Shell (LON: SHEL) has taken the final investment decision (FID) to develop the Jackdaw gas field in the UK North Sea.

It follows the decision by the UK Government to green light the project, which could yield half a billion pounds in UK investment, last month as part of its energy security drive.

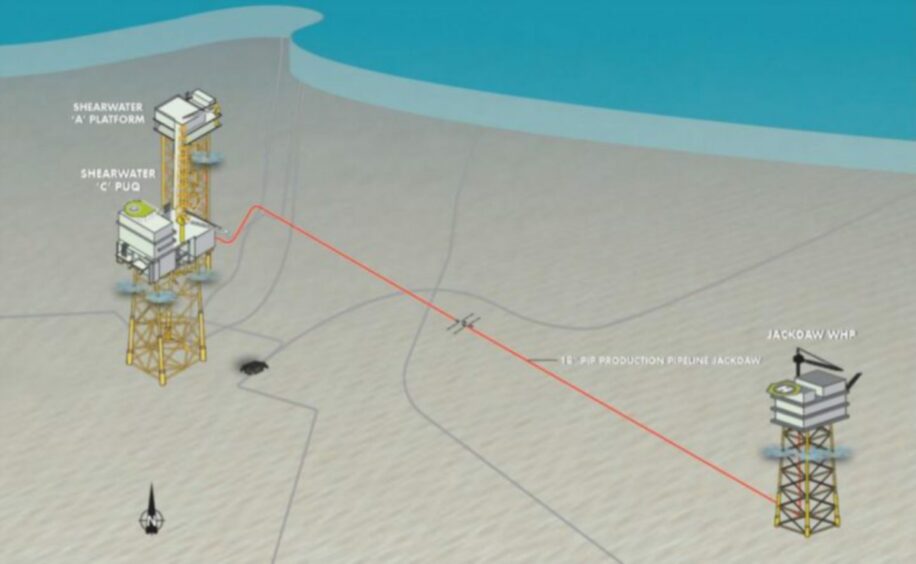

Jackdaw will comprise a wellhead platform that is not permanently attended, along with subsea infrastructure which will tie back to Shell’s existing Shearwater hub.

The project is expected to come online in the second half of 2025.

At peak production rates, estimated at 40,000 barrels of oil equivalent per day, it could account for over 6% of projected UK North Sea gas production.

It is also claimed that operational emissions from the field will be less than 1% of the whole UK basin.

London-listed Shell previously pledged to spend £500m in the UK in order to deliver Jackdaw, located about 155 miles east of Aberdeen.

That will deliver a “significant boost to companies, jobs and the prosperity of communities”, the supermajor said.

Zoe Yujnovich, upstream director at Shell, said: “We are committed to providing our customers with secure and stable supplies of energy, and to do so responsibly, efficiently and economically.

“Investments like Jackdaw are consistent with the UK’s North Sea Transition Deal and Shell’s Powering Progress strategy, providing the energy people need today while serving as the foundation for investments in the low carbon energy system of the future.”

Shell has been locked in discussion with the regulator for much of this year in an effort to get Jackdaw over the line.

The future of the field looked in doubt last year when the Offshore Petroleum Regulator for Environment and Decommissioning (OPRED) declined to approve the environmental statement for the project.

Since then, energy security has been thrown back into the spotlight following Russia’s invasion of Ukraine.

Energy prices have also soared, a large part of the cost-of-living crisis and inflation currently plaguing the UK.

Westminster has sought to bolster domestic oil and gas supplies in order to reduce imports from Russia, giving the North Sea a much-needed shot in the arm.

It is likely that Jackdaw will become a new battleground between industry and environmental groups, similar to the controversial Cambo field.

A ‘Stop Jackdaw’ campaign was launched earlier this year, and activists claim the project will do nothing to reduce household’s energy bills.

Meanwhile, Greenpeace is planning to take the UK Government to court over its decision to rubber stamp the field.

Shell believes that projects like Jackdaw will help ensure North Sea production decline is “gradual rather than too steep” as the energy transition develops.

Gas from the field will come ashore at St Fergus gas terminal near Peterhead.

The facility is also home to the Acorn carbon capture and storage project, meaning production from Jackdaw could be used to produce blue hydrogen.

Over the next decade, Shell intends to invest as much as £25bn in the UK energy system, subject to board approval and stable fiscal policy.

Scottish Conservative shadow cabinet secretary for net zero and energy, Liam Kerr said: “This welcome announcement from Shell underlines the importance of securing our domestic energy supply during these uncertain times.

“It’s therefore disappointing Greenpeace hasn’t acknowledged that Jackdaw will help to reduce energy prices and secure thousands of jobs during the transition to net zero while having a lower carbon footprint than imported supplies.

“A report from OEUK said if there is no such investment in projects such as Jackdaw, we will be reliant on other countries for at least 80% of our gas and 70% of our oil by 2030.

“The war in Ukraine has also further emphasised the growing need to increase our energy security.

“This is why it is more important than ever that Scotland’s oil and gas industry is fully supported rather than hindered when investment is made to deliver new fields.”

© Supplied by Uplift

© Supplied by Uplift