Australian-headquartered Hartshead Resources (ASX: HHR) is making headway on developing a pair of Southern North Sea gas fields.

A geophysical survey contract covering the Anning and Somerville plays has been awarded to GEOxyz UK Limited following a competitive tender and evaluation process.

It is expected that the Geo Ocean III vessel will be mobilised to the fields in April.

The deal also covers the project’s interfiled pipeline locations, and is aimed at providing Hartshead with an interpretation of the “seabed geomechanical and engineering conditions”, as well as an environmental baseline survey and habitat assessment.

A detailed analogue and 2D high resolution study over a 1,000 metre x 1,000 metre square box centred on the Anning and Somerville jacket locations will be drawn up.

The results of the survey will form part of the environmental statement, a key component of the Field Development Plan (FDP) submission.

It is also required for the Platform Front-End Engineering Design (FEED) jacket design verification.

Chris Lewis, Hartshead chief executive, said: “The Phase I development is progressing well, with work across platforms, pipelines, wells and offtake moving forward.

“The survey at the platform locations will confirm seabed conditions for the platform jacket design and provide data for the environment statement to be submitted in 2023. These are all positive steps along the road to first gas.”

Anning and Somerville

Separately, a farm-out process for Anning and Somerville is currently ongoing, with the initial phase of the partial divestment procedure now wrapped up.

Hartshead Resources previously said it has received “high interest” from parties keen to partner up on the UK gas fields, and that it “remains confident” of a successful outcome.

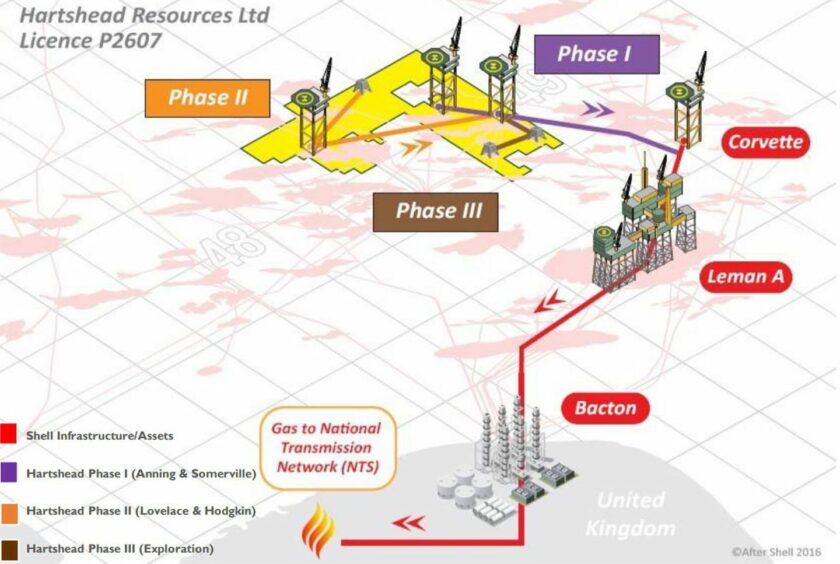

Anning and Somerville are both located in the Southern North Sea in Licence P2607, which also contains the Hodgkin and Lovelace plays.

Hartshead is currently the sole owner and operator of the permit, estimated to hold 2P reserves of 301.5 billion cubic feet of gas (around 52 million barrels of oil equivalent).

To achieve first gas from Anning and Somerville, Hartshead is expected to splash out £110 million between 2023 and 2024, according to analysis from Barclay Pearce Capital (BPC).

That is based on the assumption a partner farms-in to 50% of the phase one project, with total capex forecasted to be nearer to £350m.

Spend is likely to take place between 2023 and 2026, meaning Hartshead can secure windfall tax relief of £160m.

Recommended for you

© Supplied by Hartshead

© Supplied by Hartshead