Key North Sea oil projects currently in the pre-final investment decision (FID) phase could deliver nearly 1.5 billion barrels, according to new research.

Consultancy Wood Mackenzie said further M&A activity will be required to unlock all opportunities.

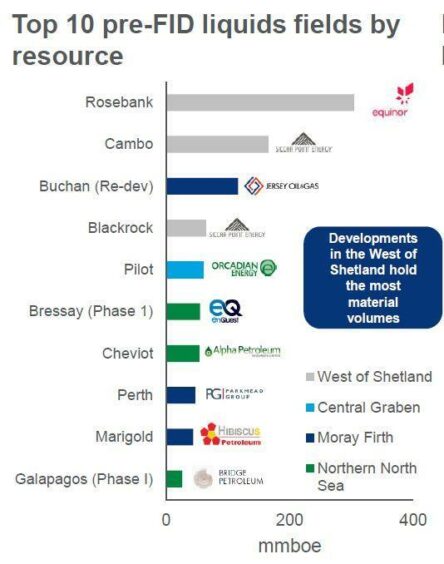

In a new report titled ‘How much more oil and gas can the UK North Sea produce?’, the Verisk-backed analysts suggest that indigenous oil and gas still has “a major role to play” in the UK’s energy mix, pointing to more than 1.4 billion barrels of liquids held in pre-FID projects.

The pack is led by the sizable – and controversial – Rosebank and Cambo fields west of Shetland, but also includes the redevelopment of the Buchan field by Jersey Oil & Gas, Orcadian’s Pilot and Siccar Point’s Blackrock, among others.

However, given the size of many of the operators, further M&A activity will be needed to bring them to fruition, the report says.

Gas prospects are more limited, with around 65 billion cubic metres (bcm) of resources held in projects at the pre-FID stage.

Concentrated mainly around the central Graben area and mostly planned as tie-backs, key projects include Isabella, Glengorm and Jackdaw, among other smaller developments.

Five key levers

Looking to 2050, if all economically viable resources in the basin were to be produced, it could deliver 5 billion boe of new volumes and around £46 billion of investment, Wood Mackenzie said.

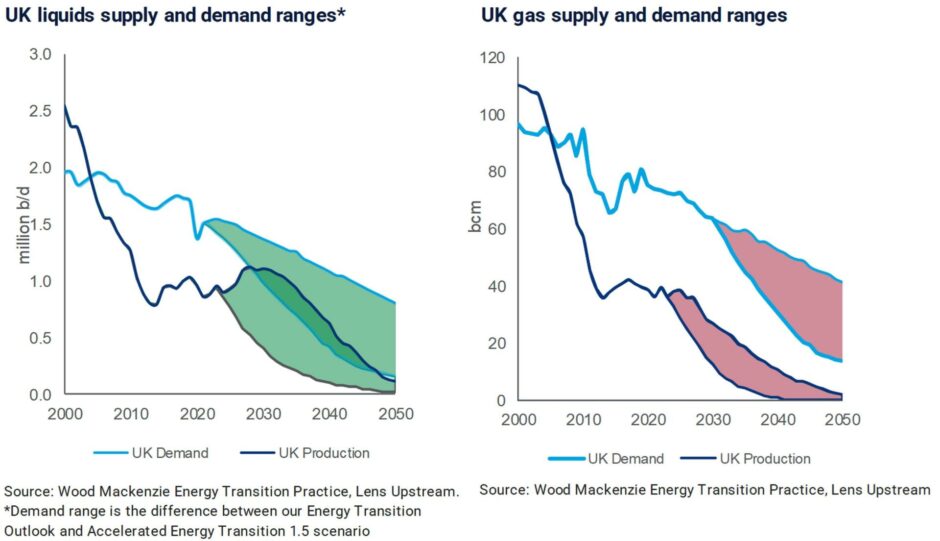

In all scenarios, UK demand for oil and gas continues to outstrip supply, though there are wide ranges of uncertainty. Production in 2030 could be between 0.6-1.6 million boepd, Wood Mackenzie reports, while the range in forecast demand is even greater.

The group’s research director for North Sea upstream, Neivan Boroujerdi, said: “By 2050, UK North Sea production will have largely ceased. But even in a net zero scenario, demand will persist with emissions being offset by carbon capture and storage (CCS) and nature-based solutions.

“Current levels of production could be maintained for the next decade, underpinning energy security and safeguarding jobs. But the UK is sorely lacking in gas and will be heavily reliant on imports in all scenarios.”

The report sets out five levers that can be used to boost production. These include: execution, new greenfield projects, increasing recovery from existing assets, exploration and the development of contingent resource.

In the short term more than 200,000 barrels of oil equivalent per day (boepd) of new production is due onstream in the next two years, including from projects such as Penguins, Seagull and Tolmount.

Avoiding further delays to these key developments should remain the industry’s top priority, analysts said.

Other measures could shore up additional supplies; a 2% rise in uptime across the basin (currently at 80%), could deliver another 80,000 boepd per year, while greater export options could provide routes to market for the roughly 45,000 boepd of gas currently used for reinjection or flaring.

In addition, 35 fields are set to cease production in the next two years, but higher prices and increased investment may offer a lifeline, and continued economic production to the tune of around 31,000 boepd.

And while the sector has secured new backing for continued exploration from government in the form of the British Energy Security Strategy, it too must continue to strive for high standards.

“While the industry has been provided a lifeline, it needs to step up. All stakeholders need to promote a culture of transparency, and a streamlined – and stable – regulatory and commercial environment,” Mr Boroujerdi said.

“Continued decarbonisation of the shelf – including electrification – is required to ensure alignment between energy security and a net zero future,” he added.

Recommended for you

© Supplied by Wood Mackenzie

© Supplied by Wood Mackenzie © Supplied by Wood Mackenzie

© Supplied by Wood Mackenzie