Equinor (OSLO:EQNR) has published economic analysis for its long-awaited Rosebank project, which sets out commitments to support thousands of UK jobs and invest billions of pounds in the local supply chain.

The Norwegian energy major expects to invest £8.1 billion over the life of the multi-million-barrel field, more than three-quarters of which (78%) will be spent in the UK.

Of this, around £4.1bn will be spent developing the field, alongside a further £3.6bn in operating expenses, while decommissioning costs are estimated at just shy of £400 million.

In terms of investment in both the supply chain and job creation, bosses at the company said “the vast amount of value creation will be local.”

At peak, Rosebank is expected to employ up to 1,600 direct, full-time equivalent (FTE) jobs, nearly 1,200 of which will be UK-based.

The estimated gross value add (GVA) of the development amounts to some £24.1 billion over the field’s life – or £2.1 billion annually at its peak – equivalent to 1% of the Scottish GDP, according to analysis prepared by Wood Mackenzie and Shetland-based Voar Energy on behalf of the operator.

While fewer workers will be needed once the field is operational in 2026, Equinor anticipates the need for nearly 300 FTE roles over its 25-year life, 90% of which it says are likely to be UK-based.

The analysis follows the publication of an environmental statement (ES) on the development – one of the largest untapped discoveries in UK waters- by offshore regulators on Thursday.

Recoverable resources are estimated at 300 million barrels of oil equivalent, and Equinor plans to deliver the field in two phases, targeting first oil at the end of 2026.

At its peak, the field is estimated to produce 77,000 barrels of oil equivalent per day (boepd), or 69,000 barrels of oil and 44 million cubic feet of gas per day – equivalent to more than 8% of the UK’s oil production through to 2030.

Production will be exported via a hook-up to the Knarr floating production, storage and offloading vessel (FPSO) vessel. A deal for the use of the vessel has already been struck with owner Altera Infrastructure.

Ithaca-owned Siccar Point Energy holds a 20% stake in the development, along with Suncor Energy which holds 40%, while the remainder is owned by operator Equinor.

An FID on the long-mooted project is expected in Q1 of next year.

Supply chain opportunities

Speaking with Energy Voice on Thursday, Arne Gurtner, senior vice president for UK and Ireland offshore at Equinor said the economic analysis shows that “the vast amount of value creation will be local.”

In its report the company said it was committed to ensuring a “substantial part of the project’s value comes to Scotland and the UK, rather than abroad.” In support of this, it recently hosted a recent supplier day in Aberdeen, in partnership with EIC, to increase the number of local suppliers invited to tender.

Mr Gurtner wouldn’t be drawn on what portions of the work scope would be handled by local firms but said the figures show “we are ready to invest into decarbonised development then there’s considerable effect from the industrial activity to be expected locally.

“We hope this together will inform decision makers in the process ahead.”

“All of this is pending a final investment decision [FID] together with the contract setting, but we have quite good arrangements in place to motivate the local supply chain,” he added.

Electrification plans

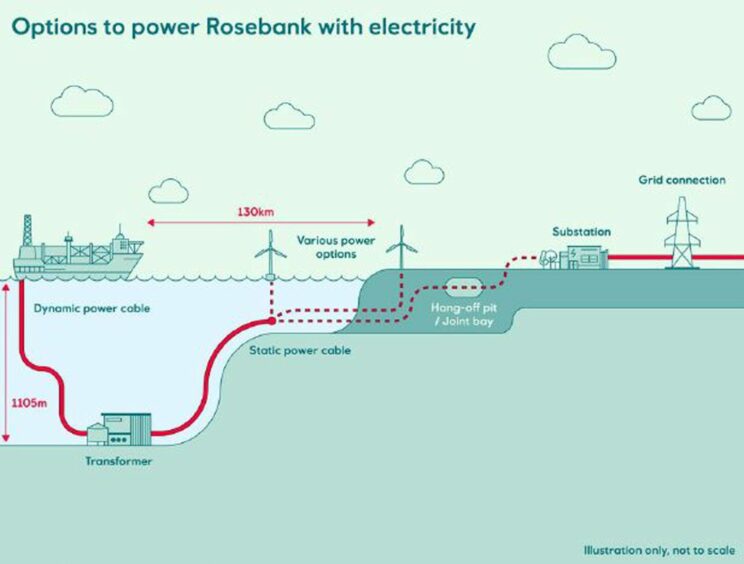

Equinor hopes to lower the operational emissions of the project by adapting the FPSO for electrification, using power either from the onshore grid or directly from renewables schemes.

A dedicated floating wind scheme has previously been mooted as one potential solution “on the drawing board.”

“We will bring Rosebank forward as the one of the most energy efficient production units on the continental shelf – it will already be that without electrification, but we are also committed to bringing electrification forward,” Mr Gurtner said.

However, he said the operator “has not yet decided on the solution yet, so we are working on that very much now.”

Windfall tax impact

Mr Gurtner also downplayed the impact of the government’s recently enacted Energy Profits Levy (EPL) – and its associated investment incentives – on the company’s plans for the field.

“The project has matured all along from when we first came into the license as operator. We have used somewhat more time to optimise the concept, both commercially but also towards a more low-carbon solution which fits which fits to our own Equinor strategy.”

“The EPL is a very, very important boundary condition which we have been following very closely, but it hasn’t directly influenced the project maturation in this phase.”

Recommended for you

© Supplied by Equinor

© Supplied by Equinor © Supplied by Equinor

© Supplied by Equinor