United Oil and Gas (UOG) says it is “looking forward to progressing” a host of central North Sea assets after a deal to sell them fell through.

A binding sale and purchase agreement (SPA) was struck with Quattro Energy Limited in September to sell its PP2480 and P2519 licences – the latter includes the Maria discovery.

Completion of the deal hinged on approval from the industry regulator and Quattro completing a fundraising process.

But after the North Sea newcomer failed to stump up the cash needed, despite deadlines being extended, UOG (LON: UOG) opted to terminate the sale in March.

In its full year results for 2021, the company now says it plans to pursue “commercialisation opportunities and potential partnerships” for the assets.

Rising commodity prices and the licenses proximity to existing infrastructure make them “attractive investment” openings.

Oil and gas is back in favour for the minute as governments try to bolster domestic supply in light of Russia’s invasion of Ukraine.

Soaring energy bills and inflationary fears also mean discussions about upping North Sea production are back on the cards.

UOG said: “During the first- half of 2021 progress was made on the work programmes associated with the licences: new 3D seismic data was purchased and interpreted, with the initial mapping providing positive indications on the existing Maria, Brochel and Maol discoveries, and on the identified prospectivity, including Zeta, Dunvegan, and the deeper Jurassic targets.

“In September 2021, the company announced that it had entered into a binding sale and purchase agreement (SPA) with Quattro Energy Limited (Quattro) to sell its UK Central North Sea Licences. Completion of the sale was conditional on receipt of approval from the Oil and Gas Authority (OGA) and Quattro completing a fundraising process. OGA approval was received, however, Quattro did not complete a fundraising process by the long stop date (28 February 2022). In Mach 2022 United terminated the SPA with Quattro and have retained the licences as part of the Company’s portfolio.

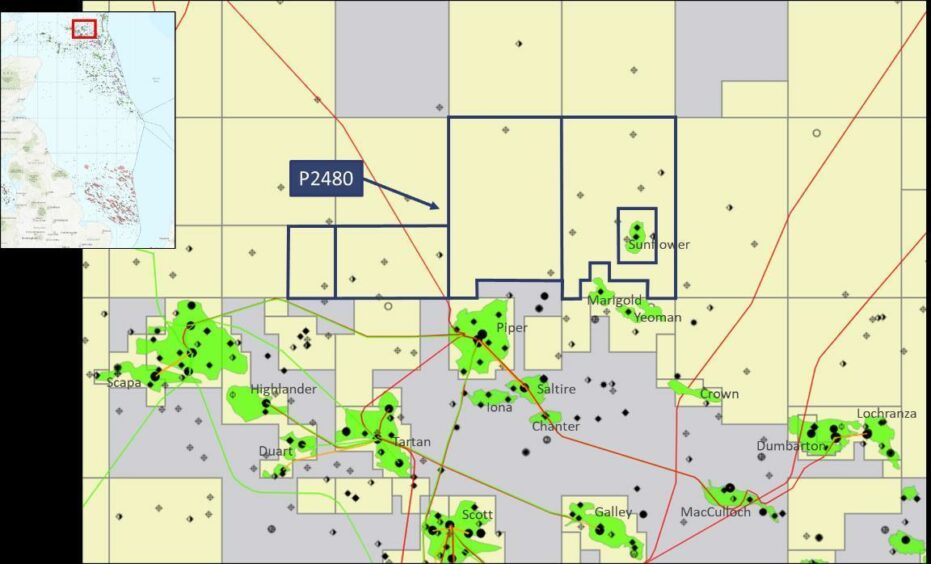

“Both licences are located in a highly prospective area of the CNS, where there is significant development activity taking place. They are situated close to existing infrastructure as well as the Marigold and Yeoman discoveries, and the substantial Piper, MacCulloch and Claymore oil fields.

“There are low-cost commitments on both licences, and with rising commodity prices and renewed activity in the nearby area United believes they each contain attractive investment opportunities. United look forward to progressing the commercialisation opportunities and potential partnerships the assets offer.”

Quattro was formed in April 2021 by North Sea stalwart Neill Carson, a founder of Ithaca Energy and i3 Energy.

Speaking to Energy Voice after the UOG deal collapsed, Mr Carson said the outcome was “unfortunate”.

UOG was awarded Licence P2480 in the 31st Licensing Round in August 2019 and Licence P2519 in the 32nd Licensing Round, in December 2020.

It holds a 100% equity interest in each.

Licence P2519 includes the existing Maria discovery, drilled by Shell in 1976, which UOG estimates to hold around 6 million barrels of oil equivalent (boe) in mid-case recoverable resources.

It also contains two Jurassic discoveries, Brochel and Maol. Maol was drilled by Shell in 1987, and on test flowed at over 2,000 boepd.

Licence P2480 includes the Zeta prospect, estimated to contain a mean unrisked in-place volume of 90 million barrels.

UOG, established in 2015, is an oil and gas exploration, development and production company with assets in Egypt, UK, Italy and Jamaica.