© Supplied by OGUK

© Supplied by OGUK A study by the Net Zero Technology Centre (NZTC) has found high capex costs remain a barrier to electrifying North Sea assets, but rising carbon taxes and net zero targets may yet spur development.

The NZTC said there was a “significant challenge in commercial viability of electrification” owing to the high capex costs of connecting to low-carbon electricity sources, and the impact they have on the lifetime costs paid for power – known was the levelised cost of energy (LCOE).

However, the study notes that these costs must be set against the prospects of higher carbon taxes, the rising cost of fuel and the need to meet net-zero emissions targets under the North Sea Transition Deal (NSTD).

NZTC worked with operators Neptune Energy and Spirit Energym as well as Sealand Projects on the study which explored the potential to electrify an offshore platform with power from offshore wind.

The report uses the Neptune-operated Cygnus platform as a case study for development. Located around 96 miles off the Norfolk coast in the southern North Sea, it was chosen in part due to its proximity to several major offshore wind schemes.

By 2030 nearly 7GW of wind capacity will be sited within 50km of the asset, rising to over 14GW within 100km – and including the Hornsea and Dogger Bank projects – which make it a suitable case study for the investigation of electrification using offshore wind.

At present however, no oil and gas assets have any direct access to this power.

It follows the opening of the Crown Estate Scotland-led Innovation and Targeted Oil and Gas (INTOG) offshore wind leasing process, in which developers are being invited to put forward project proposals that would help power North Sea oil and gas fields.

Power costs

The study examined the feasibility of replacing the 25MW of Cygnus Alpha’s post-gas compression power requirements with wind power by 2025.

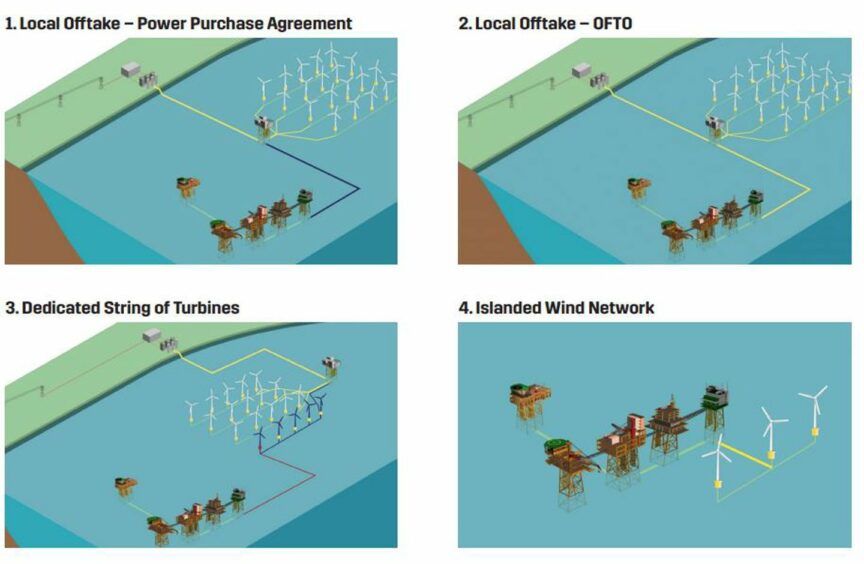

It evaluates four potential options for sourcing electricity, including local offtake under a power purchase agreement (PPA); offtake with an offshore transmission owner; using a string of turbines within a larger project; or using a dedicated “islanded” wind farm to serve the platform.

For the purposes of the study, the approach would include a new bridge-linked platform (BLP) joined to Cygnus Alpha, with space for power cables, new electric-drive plant for gas compression and additional space for future technologies.

The authors suggest other equipment, including hydrogen and carbon capture technology, could be incorporated in the 2030s, to enable scaling up of its decarbonisation potential.

Not including a “do-nothing” case of £68.44/MWh, the various scenarios for offshore wind offtake at Cygnus infer LCOEs ranging from £104.51/MWh to £137.89 in the most expensive case. All are based on a merchant wind power price of £60/MWh under a 15-year contract.

Carbon taxes also play a major in role in driving adoption. While prices remain low, the study notes “it is in fact cheaper overall to take the ‘do-nothing’ approach”.

This changes once UK ETS charges reach £149 per tonne of CO2, at which point an offshore wind network becomes more cost-effective. A further increase is required before the “do-nothing” approach becomes the least attractive, when taxes reach £179/tonne and over.

In its conclusions, the NZTC says there has been “significant appetite” from the offshore wind sector to engage with oil and gas industry in supporting electrification efforts and identify routes to market for wind projects.

“Through cross-party regulatory engagement, there were no immediate blockers identified, however it is noted that the timeline for consenting, design and commercial commitments may be considered constraints for securing electrification,” the report adds.

Commenting on the findings, NZTC senior project manager Graeme Rogerson said: “The size of the prize is significant if we can establish a viable way to leverage the existing infrastructure to supply power to offshore oil and gas assets.

“We have a number of barriers to overcome including regulatory challenges and establishing a way to make one of the four proposed options economically viable. However, the engagement levels from stakeholders have been hugely promising and there is definite appetite to maximise the opportunity for electrification of oil and gas assets.”