© Image: FFluor

© Image: FFluor The Penguins FPSO is now well underway on its journey to the North Sea, with an estimated arrival in early February – just behind operator Shell’s (LON:SHEL) much anticipated Q4 results.

Shell’s first new manned vessel for the UK in 30 years began its journey last month, departing the yard in Qingdao after a handover ceremony.

The vessel is now more than halfway through its more than 17,000-nautical mile journey, on board the Boskalis-owned White Marlin heavy transport ship, and set to arrive in Norway around 6 February.

The date puts the vessel’s debut within days of the supermajor’s fourth quarter earnings announcement.

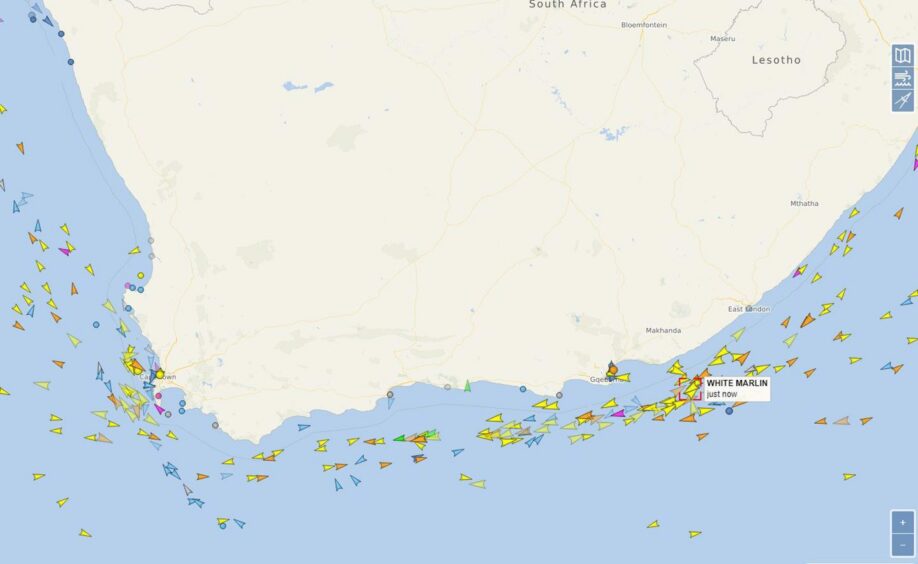

According to marine data tracking site Vessel Finder, as of Monday afternoon the White Marlin was rounding the southern tip of Africa, a few hundred miles from the Cape of Good Hope. Data for the ship had previously been unavailable while in Chinese waters.

Position of the Boskalis White Marlin, carrying the Penguins FPSO, as of 1430GMT 09/01/2023. Source: VesselFinder

Position of the Boskalis White Marlin, carrying the Penguins FPSO, as of 1430GMT 09/01/2023. Source: VesselFinder

Penguins left China bound for an unnamed Norwegian yard – later confirmed to be Aibel’s Haugesund facility – for commissioning work, ahead of final delivery to Shell.

The Haugesund yard is a favoured site for Shell, where it recently sent the Pierce FPSO for modifications ahead of redeployment at the namesake field in the UK North Sea.

It is not yet clear whether Penguins’ arrival will result in any action from environmental campaigners.

Ships such as Greenpeace’s Arctic Sunrise have previously attempted to disrupt the path of oil and gas vessels, such as the Transocean Paul B Lloyd in 2019 when it headed for the Ithaca-BP Vorlich oilfield.

The incident, which cost taxpayers £500,000, saw five Greenpeace protestors handed community service orders.

The rig was later pursued by the Arctic Sunrise on the way to the oilfield.

Q4 results

Shell’s impending results – published 2 February – are expected to round off a year of whopping profits, in which it reported pre-tax profit of $26bn in Q2 and $11.4bn in its Q3 results published in October.

In an update last week, the energy major’s expectations suggested that overall performance would be below that of Q3, and charted the addition of a $2bn liability from new windfall tax policies set by the UK and EU.

Nevertheless, its gas trading arm is forecast to perform “significantly higher” than the previous quarter.

Penguins FPSO

Located around 150 miles north-east of Shetland, Penguins is a redevelopment of a former tie-back field to the Brent Charlie hub.

Operator Shell (50%) is partnered with NEO Energy (50%) on the project, after the latter acquired ExxonMobil’s stake last year.

It is expected to unlock 80 million barrels of oil and deliver peak production of 45,000 barrels per day, the supermajor said at the time of investment decision in 2018.