Neptune Energy has become the latest North Sea operator to forecast its windfall tax hit ahead of the Spring Budget tomorrow.

In its annual report published on Tuesday, the independent said the Energy Profits Levy (EPL) will see it take a £53m tax hit.

Last year the firm made $168m (£138m) in operating profits from the UK.

The figures come also alongside new economic analysis which shows its European activities generated nearly $5 billion of value-add.

Neptune said it had provided “record levels” of support for European economies in 2022, with its activities representing some $4.8bn in gross value added (GVA) and supporting more than 9,200 jobs.

The firm posted pre-tax profits of $3 billion last year – more than doubling its takings in 2021 – as oil and gas prices soared across Europe.

However, the effects of the UK’s Energy Profits Levy (EPL) and other European measures meant its tax charge also more than doubled to $2.2bn across the group, making for an effective tax rate of 70%.

The EPL represents 35 percentage points of a 75% headline tax rate that also includes ringfence corporation tax and the supplementary charge.

Windfall levies due by Neptune are expected to total around $65m in 2023 in the UK, alongside a further $40m in royalties for operations in Germany and the Netherlands – the latter of which are due to be paid in 2024.

The additional charges are expected to have “a negative impact on investment intentions, with higher returns now required for projects to be sanctioned in the Netherlands, the UK and Germany,” the company noted.

It comes as fellow producer Harbour Energy says the tax has “wiped out” its UK profits, prompting it to slash investment and jobs – though its claim has been disputed by some economists.

UK GDP impact

Meanwhile, economic impact analysis by Oxford Economics suggested Neptune’s expenditure contributed $771m (£634m) to UK GDP and supported 3,285 jobs.

For every Neptune employee in Britain, data suggests around 12 jobs were supported elsewhere in the domestic economy. UK revenue was just shy of $300m (£247m) in 2022.

This is magnified in Norway, where the group contributed some $2.9bn to GDP, and supported 1,616 jobs, though this came with a lower impact; each Neptune employee in Norway supported four roles elsewhere in the country.

Chief executive Pete Jones said: “The analysis shows the positive impact that Neptune has on the economies and labour markets where we operate. Our investments put supply chains to work, provide energy for both domestic consumption and export, and make an important contribution to energy security.

“Our activities also create a ripple effect that goes even further, driving economic growth and benefitting each of the locations where we work.”

Oxford Economics’ director of economic impact consulting for Europe, Pete Collings, added: “2022 was an extremely volatile year for the European energy markets. High energy prices and prudent cost controls mean Neptune’s direct impacts to European markets maintains its growth.

“Our research shows that Neptune’s activities continue to provide significant economic benefits further down the supply chain and in the consumer economy.”

UK CCS plans

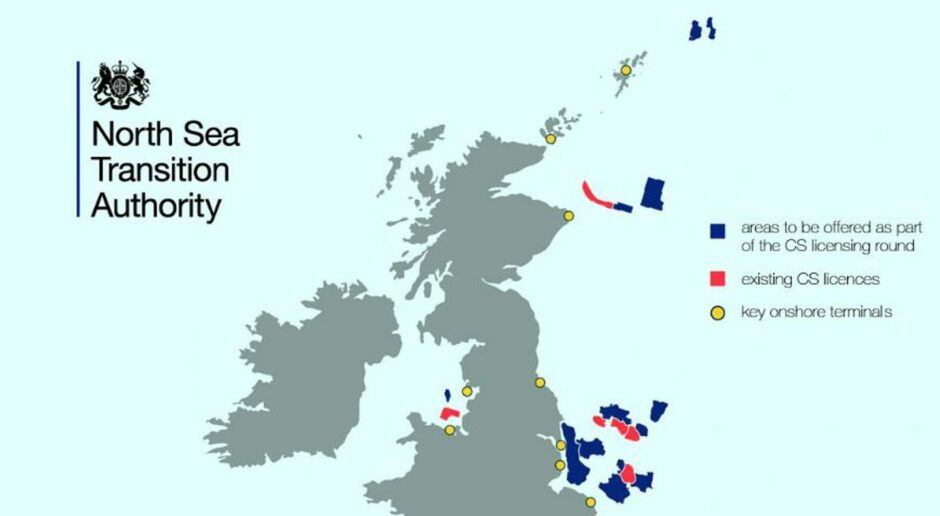

Neptune’s annual report also reveals the group applied for three carbon capture and storage licences in the UK last year.

The North Sea Transition Authority (NSTA) said last September that a total of 26 bids from 19 companies had been submitted for the 13 leases on offer as part of the UK’s first-ever carbon storage licensing round.

Results of the process are expected early this year.

Neptune said development of its Seagull project is continuing, and that start-up remains “on schedule.”

2022 saw completion and testing of the first development well, while operations to complete the second well are ongoing now. Two remaining wells are expected to be drilled in 2023 and brought onstream in 2024.

Increased East Asia investment

Last year also saw the group progress development plans for its Maha and Merakes East fields in Indonesia, both of which will be developed as tie-backs to the Jangkrik FPU.

A plan for development of the Merakes East project was approved in December 2022, with first gas now expected in 2025.

At Maha, Neptune said it expects to submit a PDO in the first half of 2023, subject to finalisation of the unitisation agreement. Geotechnical studies and FEED would then commence in the second half of 2023, ahead of first gas in 2026.

Investment levels are expected to increase in 2023 and 2024 due to the start of development activities at Merakes East and Maha.

In mid-2023 Neptune plans to drill the Geng North exploration well, located in the North Ganal licence targeting a large multi-Tcf gas prospect, with standalone development potential in a success case.

Finally in Australia, it said it would continue to evaluate opportunities to enhance its Petrel project.

Recommended for you

© Supplied by NSTA

© Supplied by NSTA