Jersey Oil and Gas (LON:JOG) expects to conclude farm-out talks on its flagship Buchan field by Q1 2023, “if not by the end of the year”.

The firm said uncertainty like the windfall tax has “slowed progress” but welcomed the investment allowance attached to it.

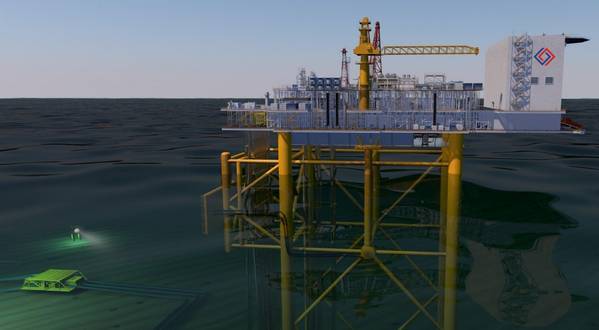

Jersey intends to develop the “Greater Buchan Area” (GBA) as an area-wide development, and said it is in “advanced commercial discussions with a select number” of counterparties on a farm-out process.

CEO Andrew Benitz said he hopes for a “successful conclusion” to those farm-out discussions” if not by the end of the year then “certainly in Q1 2023”.

The GBA comprises the Buchan oilfield, as well as the J2 and Verbier oil discoveries.

It boasts estimated gross 2C economic resources of 162 million barrels of oil equivalent (mmboe), making it one of the biggest pre-FID developments in the UK North Sea.

FID had been expected this year but was delayed due to electrification studies, the firm said.

The firm has, meanwhile, been given more time to develop its long-held Verbier discovery in the North Sea.

The North Sea Transition Authority (NSTA) has approved the second term of the Verbier licence (P2170), meaning it is now aligned with its main Buchan development due to expire in August 2023.

Verbier has been through several episodes, having gone from from a potential 130 million-barrel development, until a “disappointing” appraisal cut estimates down to just 25 million.

Such was the extent of the dismay, former operator Equinor sold back its 70% stake to Jersey in 2020.

Jersey CEO Andrew Benitz said: “We are pleased that the NSTA has agreed to extend the Second Term of the Verbier Licence in order to align it with the rest of our GBA asset base.

“Although multiple fiscal changes have slowed progress with closing out commercial farm-out discussions, we look forward to a successful conclusion if not by the end of the year then certainly in Q1 2023.”

Recommended for you