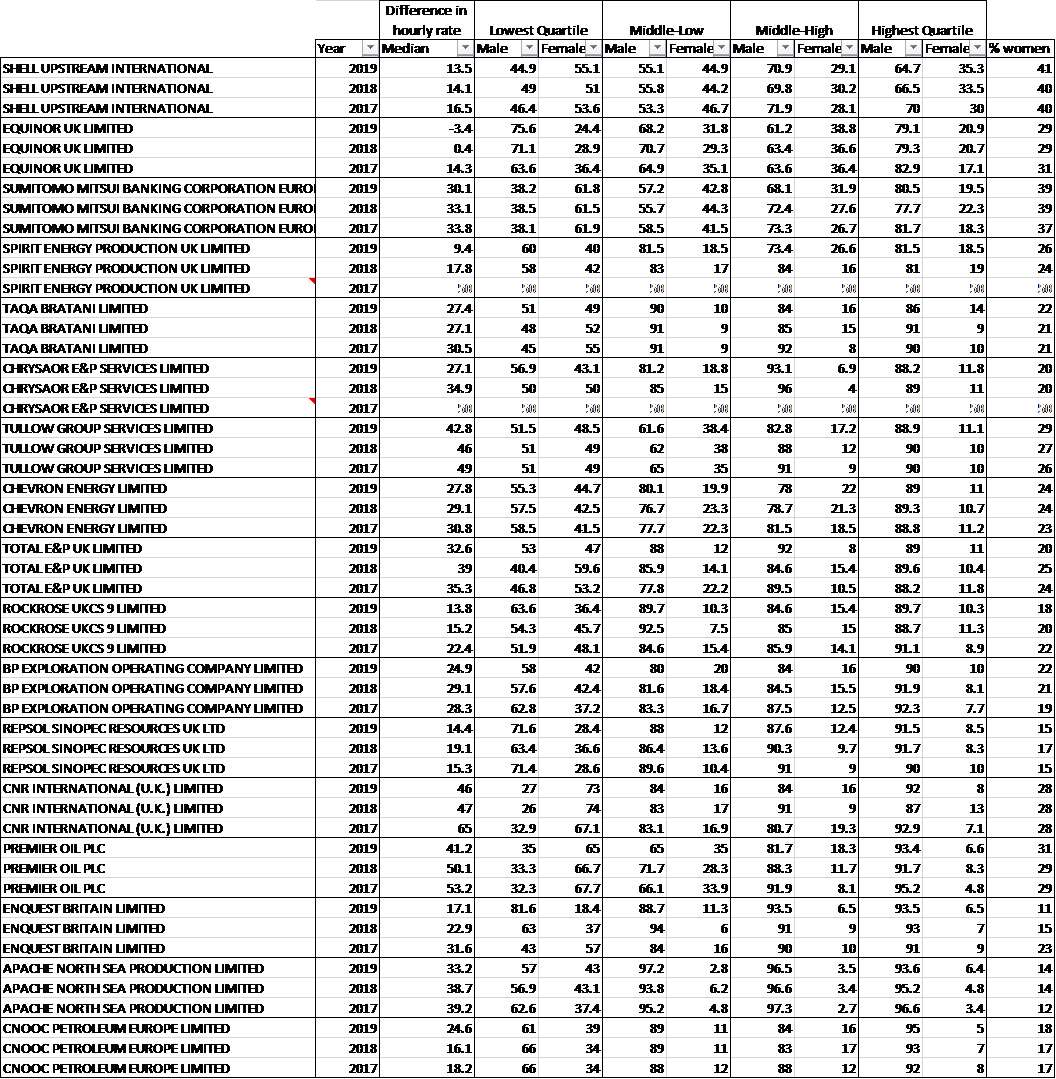

Transparency in reporting is producing results, with most operators showing year on year improvements towards gender balance. We encourage all employers to publish their data without delay, and use it to drive their action plans. With metrics like the median pay gap (-3% to 46%), percentage of women at the top (5% to 35%) and percentage of women overall (11% to 41%) varying massively between organisations, it’s clear balance is attainable within our industry but it takes sustained determination at all levels of leadership.

Why now?

It’s our pleasure to kick off March with some good news: the progress toward gender balance in oil and gas operators, as revealed by gender pay gap statistics. In normal times, within 1 year of the snapshot date of the 5th April, companies with more than 250 employees must report their statistics (mean and median gender pay gaps, bonus pay gaps, and the proportion of men and women in each pay quartile). Recognising the uncertainty and pressure businesses faced due to COVID, on 24th March 2020 the UK Government Equalities Office and the Equality and Human Rights Commission lifted the requirement to file 2019-20 reports by April 5th 2020. Consequently, AXIS Network also delayed our full analysis of gender pay gap data to give operators more time to publish. On 23rd February 2021, EHRC announced employers will have an extra 6 months’ grace to publish their latest statistics. Rather than wait until October, we encourage all employers to report without delay, understand what’s driving their numbers, and use that understanding to drive their action plans. Gender balance is simply good business – so why wait?

Data presented below were downloaded from the UK Government Gender Pay Gap website at year-end 2020, and reflect the snapshot date of April 2019, with the same cohort of employers (oil and gas operators) AXIS Network analysed previously (snapshots April 2018 and April 2017).

How many companies published and when?

The UK government website shows the number of businesses filing a 2019-20 report was just 57% of the number who reported a 2018-19 report. This suggests most UK businesses see reporting as a compliance issue, and that without a mandatory reporting requirement many employers prefer not to share their data. By contrast, of the 22 oil & gas operators1 expected to file a 2019-20 report, 17 (77%) published at some point in 2020. This demonstrates our industry’s commitment to gender-balance transparency is far higher than is typical in the UK. The first operators to publish were Rockrose (20th June 2019) and Shell (20th November 2019) and last operators to publish were Taqa (1st October 2020) and Chevron (24th November 2020). Of the 5 that did not publish, 2 had been consumed in mergers (Maersk Oil with Total E&P North Sea Ltd, and ConocoPhillips with Chrysaor Production (UK) Limited). We hope that oil and gas companies still to file 2019-20 reports will do so as soon as pandemic-related pressures in HR departments abate. Meanwhile it’s encouraging to see that three companies (Shell, Chevron and Rockrose) have already published their 2020-21 reports, well ahead of the 2021 deadline. Thereby demonstrating their commitment to transparency even without a mandatory reporting requirement. As well as gender pay gap data, Shell UK’s 2019-20 report voluntarily includes data on the ethnicity pay gap. This shows a commitment to openness about the progress they are making to address inequalities beyond gender.

Median Hourly Pay

Since UK gender pay reporting began, the statistic that consistently makes headlines is the gap between median hourly earnings of men and women. Our 2019 GPG analysis of UK operators describes why standalone interpretation of this single figure is problematic. Discrimination/unequal pay is not the only cause of median gaps, and progressive and retrogressive actions alike can both narrow and widen them.

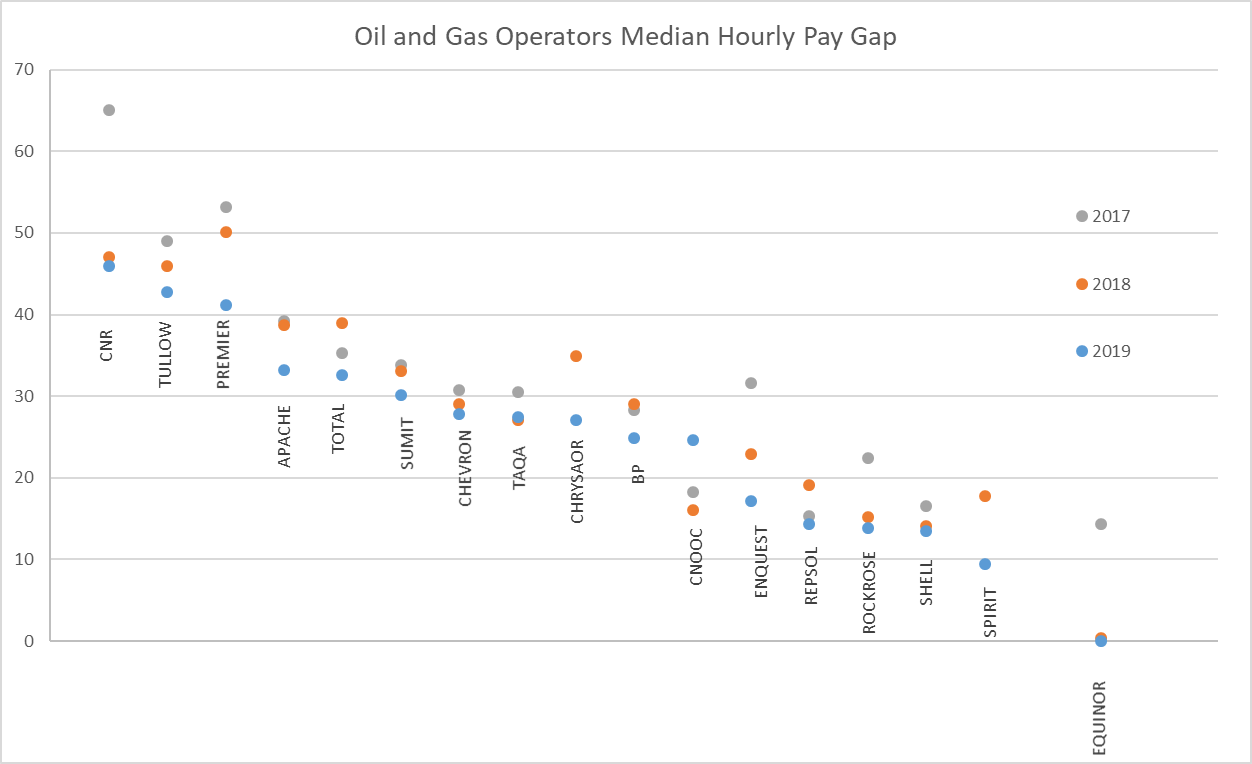

In the 17 operators analysed here, the median woman earns 75p to the £1 earned by the median man. Compared with the UK average (10.6%), the average gap in median hourly pay for these operators (24.9%) is indisputably high. Interestingly, the year-on-year trends (Figure 1), show a general narrowing of the gap, with one operator (Equinor) actually having a negative gap (the median woman receives more per hour than the median man). Furthermore, Spirit this year demonstrated what Equinor showed last year: even companies that already have a relatively small gap can still make dramatic shifts towards balance. CNOOC was the only operator showing an opposite trend, having a larger gap on the snapshot date in 2019 (24.6%) than it had in 2018 (16.1%).

Figure 1. Difference in median hourly pay between men and women in operators holding OGA licenses. (2019 = snapshot date of 5th April 2019, published any time before 31st December 2020).

Healthy pipelines, broken rungs and skinny middles: the story of the quartiles

It is easier to see the underlying reasons for widening/narrowing GPG gaps in the pay quartile data. The gender composition of quartiles depends on who leaves the workforce, who is hired and promoted, and how pay is structured across job grades and functions. Companies that are successful in attracting, retaining and developing female talent in all functions see all quartiles shift closer to 50:50 through time.

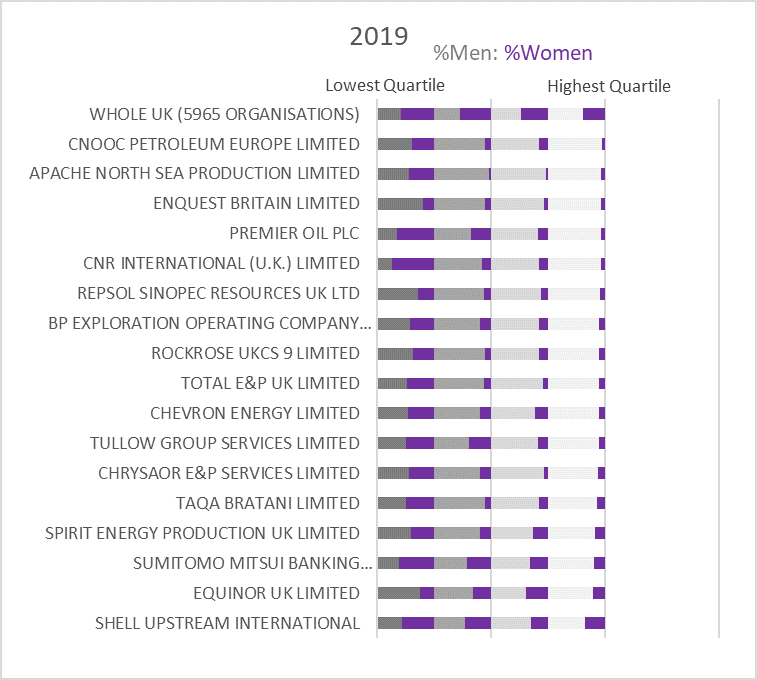

In UK companies as a whole, the percentage of women drops from 58% in lowest-earning quartile, through 54% and 48% in the lower-middle and upper-middle quartiles to 39% in the highest-earning quartile (April 2019 snapshot). In the 17 oil and gas operators analysed (Figure 2) there are typically fewer women in every quartile than we see nationally, and the drop-off from lowest quartile to highest quartile is steeper. Extreme occupational segregation (e.g. more women in lower paid administrative roles, more men in higher-paid engineering roles) and/or significant issues promoting women through the ranks could explain this observation. Though as with median pay gap data, the variation within our industry is more interesting than the comparison with the national average overall. Premier has the steepest drop in female representation from lowest-paid (65% ) to highest-paid (6.6%) quartiles. Apache shows the biggest “Broken Rung” effect, with women constituting 43% of the lowest-paid quartile, but only 2.8% of the next quartile up. The overall distribution in Apache is a “skinny middle” with more women in the highest and lowest pay quartiles than elsewhere. The lack of middle-management role models for women in lower-paid positions can be a real issue in companies with broken rungs. Furthermore, the paucity of in-house mid-career talent can leave companies with skinny middles reliant on external executive recruitment. Equinor shows the flattest distribution, with the proportion of women and men hardly changing from lowest-paid quartile (24.4%) to highest-paid quartile (20.9%). Finally, Shell is the only operator with a >40% female workforce and a healthy pipeline, with each quartile having ~30% or more women.

Figure 2. Pay quartiles from April 2019 snapshot in oil and gas operators compared with other organisations that filed statistics.

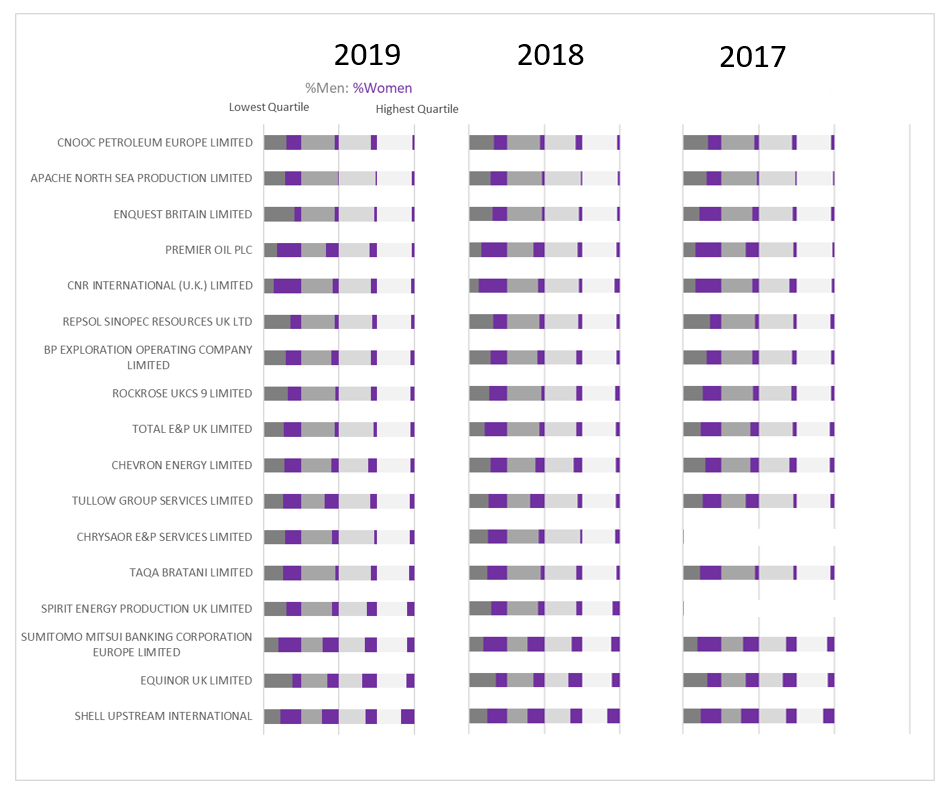

Premier, Spirit, Chrysaor, Total, Enquest and Apache had the biggest year-on-year shifts in median hourly pay gap, but pay quartile data suggests rather different factors underly these shifts. Figure 3 shows how pay quartiles have changed in the 17 operators in the last 3 reporting cycles (snapshots 5th April 2017, 2018, and 2019). Premier (along with BP and Tullow) have increased the percentage of women in the three top-paid quartiles from 2017 to 2019. Spirit has dramatically increased female representation in the next-to-highest quartile from 16% in 2018 to 27% in 2019. Chrysaor has seen a decrease in women in the lowest paid quartile, and increase in the middle quartiles, with little change at the very top. Enquest has dramatically reduced the proportion of women working for them (from 23% in 2017 to 11% in 2019) with the biggest drops occurring in the lowest-paid quartile (57% in 2017 to 18% in 2019). Total has a similar, though less dramatic trend (overall 24% in 2017 to 20% in 2019, lowest-paid quartile 53% to 47%). Apache’s pay quartiles show a unique progression – with the percentage of women in the top quartile increasing but the percentage of the middle-lower quartile dropping.

Figure 3. Percentage of men and women in each pay quartile for the last 3 GPG cycles (Chrysaor and Spirit were not required to publish in 2017).

Figure 3. Percentage of men and women in each pay quartile for the last 3 GPG cycles (Chrysaor and Spirit were not required to publish in 2017).

What next?

The next reporting cycle, from the April 2020 snapshot, will be essential for understanding the baseline picture before the pandemic re-shaped who works where, when and how. Having seen the positive impact of pay gap transparency in our sector, we hope to see 100% of oil & gas employers publishing their next set of numbers. And with Westminster considering making Equality Impact Assessments a feature of the post-COVID industrial strategy, we can expect gender balance to remain a business priority for leaders in oil and gas. Gender pay gap reporting is relevant to all four pillars of the AXIS pledge: Analyse, Plan, Be Transparent and Be Vocal. In 2021, we hope to work with more companies to help them understand the narrative behind their numbers, and realise their gender balance goals.

Katy Hardacre has worked in international oil and gas for almost 20 years, and is a subsurface lead at Chrysaor. An advocate for gender balance in both work and family life and avid data storyteller, she has served on the committee of AXIS since 2019, covering social media and analytics. AXIS is Aberdeen’s leading gender balance network. The group supports individuals, leaders and organisations in the pursuit of gender-balanced teams and systems.

Katy Hardacre has worked in international oil and gas for almost 20 years, and is a subsurface lead at Chrysaor. An advocate for gender balance in both work and family life and avid data storyteller, she has served on the committee of AXIS since 2019, covering social media and analytics. AXIS is Aberdeen’s leading gender balance network. The group supports individuals, leaders and organisations in the pursuit of gender-balanced teams and systems.