Australian firm Finder Energy (ASX: FDR) has shared details of its chances of success (COS) on its P2524 licence in the UK North Sea.

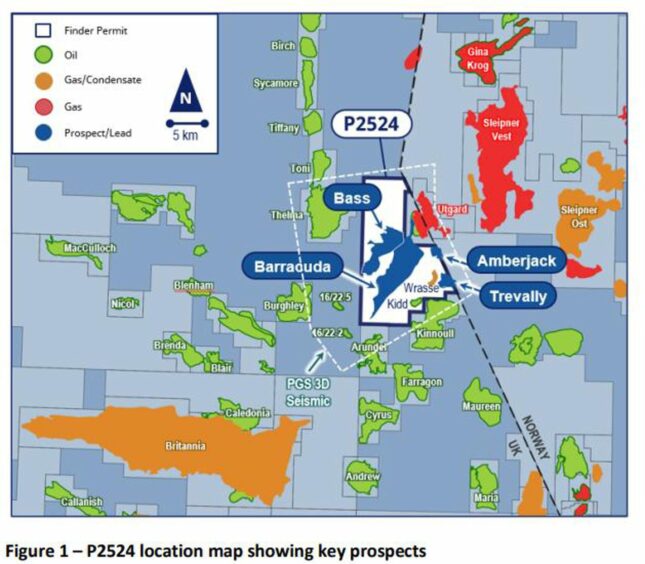

Three prospects, Barracuda, Amberjack and Trevally, in the “prolific” South Viking Graben have all been “high-graded”, the company said.

Perth-headquartered Finder has a 40% stake in the region – Harbour Energy holds the remaining 60%.

Barracuda, which Finder hails as its “leading” oil prospect, gas gross mean prospective resources of 67 million barrels of oil equivalent (MMboe).

According to the analysis, the prospect has a 31% geological COS.

Meanwhile, the low-risk Amberjack (72% COS) and Trevally (57% COS) schemes have a 72% COS and a 57% COS.

They are also ideally positioned to tie back to nearby infrastructure, according to Finder.

Harbour owns and operates the nearby Brittania infrastructure complex.

The company says P2524 presents “multiple value creation pathways” and Finder is progressing with joint venture discussions.

There are also plans for a farm-out process, as well as commercial evaluation of tie back opportunities.

The P2524 licence was awarded in 2020 in the 32nd offshore licencing round, with an initial term of 5 years, and a drill or drop decision at the end of the third year (30 November 2023).

It is located on the western margin, on the cusp of the UK-Norway international median line within the South Viking Graben area, which Finder says is petroleum and infrastructure rich.

The company, founded in 2004, made its entry to the North Sea in February 2021, with the award of licence P2530 in the 32nd offshore round.

In April it then bagged licence P2528 near the CNOOC Buzzard field.

Since then it has continued to boost its UK footprint, swooping for Azinor Catalyst’s P2502, P2524 and Goose licences last year.

Finder recently announced it had struck three farm-out deals with Aberdeen-headquartered Dana Petroleum in the UK central North Sea.

Recommended for you