Despite Aberdeen’s status as a global energy hub, household bills are subject to larger market forces, as Energy Voice explains.

Last week energy regulator Ofgem announced that the energy price cap – a limit on the default tariff that can be charged on household energy bills – would rise by nearly £700.

Ofgem said that as of 1 April approximately 22 million customers would see an increase, with the average customer bill rising from £1,277 to £1,971 per year.

Some have questioned why energy prices have risen so sharply, especially if they live in a so-called ‘energy capital’.

I live in Aberdeen. The supposed oil capital of Europe. I can see an offshore wind farm from my bedroom window and my electricity supply is 100% renewable. How the hell are my bills going up 54% exactly?

— Lewis (@Lewisf42) February 5, 2022

Twitter user @lewisf42 asked: “I live in Aberdeen. The supposed oil capital of Europe. I can see an offshore wind farm from my bedroom window and my electricity supply is 100% renewable. How the hell are my bills going up 54% exactly?”

It’s an understandable question.

The first point to note is that while the price cap was enacted to stop suppliers profiting from inflated energy tariffs, it cannot set controls on the wholesale cost of energy – and that’s at the heart of recent price increases.

Here Ofgem breaks down the component parts of its price cap calculation – the wholesale cost element has more than doubled.

So why are wholesale prices so high?

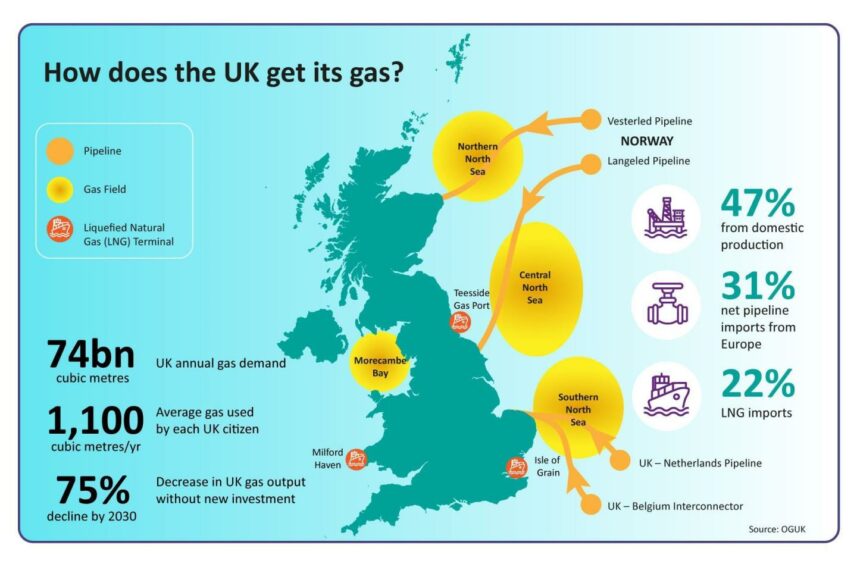

A lot of it comes down to gas. The wholesale price of gas in the UK has more than quadrupled in the past year, as global demand has outpaced new supplies.

Local storage options have also been constrained following the closure of the Rough gas storage facility in Yorkshire in 2017, which could hold about nine days’ worth of UK gas supplies. This lessens suppliers’ ability to buy and store gas when demand and prices are lower.

The UK is also exposed to global pricing, as gas imports currently constitute around 53% of our demand. At the same time, it’s one of the largest gas consumers, with 85% of homes reliant on gas for heating.

Gas is also the feedstock for much of the UK’s power stations. Because gas-fired power stations are flexible – they can produce more or less electricity according to demand – they play a key role in setting the overall price, so higher gas prices lead to higher electricity prices too.

In a recent blog, Professor Michael Grubb of UCL Bartlett School of Environment, Energy & Resources explained:

“Since renewables and nuclear will always run when they can, it is fossil fuels – and at present, unequivocally gas, plus the cost of taxes on CO₂ pollution – which set the price almost all the time, because some gas plants are needed most of the time, and they won’t operate unless the electricity price is high enough to cover their operating cost.

“It’s a bit like having to pay the peak-period price for every train journey you take.”

What about renewables?

A rise in renewable generation over the past decade has also prompted many people to move to part or fully renewable tariffs for their household supplies.

However, because the electricity market relies on multiple generation sources across the UK as well as imports from further afield to balance supply and demand, the cost of renewable electricity is still influenced by the same forces as power from gas.

One important point is that as costs have risen, renewables have helped exert downward pressure on prices.

The Contract for Difference (CfD) system, under which much large-scale renewable capacity has been built, sees the government guarantee renewable generators a price for the power they produce – often called the “strike price”.

This is often described as a “subsidy” payment – and when power prices are low, it means consumers money is used to effectively “top up” payments to the agreed price. This is usually passed on through consumer bills.

But when market prices are higher than the agreed strike price, generators pay back the difference, and consumer bills are reconciled.

As RenewableUK chief executive Dan McGrail noted last week:

“Figures published today by Ofgem show that green levies are falling, so anyone attempting to blame renewables and net zero for high energy prices is seriously misinformed. Let’s be clear – this is a crisis caused by the soaring cost of gas.”

“In the last three months of 2021, wind and solar power was so cheap that they actually paid back nearly £160 million to consumers, reducing energy bills.”

Network costs

Other, smaller factors will also affect how much you pay for your energy, but they strike at the heart of the question posed by Twitter user Lewis.

These include VAT, the costs of energy-related policy measures such as insulation schemes (about 8% of the cap), and the cost of transmission networks and bust suppliers (which together have risen to about 20% of the cap).

There are marginal differences in energy costs depending on where you live. The UK is broken up into 14 different pricing regions for energy, where it costs different amounts to get electricity and gas to people’s homes.

Critics have said the current method of judging the costs of transmission needs updated. Under the current charging regime, renewables projects have to pay more to supply energy based on how far they are away from major urban hubs.

The system was drawn up 30 years ago with the aim of encouraging developers to build power plants near to where demand is at its greatest, but means that offshore wind projects in the most remote – and often windiest – areas of Scotland have to pay to offload their energy, while similar schemes in England do not.

While the cost is borne by generators, it is passed onto consumers through bills.

Ofgem is currently consulting on how the system could be revised.

What about oil and gas?

As for the North Sea oil and gas supplies landed in Scotland, not all of it is consumed here. Much is sold under existing supply contracts or exported, as the nature of global markets means that producers sell their commodities for the best price they can get.

Richard Black, a senior associate of the Energy and Climate Intelligence Unit, set out this dynamic in a recent thread on gas production and UK energy security.

And as any company would, they're selling it for the best price they can get. Which happens to be, for large volumes of it, by sending it through the pipeline into Belgium and the Netherlands

— Richard Black (@_richardblack) January 27, 2022

While the government has made clear that UK energy supplies – gas in particular – are secure, the price of those supplies will continue to be determined by wholesale markets.

It’s also the key reason why living in and oil and gas capital such as Aberdeen doesn’t mean your gas and electricity bill will be lower.

Recommended for you

© Supplied by OGUK

© Supplied by OGUK © PRESS AND JOURNAL

© PRESS AND JOURNAL