Hartshead Resources (ASX:HHR) will carry out a joint engineering study with Shell and Petrofac, examining the potential to tie-in its proposed Phase I gas field development to the supermajor’s southern North Sea infrastructure.

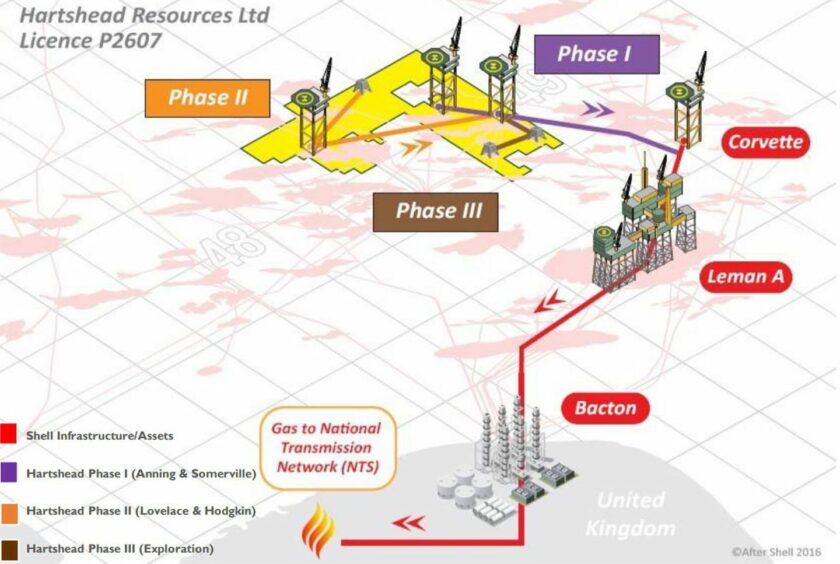

Australian-headquartered Hartshead owns and operates License P2607, comprised of five blocks in Quads 48 and 49 in the UK’s Southern Gas Basin which include the Anning, Somerville, Hodgkin and Lovelace gas fields.

Known as Victoria, Viking Wx, Audrey NW and Tethys N, respectively, the fields were officially renamed last year to reflect the re-development of the area.

The company intends to produce from the fields via a series of phased developments, beginning with Anning and Somerville estimated to hold 2P reserves of 301.5 billion cubic feet of gas (around 52 million barrels of oil equivalent).

The new study agreement with Shell will provide a basis for design and cost estimates for the potential tie-in of two new minimum facility unmanned platforms to Shell infrastructure via a link between the Corvette platform and Leman Alpha.

Gas export will then be routed via Leman to the Bacton terminal in Norfolk, before injection into the National Transmission System.

The £500,000 study is expected to take three months and will be undertaken by Petrofac and managed by Hartshead. Funded from the operator’s existing cash reserves, it will detail any required brownfield modifications necessary as part of the gas offtake route for the Phase 1 development.

Shell will provide project assurance before the next phase of engineering begins, which would see front-end engineering and design (FEED) undertaken during 2022/23 and a final field development plan (FDP) submitted to the UK government.

Hartshead says it intends to make a final investment decision (FID) on Phase 1 next year and achieve first gas in late 2024.

Petrofac’s work scope includes offshore construction support for the subsea pipeline tie-ins on the Corvette-Leman Alpha export line; installation of line-of-sight communication dishes and interface connection; pipework for production and export routes; and integration of communications and all reporting systems for the new platforms.

Success would also unlock further development at P2607, with Phase 2 planned to include Hodgkin and Lovelace.

Hartshead has said it aims to complete further geological and geophysical work on these fields this year, prior to having contingent resources audited and moving the fields forward for development.

A further third phase could include up to 14 prospects and leads with unrisked 2U prospective resources of 344bcf, though the operator notes that additional work is planned to de-risk, economically evaluate and rank targets further, before it short-lists preferred prospects for initial well planning and drilling.

UK-based Hartshead was acquired by Australian player Ansila Energy last year, with the combined entity subsequently adopting the Hartshead name as it sought to create a new North Sea-focused gas developer.

© Supplied by Hartshead

© Supplied by Hartshead