United Oil & Gas has cancelled its planned sale of a brace of central North Sea assets, after buyer Quattro Energy failed to meet extended deadlines for fundraising.

United (UOG) announced the £3.2 million deal to sell its PP2480 and P2519 licences – the latter including the Maria discovery – to newcomer Quattro Energy last July.

The deal had been slated to close in September, though delays pushed it to the fourth quarter of 2021 and then into February 2022.

In a March 3 trading update, UOG said it had taken the decision to terminate the sale.

The company added: “Completion of the sale was conditional on receipt of approval from the Oil and Gas Authority (OGA) and Quattro completing a fundraising process. In December 2021 United announced that the long stop date for satisfaction of the SPA conditions was extended to 28 February 2022.

“Although OGA approval was received, Quattro did not complete a fundraising process by this date. United has decided to terminate the SPA with Quattro.”

Quattro was formed in April 2021 by North Sea stalwart Neill Carson, a founder of Ithaca Energy and i3 Energy.

Speaking to Energy Voice, Mr Carson said the outcome was “unfortunate”. He added that Quattro’s plans required considerable engineering and commercial detail to secure funding, and that the necessary work was not able to be completed in time for the seller’s backstop date.

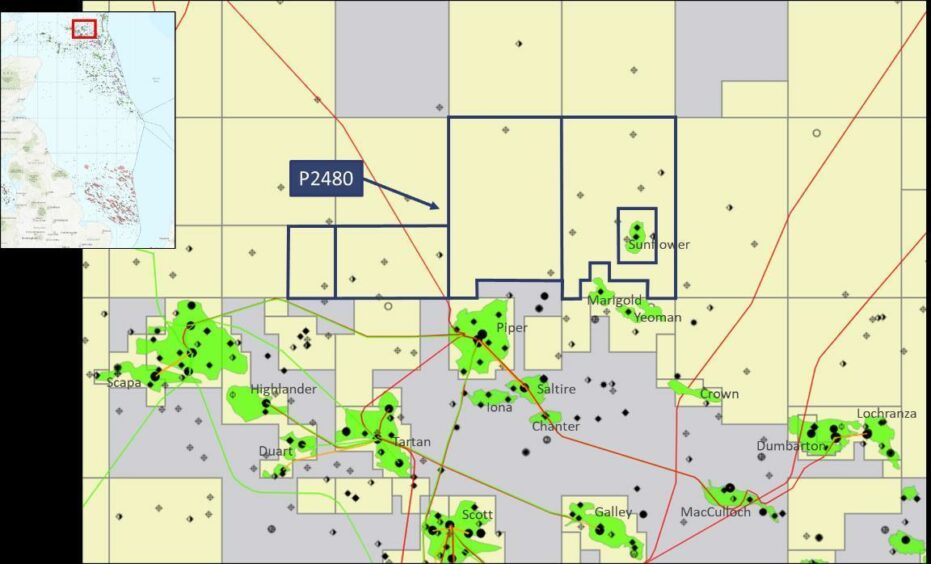

UOG was awarded Licence P2480 in the OGA’s 31st Licensing Round in August 2019 and Licence P2519 in the 32nd Licensing Round, in December 2020. It holds a 100% equity interest in each.

Licence P2519 includes the existing Maria discovery drilled by Shell in 1976, which UOG estimated to hold around 6 million barrels of oil equivalent (boe) in mid-case recoverable resources.

In addition, P2519 contains two Jurassic discoveries, Brochel and Maol. Maol was drilled by Shell in 1987, and on test flowed at over 2,000 boepd.

Licence P2480 includes the Zeta prospect, estimated to contain a mean unrisked in-place volume of 90 million barrels.

Both licences are close to existing infrastructure and located in a prospective area of the central North Sea. This includes the nearby Marigold and Yeoman discoveries, the former of which is the subject of a joint development project by Hibiscus Petroleum and Ithaca Energy.

UOG adds that both licences come with “low-cost commitments”, and that renewed activity in the nearby area should mean attractive investment opportunities.

It said it looked forward to progressing any “commercialisation opportunities and potential partnerships” the assets offer.

UOG chief executive Brian Larkin commented: “Although the conditions of the SPA for the sale of our UK CNS assets were not met and United has decided to terminate the SPA with Quattro, we believe the backdrop of high oil process and increased investment in the North Sea means these licences offer a range of exciting opportunities for United for limited near term outlay.”

Established in 2015, UOG is oil and gas exploration, development and production company with assets in Egypt, UK, Italy and Jamaica.

The company added that the sale of its Italian unit, UOG Italia, to a subsidiary of AIM-listed Prospex Energy was progressing. UOG Italia holds a 20% non-operated interest in the Podere Gallina licence which contains the Selva gas development project in Italy. The transaction has a longstop date for completion of 6 April 2022.

“With our low-cost producing asset base, which is significantly leveraged to the rising oil price, we remain focused on implementation of our work programmes from a fully funded position in Egypt, in addition to progressing the farm out of our Jamaican assets. We look forward to updating the market on further progress in our full year results at the end of April,” Mr Larkin added.