© Shutterstock

© Shutterstock North Sea operators have handed back up to 1.1 billion recoverable barrels of oil from UK fields, according to data released by the Oil and Gas Authority (OGA).

Relinquishment information from the regulator has revealed the scale of uneconomic or risky fields, often termed as “marginal”, which operators chose not to develop.

Experts said the “severe cash flow pressure” experienced by the oil and gas sector in 2020 will likely also have played a role.

Energy giants Total and BP handed back licences with the vast majority of resources in recent months, though a range of other companies handed back dozens of licences.

On a P10 basis, which represents the high-end, most optimistic estimate, operators handed back 1.12billion recoverable barrels of oil and 673billion cubic feet (bcf) of gas.

On a P50 basis, which is considered the “best estimate”, these figures drop to 522million barrels of oil and 251.5 bcf gas being relinquished.

A total of 30 relinquishment reports were published by the OGA on May 6, which provide the figures, with most dating from September 2020 to February 2021.

Licences with the largest prospectivity were handed back by Total and BP, who are also among the companies expected to sanction some of the largest North Sea developments in coming years such as Clair South and Glendronach.

Total, in the west of Shetland, looms large, particularly with the relinquished P2214 licence in the Corona Ridge region with the Callanish prospect, which was handed back in November.

Callanish holds up to 269million recoverable barrels of oil, while the whole licence, including parts which were relinquished by Total in late 2019, contains total recoverable resources of up to 492m barrels combined in the high-case, and 206million in the mid-case best estimate.

After acquiring new seismic data across the licence, reservoir quality at Callanish, the main prospect was deemed a “key risk” with similar issues for the others. Total decided to relinquish it fully at the end of November after a drill or drop decision.

Also in the west of Shetland, Total handed back the Vichy prospect, picked up in 2018, after Siccar Point’s Lyon well less than 7miles away came up dry.

In the central North Sea, Total and BP were 50-50 partners on a single licence, P2386, which contained 10 marginal prospects sitting between the Culzean field to the north and Elgin-Franklin to the south.

Combined, the prospects had potential for as much as 107million barrels to be recovered in the mid-case, according to Total, or 231m in the high estimate.

However, studies showed what the firm described as “very limited Triassic prospectivity”, leading to the relinquishment.

BP also handed back the Elgar prospect in the central North Sea, which came “following an unsuccessful farm-down in 2019 and the announcement of the marketing of the BP interest in the Andrew area fields in 2020”.

The oil giant said the relinquishment of the prospect, in P2167, which contained up to 201m recoverable barrels and 309bcf, was decided to “align exploration work programmes more closely with BP’s strategy in the North Sea region”.

Other prospects, such as the BP-Ithaca “Vorlich West”, the Equinor-Shell “Lillyvick” and the NEO Energy “Ada West” were considered too high risk for potentially low reward.

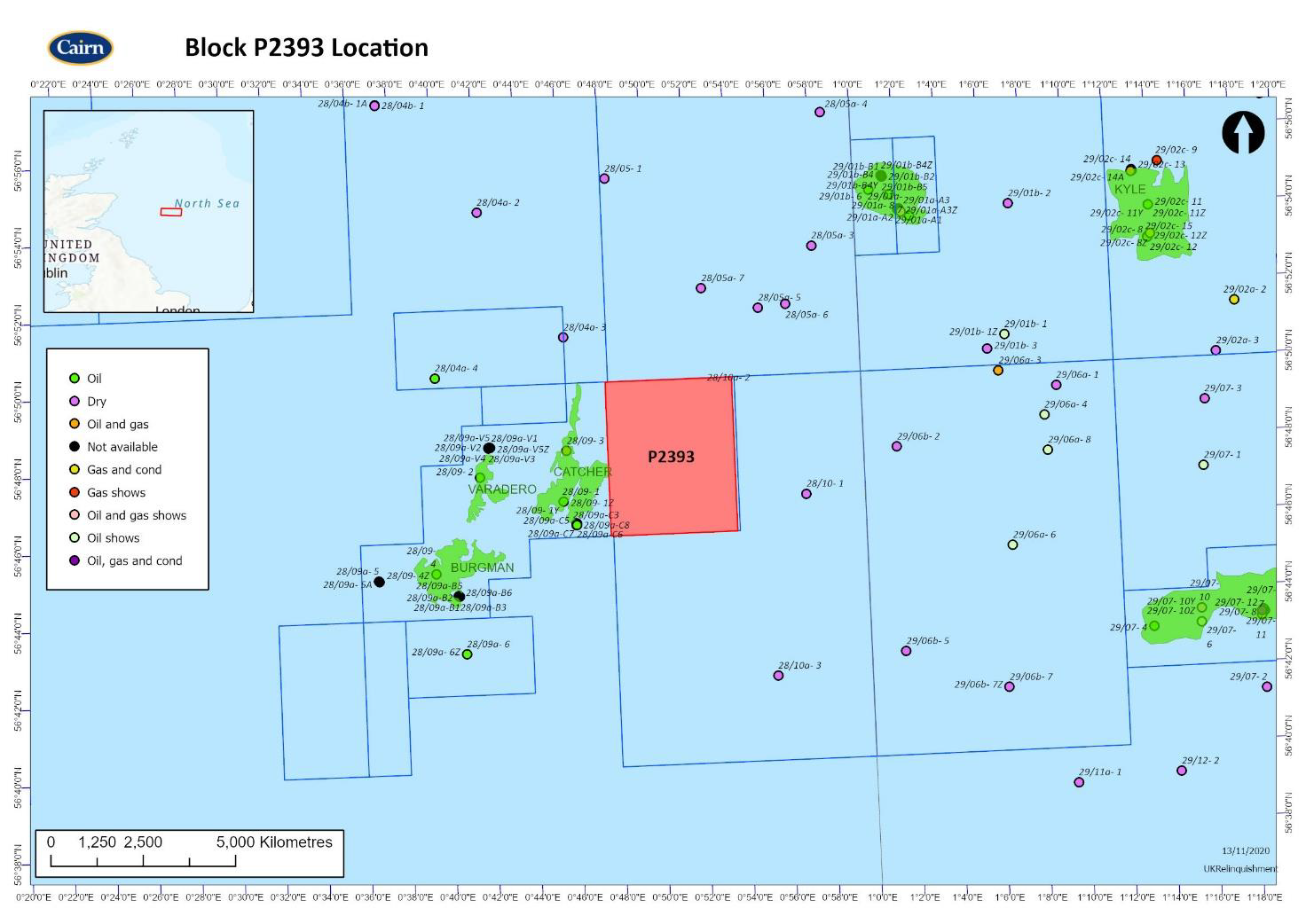

Some firms like Cairn Energy, had hoped their prospects like Peppermint, originally called Catcher NE, would share the same success as other nearby fields, while others like Corallian Energy’s Jackdaw South failed to attract buyers.

Others firms like Summit Exploration and Serica Energy, who trawled through thousands of seismic data tapes from the 1980s found in deep storage in Wales, ended up relinquishing “Columbus West” over concern the prospect was heavily weighted to oil rather than gas.

Professor Alex Kemp, petroleum economist at Aberdeen University, said 2020 was a “traumatic year” for the sector as the oil price fell below $20, and severe pressure on cash flows may have precipitated much of the relinquishment.

He said: “It is not really surprising that the relinquishments in terms of numbers of fields were maybe quite substantial and the dramatic fall in the price precipitated more of these being done than otherwise would have happened.

“Companies will have been reassessing the economics of field developments and they would not have imagined that here we are in June 2021 with the oil price at $71.

“There will be fields which will never be developed. Some of them have just been relinquished. Now, whether anybody else will take them up is a question and, who knows? Some of them might, but a bit doubtful.”

Firms are required to pay fees for holding acreage which have historically been considered to be minor, but the focus on “survival” in 2020 would likely have come into the relinquishment equation, Prof Kemp said.

The “investment hurdle” with the oil price crash, as well as environmental considerations from investors may have also played a role.

However, with the Brent Crude now in relative health, more projects are expected to be sanctioned this year. Meanwhile the OGA’s recent 32nd licensing round saw 98 of 113 licences offered taken up.

Professor Kemp said: “The price has come up enormously and investment projects which are still held by the companies look a bit better, their cash flows are a bit better, so I’m hoping that in the second half of the year we will actually get some positive field developments.”