A handful of North Sea oil and gas schemes have been included in a list of infrastructure projects the UK Government is aiming to fast track.

Among those in line to be accelerated are the Ithaca Energy Cambo project, the BP (LON: BP) Murlach field, and Harbour Energy’s (LON: HBR) Talbot subsea development.

The Victory gas field, which was recently acquired by an unnamed oil and gas major, and NEO Energy’s Affleck redevelopment also made the cut.

Various offshore wind, hydrogen, and carbon capture and storage (CCS) projects have been named too.

Westminster is aiming for construction to kick off on the “vast majority” of the initiatives picked by the end of next year.

Planning reform, regulatory changes and improved processes will all be explored in order to “speed up their development and construction”.

Streamlining offensive

The Chancellor Kwasi Kwarteng delivered his mini-budget on Friday, in which he laid out numerous measures designed to boost growth, including rolling back disliked IR35 tax laws.

He said: “Our planning system for major infrastructure is too slow and fragmented. The time it takes to get consent for nationally significant projects is getting slower, not quicker, while our international competitors forge ahead. We have to end this.

“We can announce that in the coming months, we will bring forward a new bill to unpick the complex patchwork of planning restrictions and EU derived laws that constrain our growth.

“We will streamline a whole host of assessments, appraisals, consultations, duplications and regulations.

“We will also review the government’s business case process to speed up decision making and today, we are publishing a list of infrastructure projects that will be prioritised for acceleration in sectors like transport, energy and telecoms.”

Westminster has been pushing hard to increase North Sea oil and gas flows, following Russia’s invasion of Ukraine in February.

A new offshore licesing round will open next month, allowing companies to begin hunting for fresh oil and gas sources.

Delayed details about a climate compatibility checkpoint, which will apply to future permits, have also been released.

It means – after a tricky few years for the sector in which it became something of a whipping boy for politicians – companies are readying for a bow wave of work and optimism is high.

The famous five

Mr Kwarteng’s decision to include the first phase of Cambo will undoubtedly attract the ire of environmental groups.

For much of the last year, the 175 million barrel West of Shetland project was campaigners’ most wanted criminal, with numerous protests taking place against its development.

Cambo had looked dead in the water when Shell (LON: SHEL) opted to pull out of the project, which was then owned by Siccar Point Energy – the company was subsequently bought by Ithaca.

Also located in the West of Shetland is the Victory discovery, which Reabold Resources recently sold to an unnamed “oil and gas major”.

Previously, a tieback to TotalEnergies’ Laggan-Tormore pipeline was the preferred development option for the field, which holds mid-case recoverable resources of 179 billion cubic feet of gas (bcf).

Oil giant BP announced earlier this year it is pressing ahead with plans to develop the Murlach oil and gas field.

The project is expected to recover 25.9 million barrels of oil and 602 million cubic metres of gas, produced through a two-well tie-back to the ETAP production hub.

Murlach is a redevelopment of the Skua field which was in production in the early 2000s, then operated by Shell.

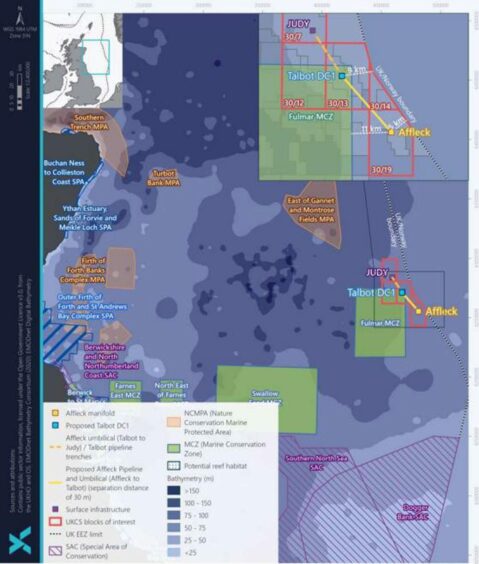

An environmental statement (ES) for the Talbot subsea development was lodged in the summer, with a view to reaching first oil in Q3 2024.

Located in block 30/13e of the North Sea, the Harbour scheme lies around 170 miles south east of Peterhead.

Recoverable reserves at the field are estimated at around 18.1 million barrels of oil equivalent (boe) of light oil with associated gas.

NEO also submitted an ES recently for the proposed redevelopment of the Affleck field, 178 miles south-east of Aberdeen.

With first oil on the slate for 2024, peak production from the project is expected to be 5,218 barrels of oil a day.

NGOs have been quick to condemn the move to cut red tape, with one campaigner accusing the government of “denying the reality” of climate change.

Ryan Morrison from Friends of the Earth Scotland, said: “The UK Government must be clear about what corners they are going to cut, or which environmental and worker safeguards they will be scrapping in this reckless push for fossil fuels.”

CCS

While oil and gas bosses will be “toasting the chancellor”, as shadow chancellor Rachel Reeves put it, there was less good news for CCS.

Nick Cooper, chief executive of Storegga, the driving force behind Aberdeenshire’s Acorn project, called on the government to “act soon”, lamenting a lack of change.

He said: “The Chancellor made it clear in his first speech that his central aim was to ‘unleash the power of the private sector’. However, we’re still waiting to unleash the billions of pent up private sector investment ready to support the development of the Scottish Cluster of decarbonisation technologies in Aberdeenshire. We also have no update on the green freeport bid process, which would act as an investment zone.”

Onshore and offshore wind

Wind chiefs were more chipper after the government committed to remove the block on onshore developments in England.

Scottish offshore wind projects arising from ScotWind and INTOG will also benefit from the fast track scheme.

RenewableUK’s CEO Dan McGrail said: “Removing the block on onshore wind in England means we can generate significantly more cheap electricity for hard-pressed billpayers in areas where projects have local support. Once projects have planning permission they can be up and running within a year, so this technology offers us a great opportunity to tackle the cost of energy crisis.

“Speeding up the planning process for offshore wind is vital too, as it will allow us to unlock an enormous amount of new capacity much faster and help us to meet the Government’s target of quadrupling our offshore wind capacity by 2030. It will also help us to meet the Prime Minister’s vision of the UK becoming a net energy exporter by 2040. At the moment it can take up to ten years to get a project over all the hurdles. We can’t afford these glacial timescales any longer, especially as offshore wind has now reached a point where it’s even cheaper to build than onshore wind.”

© Bloomberg

© Bloomberg © PA

© PA © Supplied by BP

© Supplied by BP © Supplied by NEO

© Supplied by NEO