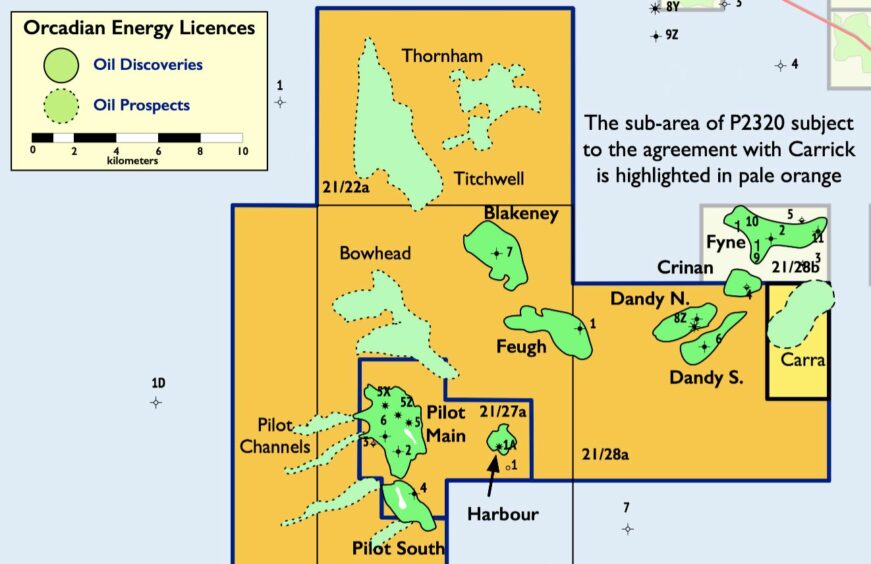

Orcadian Energy (AIM:ORCA) has executed a formal agreement with Carrick Resources which will see the latter farm in to a 50% share of its Carra prospect in exchange for further seismic interpretation.

The North Sea-focused firm first mooted a deal for Carra, a sub-area of Licence P2320, last October.

The prospect lies to the east of the Crinan and Dandy discoveries and to the South of Fyne.

While undrilled and unexplored, early internal estimates from Carrick indicate it could contain P50 recoverable prospective resources of 30 million barrels of oil.

The farm-out deal has no cash consideration, but will instead be satisfied by the fulfilment of work milestones.

Carrick will review existing data and reinterpret data currently being reprocessed by TGS, and will remap the prospect.

In return, on completion of the updated mapping, Orcadian will, assign a 50% interest in the sub-area of licence P2320 to Carrick.

This work is expected to take four months, and Carrick can withdraw from the agreement prior to completion of the remapping of the prospect.

Carrick has agreed that after the transfer, it will then work up the Carra prospect to drill-ready status and manage a further farm-out process on the prospect.

Orcadian’s CEO Steve Brown said: “We are delighted to have signed the SPA with Carrick. This SPA enables us to further de-risk and maximise value from our assets in a very cost-effective way while developing a drill ready prospect on Carra.

“Progressing Pilot and the prospects close to it remains our core focus whilst we continue to extract the maximum value on all our assets. We look forward to working with the Carrick team progressing Carra.”

In June Orcadian successfully raised a further £1 million to help progress development of its wind-powered Pilot project.

The funds, raised through a share placing, will help pay for a key Field Development Plan, licence fees and for other general working capital purposes.