November’s changes to the oil and gas windfall tax have had a “significant impact” on the profitability of new projects, analysis has found.

Research carried out by Arturo Regalado of Aberdeen University shows the current incarnation of the energy profits levy results in a lower net present value (NPV) for North Sea schemes.

Crucially, he finds the investment allowance included as a sweetener in the policy is “not enough” to offset the higher tax rate for newer fields.

Going back for more

If the oil and gas sector thought the original incarnation of the energy profits levy (EPL) was bad, and it did, then the UK Government’s doubling down of the policy was even worse.

Announced in May 2022, the first North Sea windfall tax increased the headline rate of tax on North Sea producers by 25%, taking the total levy to 65%.

In a bid not to deter investment in new oil and gas projects, at a time when energy security was top of Westminster’s bill, a spending relief mechanism was included.

It meant firms got £91.25 back for £100 spent on new schemes.

Despite the tax, oil and gas majors continued to report bumper global profits, at the same time as the UK grappled with the ongoing cost-of-living crisis.

Calls of the government to cream more off the sector intensified, and it eventually buckled after a change of prime minister.

In his autumn budget, Chancellor Jeremy Hunt increased the rate to 35%, for a 65% headline levy, and extended the policy until 2028.

He also removed a sunset clause linking the EPL to the oil price, and “reduced the allowance” in order to “maintain the value of relief”.

A comparison of the changes

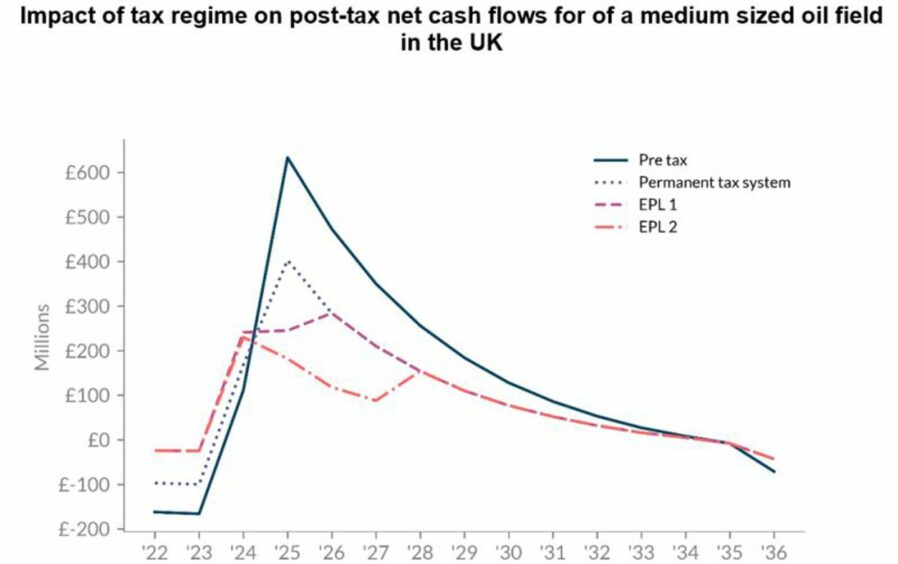

Comparing the profitability of oil and gas projects between the first and second windfall tax, Mr Regalado found the “changes have a significant impact on profitability”.

In a post on LinkedIn, the energy economist, formerly of IHS Markit, said: “As the plot shows, the EPL as designed in summer (EPL 1) made a decent job at smoothing revenue spikes in early years and capturing higher economic rent compared with the permanent system. However, the November changes (EPL 2) severely reduced after tax profits in the early years.

“In terms of NPV, EPL 1 increased the value of a project compared to the permanent system because of the investment allowance. On the contrary, EPL 2 results in a lower NPV compared to the permanent system or EPL 1; the investment allowance is not enough to offset the higher Levy rate.

“The implication being that under EPL 1 projects were certainly attractive because of the investment allowance, but under EPL 2 the decision is more nuanced and NPVs will be generally smaller.”

Recommended for you

© Jordan Pettitt/PA Wire

© Jordan Pettitt/PA Wire