Ithaca Energy said the government’s new windfall tax could accelerate the timeline for planned North Sea capex as the company looks to cash in on the investment relief.

But bosses at the firm underlined they does not envisage the levy will have any impact on its “day-to-day” operations.

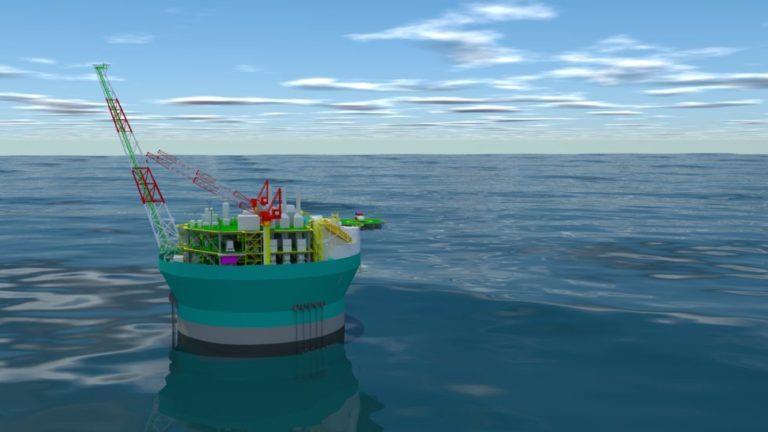

Ithaca is on record as expecting capital expenditure to total around $400m each over the next three years – and more broadly said it expects to spend “easily above $3bn” across the Cambo and Rosebank projects in the West of Shetland, though their timelines aren’t clear.

As things stand, the tax announced last week and the boosted investment allowance are expected to last until the end of 2025.

A near-doubling of the investment allowance to 80%, on top of other measures, means firms will get 91 pence back per £1 spent for a total relief rate of 91.25%.

During an investor call on Tuesday, David Crawford, Ithaca’s chief financial officer, said: “On day-to-day operations it doesn’t change anything. We’re allowed to produce as much oil and gas safely as we can, which generates the high cash flow that Ithaca benefits from.

“It won’t change what we’re doing but it may mean that we change the timing of some of our capital investments. Some of them we may bring forward to between now and 2025, with the production coming after.

“There may be some taxes that we have to pay, but we will optimise our capital profile year-on-year to see what we can do to minimise the profits levy.”

Ithaca had no comment on Cambo specifically, though analysts have suggested this as a project which could be accelerated thanks to the investment incentive.

In its first quarter results, published last week, Ithaca set out expected capital expenditure plans for 2022 of $444m as a pair of projects progress.

The Abigail field, produced via the FPF1, is on track for first oil in Q3 of this year, while the Captain enhanced oil recovery scheme is on the slate to start producing next year.

Earlier this year it was announced that Ithaca had agreed to buy Siccar Point Energy, operator of the controversial Cambo project.

Ithaca chief executive Alan Bruce said: “We announced in April our intent to acquire Siccar Point, which really is a transformation acquisition for the company.

“Everything is progressing to plan and we’re hoping to close the transaction by the end of June – this really brings together two very complementary portfolios.

“It significantly extends our resource life and it provides line of site to growing cash flows through the end of the decade and beyond.”

Siccar Point has become something of a household name in recent months due to its ownership of Cambo, a whipping boy for environmental groups and politicians.

At the end of last year Shell, which has a 30% stake in the project, announced its decision to pull out of the scheme, though there have been reports it is reconsidering due to the high oil price.

On whether Ithaca has had any discussions with the oil major on Cambo, Mr Bruce said: “Once the transaction is closed, we’ll be on the licence and that would be the time for us to engage with Shell. I’ve no further comment on that at this point in time.

“But as I say, once the transaction closes then it’s a big priority for us in terms of working through all of the projects in the Siccar Point portfolio.”

Recommended for you

© Supplied by DCT Media/ Wullie Ma

© Supplied by DCT Media/ Wullie Ma © Greenpeace

© Greenpeace