CNR International has decided to shut down Ninian, one of the greatest oilfields in the North Sea, due to “challenging” UK market conditions.

The Canadian oil firm cited “prevailing regulatory and economic conditions in 2022, along with the increasingly challenging commercial outlook in the UK” for the move.

CNR International is “accelerating the abandonment” of its remaining two platforms at the 45-year-old oilfield: Ninian South and Ninian Central; the latter being the largest platform ever constructed for the UK.

The company has also written down 65 million barrels of oil equivalent from its proved reserves, as the field has become “economically unsustainable”.

CNR International noted the “impact of higher natural gas and carbon costs” on the decision.

It did not directly mention the UK windfall tax, imposed in the last year to create a 75% UK overall tax rate on the industry – but experts say the levy is likely to have played a hand in the decision.

In a statement to Energy Voice, CNR International said it has “no further drilling activity planned” and is proceeding with the shutdown of the South and Central platforms, alongside the field’s wider hub infrastructure.

“The company has made the decision following a detailed review of Ninian opportunities and projected cost burdens, concluding that the field is economically unsustainable.

“The cessation of production and decommissioning of these platforms is likely to take several years and lead to fewer jobs long-term in the North Sea.”

CNR International underlined that it will continue to operate its Tiffany platform in the UK North Sea, as well as manage its offshore Africa operations out of Aberdeen headquarters.

“As a result, no job losses are currently planned,” it added.

‘Rocked by UK regime’

Mike Tholen, sustainability director at trade body Offshore Energies UK (OEUK), said: ”This news is a stark example of how confidence to invest in UK energy security is being rocked by the UK’s current fiscal regime. The Ninian platforms are iconic assets that have contributed thousands of jobs and millions of pounds to the UK.

”We have written to chancellor Jeremy Hunt urging him to focus on creating a long-term competitive regime that supports investment across the energy sector. We also continue to warn that the windfall taxes introduced last year have rocked investor confidence and companies’ investment plans.

“Two windfall taxes on the oil and gas sector plus a windfall tax on the electricity generators have significantly underminedk the appetite of companies and international investors to invest in the UK. The Spring Budget must address energy security where the offshore energy sector has a vital role to play whilst supporting the energy transition.”

The UK Government declined to comment.

Ninian

The Ninian field was discovered in 1974 and started production in 1978.

Professor Alex Kemp, a petroleum economist at Aberdeen University and author of the “Official History of the North Sea”, said Ninian is “one of the giants” of the industry.

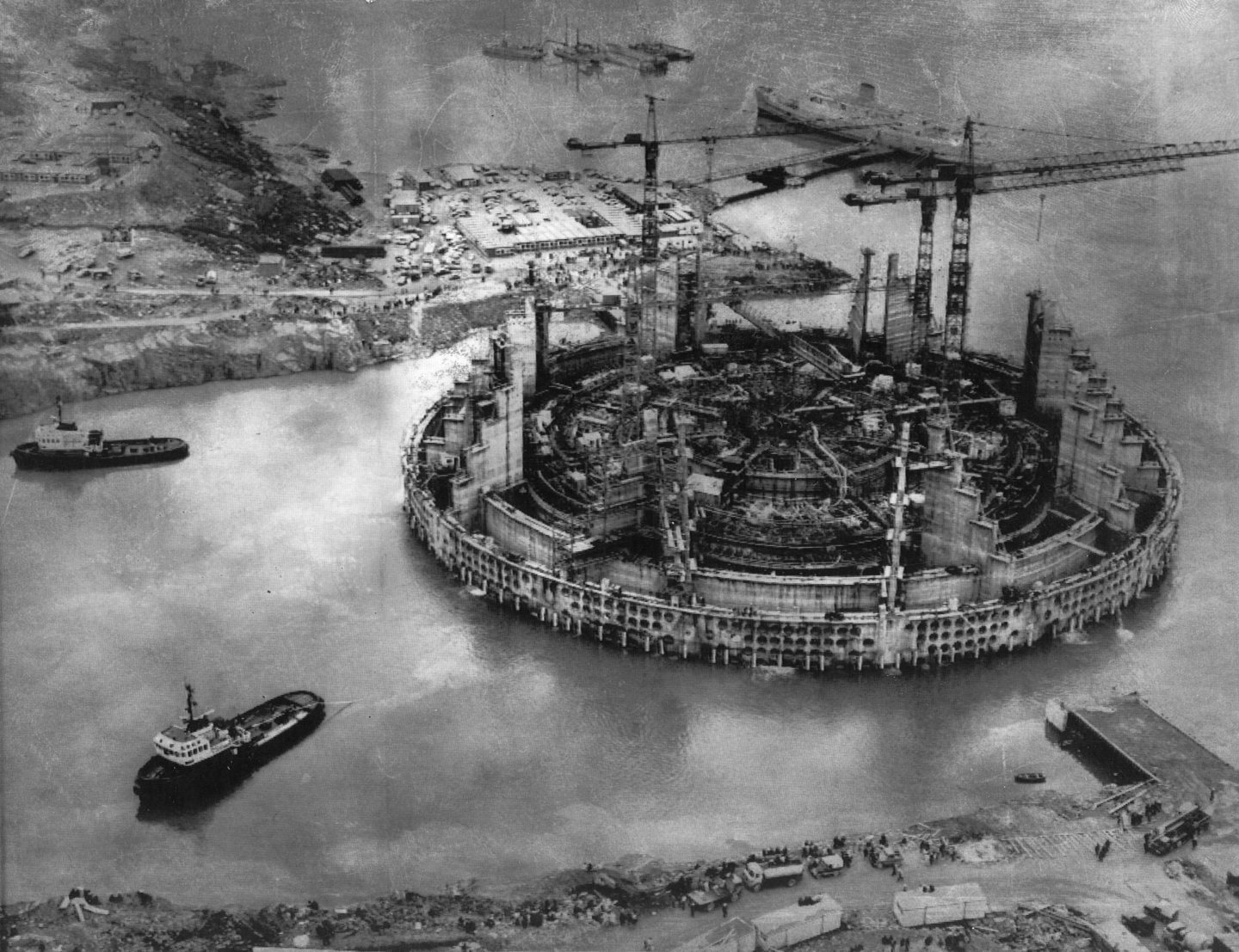

He also highlighted that Ninian Central, constructed at Kishorn on Scotland’s West Coast, is the greatest platform by size ever created for the UK.

Ninian became just the third field in the sector to surpass one billion barrels of oil equivalent produced, after Brent and Forties.

“The Ninian oilfield is one of the giants. When we’re talking about the giants of the UK sector, we’re talking about Forties, Brent, Beryl, Piper and Ninian,” said Professor Kemp.

“With the cost increases in the last year or so, plus very high tax, its not really surprising that its not economically advantageous compared to other opportunities.”

With the 35% windfall tax imposed on the industry last year, the North Sea now has a 75% overall tax rate, which has impacted the Ninian field.

Professor Kemp said: “With very mature fields, yes, you could increase drilling, but on very mature fields we’re likely talking about not that many barrels at a relatively high cost and a 75% tax rate.

“I can understand why very old fields are not going to get a big return.”

Professor Kemp is publishing a study next week on why economics of such projects is now “difficult” in the face of the current regime.

Decom opportunity

Despite being accelerated, the Ninian oilfield shutdown means a new opportunity in a new phase of life for the area through decommissioning, which will drive jobs and activity for years to come.

Sam Long, chief executive of Decom North Sea, said: “Any Cessation of Production/decommissioning announcement sadly reflects the end of an era and will have an impact on employment.

“However, at the same time, it is a reflection of both the age of the basin and an expression of the Energy Transition. This is what the transition looks like, oil and gas production will ultimately decline through economic and technical necessity. Assets such as NC and NS will need to be removed in order to facilitate Net Zero ambitions in upstream oil and gas.

“The decom activity that results from this will support a large number of jobs for a lengthy period and by extension is also an enabler for the Energy Transition, as it helps retain skills and jobs in a growing market, worth $8-10bn per annum globally.”

Recommended for you

© Supplied by P&J

© Supplied by P&J © Supplied by OEUK

© Supplied by OEUK © Supplied by University of Aberde

© Supplied by University of Aberde