Researchers at Aberdeen University have published in-depth analysis of divergent tax rates on UK oil and gas spending.

Aberdeen University said its findings show “investment in at least some new field developments, particularly relatively small ones, is likely to be discouraged”.

That comes despite a UK Energy Security Strategy, designed to increase domestic investment in oil and gas to secure supply of domestic product.

The ‘economic impact of the Energy Profits Levy (EPL) on UKCS investment projects’ paper seeks to cut through the “strong debate” around the government’s controversial fiscal intervention.

Reactions to Westminster’s North Sea windfall tax have been numerous and polarising, since the policy was first mooted over a year ago.

The government has claimed it will spur spend on new energy projects, while industry has decried the impact of the additional levy on investor confidence.

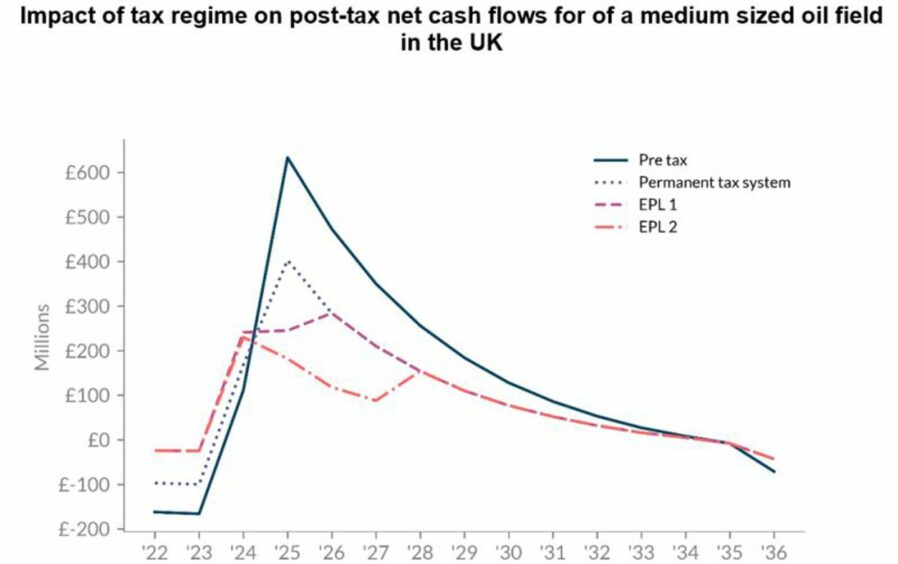

In a bid to paint a true picture of the impact of the EPL, research leads Professor Alexander Kemp and Arturo Regalado developed a “simplified economic model” of three oil fields intended to be typical of North Sea “assets of recent vintage”.

From there they were able to “assess the impact” of the policy on the “economics of UKCS investment projects”.

Drip feed spend

Their research supports claims that the windfall tax “places a higher burden” on North Sea fields that have recently come onstream, rather than “new projects”.

Moreover, they found the fiscal regime pushes operators to phase their spend, delaying first production while also taking advantage of current investment relief.

The report states: “Projects that began before 2022 will have less opportunity to claim the additional tax savings and will be highly exposed to the headline tax rate of 75%.

“The results also suggest that the EPL promotes two behaviours. First, operators are encouraged to invest in new or incremental projects to claim tax relief immediately under the expectation that the EPL will not apply once the projects come online and production ramps up.

“The second incentive leads the operator to phase investment expenditure and production to take advantage of the timing of the investment reliefs and the payments of the EPL. This can lead to a negative impact in the short run where some operators delay investment and first production to benefit from the expiration date of the EPL.”

Tax and tax again

After weeks of speculation, the government announced the EPL at the end of May in a bid to bag some of the “extraordinary” profits being made by oil and gas companies.

An additional 25% tax was slapped on the sector, for a headline rate of 65%, with a spending relief mechanism included to soften the blow and to encourage investment.

But as majors continued to post bumper profits, against a backdrop of a wider UK cost-of-living crisis, pressure on the government to go for more grew, and in November it caved.

An additional 10% was added to the EPL and, crucially, the policy end date was pushed back until 2028 – a clause linking it to the oil price was also scrapped.

Some UK operators have responded by cutting their North Sea investment or shelving planned projects, though there are calls for the government to go even further.

In its simple aim of taxing company’s extraordinary profits, the Aberdeen University research team finds the EPL is “successful”.

But that result “is underpinned by the assumptions made on the beginning of production”, and delayed start-up would reduce the amount of profits taxed.

Moreover, the investment allowance under the amplified North Sea windfall tax “is not enough to offset the taxed profits”, particularly for companies that have no income to offset it against.

“Where other income is available, EPL 2 has reduced the post-tax net present value (NPV) compared to the permanent system. Moreover, the increased rate and

longer duration of the Levy negates the positive impact of EPL 1 where

the profitability of the projects was increased because of the investment

allowance. All this assumes that the capital rationing facing investors is

not increased.

“If the company does not have other income available to claim immediate

tax relief, EPL 2 will severely impact the profitability of small projects

and significantly reduce the value of medium and larger projects. Under

these conditions there is no inbuilt incentive to increase capital

expenditures and the value of projects are significantly diminished.”

Decom impact

There is likely to be a knock-on for decommissioning too, given expenditure on removing and recycling North Sea assets is not tax deductible.

According to the research, the EPL “will clearly reduce cash flows”, creating incentives to “delay decommissioning work”.

The report concludes: “The effects of the updated Energy Profits Levy (EPL 2) on new investment in the UKCS are complex.

“The present study finds that they depend principally on (1) the timing of the investment expenditure and the related income, and (2) whether the investor is in receipt of other ring fence income at the time of the investment. (Of course, like all investments in the petroleum industry, oil price and cost behaviour also have major effects on incentives to invest).

“If the investor has incurred his project investment costs prior to 26th May 2022 and has substantial income in the period 2022-2025 the EPL 2 has a major negative impact on his post-tax returns. The negative effect is particularly pronounced when the income subjected to the EPL 2 occurs in the early years of the producing life of the field.”

OEUK response

This paper follows on from EY research that found a decline of Scotland’s oil and gas production will increase emissions, threaten jobs and could make the country poorer.

Trade body Offshore Energies UK (OEUK) has been one of the most ardent critics of the windfall tax, and has repeatedly warned the 75% risks driving companies out of UK waters and towards more attractive opportunities elsewhere.

Commenting on the report, OEUK sustainability and policy director, Mike Tholen said: “We have seen more companies raising concerns about the future of the North Sea and their plans to invest there – and this report is a stark reminder that the windfall tax and the uncertainty it brings is ultimately bad for business.

“New exploration is needed simply to maintain the natural decline in production of North Sea oil and gas. Without new investment, production will fall even faster and could leave us nearly wholly reliant on imports within this decade – offshoring our people, skills, and emissions to other countries.

“Ahead of the Spring Statement, OEUK urges government to create an environment that encourages investment in our domestic energy to make sure we can support our own energy security, jobs, and economy as we shift to a sustainable UK.

“Our industry wants to work with government to build that future, but we need an attractive and stable fiscal and regulatory regime if we are to achieve it.”

Recommended for you

© Supplied by University of Aberde

© Supplied by University of Aberde © Arturo Regalado

© Arturo Regalado © Supplied by Diamond Offshore

© Supplied by Diamond Offshore © Supplied by OEUK

© Supplied by OEUK