NEO Energy has struck a deal to acquire operatorship and a 50% stake in the Greater Buchan Area from Jersey Oil and Gas (AIM: JOG) in a deal worth up to $170m.

The private-equity backed player, which is the fifth-largest producer in the UK North Sea, has agreed the farm-in deal for the assets in the Moray Firth.

The deal is worth up to $170m for JOG.

Jersey is selling a 50% working interest in Buchan in return for up to US$33.9m in cash payments, plus US$12.5m carry to take the development through to sanction and a 12.5% carry of the Buchan development costs capped at the approved Field Development Plan cost.

With first phase development costs likely to be up to US$1bn to first oil, that makes a farm out valuation worth up to $170m.

Jersey Oil and Gas said NEO Energy coming in “unlocks the route” to monetising Buchan’s 100 million barrels of oil equivalent in resources and finalising the development solution.

First oil is targeted for 2026 and Jersey said it has “confirmed a short list of attractive options” for GBA which utilise existing North Sea infrastructure.

It added that the “unstable fiscal conditions” due to the UK windfall tax “have been challenging” and the joint venture “will be mindful of the future fiscal attractiveness of the UK” as it progresses.

Jersey said it expects to divest up to 30% more of its stakes in the project.

CEO Andrew Benitz said: “We are delighted to announce this transaction with NEO Energy, a well-funded industry heavyweight and the fifth largest producer in the UKCS. The farm-out marks a major value creation moment for JOG, a significant de-risking of the GBA development programme, from both an operational and funding perspective, and provides the springboard from which to grow the long-term value of the business.

“We are looking forward to working collaboratively with NEO Energy to select the optimal development solution for the GBA and taking the project through to sanction and on into future production.”

NEO Energy, backed by private equity firm HitecVision, has built itself up through M&A deals over they years to become the sector’s number five producer.

In January, the firm named Nexen veteran Paul Harris as its new CEO, replacing dealmaker Russ Alton in the top job.

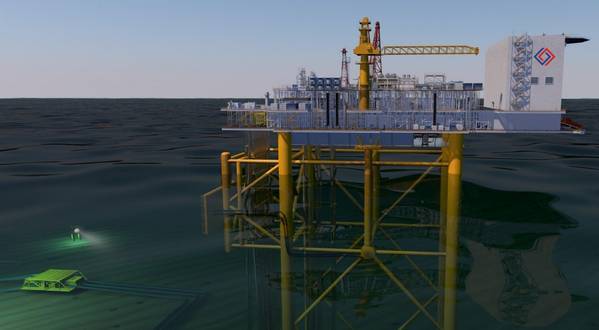

Located on licence P2498 across Blocks 20/5A, 20/5E and 21/1A, the GBA comprises the Buchan oilfield, as well as the J2 and Verbier oil discoveries, and boasts estimated gross 2C economic resources of 162 million barrels of oil equivalent (boe) – making it one of the biggest pre-FID developments in the UK North Sea.

Buchan came on stream in 1981, but production halted in 2017 because the Buchan Alpha platform was unsafe and had to be removed by then-operator Repsol Sinopec.

Jersey has been working on plans for the area for several years, but extended its development timeline in late 2021 to allow for further studies on electrification.

Recommended for you