The industry regulator has opened an investigation into the proposed sale by Esso of 13 producing fields to NEO Energy.

The Oil and Gas Authority (OGA) inquiry relates specifically to Elgin Franklin and comes amid concerns that the billion dollar deal is not progressing as quickly as expected.

The OGA has previously voiced its concerns generally about transaction drag and the chilling effect it could have on the market.

Negotiations between NEO, backed by HitecVision, and ExxonMobil (NYSE: XOM), Esso’s parent company, kicked off in February.

But as of yet, they have not reached a conclusion, prompting the OGA to open an investigation.

The consent of joint venture partners is required in order to effect the transfer.

TotalEnergies (LON: TTE), formerly Total, is the operator of Elgin Franklin – there are eight joint venture partners in the asset.

Collaboration is an obligation in the OGA strategy and failure to comply is sanctionable under the Energy Act 2016.

The policy states that “in undertaking relevant activities relevant persons must collaborate and co-operate with others who are seeking to acquire an interest or invest in offshore licences or infrastructure”.

The regulator conducted a thematic review in October 2020 into industry compliance with regulatory obligations.

It examined agreement in six areas of interaction between the OGA and licensees, identifying some very good and improving practice.

But is also noted the need for further improvement and warned that sanctions could follow in cases where breaches were found.

The investigation will now examine the engagement between the parties since Exxon and NEO announced the proposed transaction earlier this year.

This includes serving the parties with information notices, which ask them to account for their actions since the deal was tabled.

The opening of an investigation does not prevent the proposed transaction from progressing, the OGA said.

Moreover, everyone with interests connected to the transaction must still “meet their obligations under the OGA strategy and industry voluntary codes of practice”.

NEO’s plans to acquire Exxon assets will take the firm to fifth in the list of the North Sea’s largest producers, with of 70,000 barrels of oil equivalent per day (boepd)

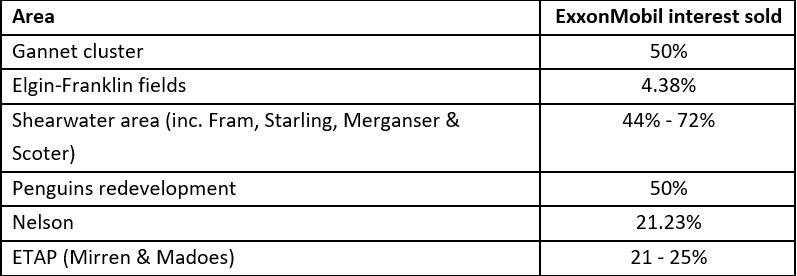

Worth in excess of a billion dollars (£707.3m), the deal, which had expected to be completed this year, would give NEO, stakes in several main operating hubs.

That includes Shell’s Shearwater and Gannet.

NEO was formed in 2019 through the merger of Verus Petroleum and NEO E&P

Last year, the company acquired a package of UK North Sea oil and gas fields from TotalEnergies.

A spokesperson from TotalEnergies said: “TotalEnergies has consented to all aspects of this transaction. TotalEnergies has fully cooperated with OGA investigation and is not aware of any issues that would prevent the proposed transaction from progressing as planned.

“TotalEnergies takes its responsibilities under the OGA strategy very seriously and has collaborated and co-operated with both ExxonMobil and Neo constructively and in a timely manner as the parties progressed discussions around the proposed transaction.”

A spokesman for Exxon said: “ExxonMobil and its partners have made considerable progress to finalise the sale of the majority of ExxonMobil’s assets in the United Kingdom central and northern North Sea.

“We support the investigation by the Oil and Gas Authority and continue to work actively with all our partners to complete the transaction as soon as possible.”

NEO declined to comment.