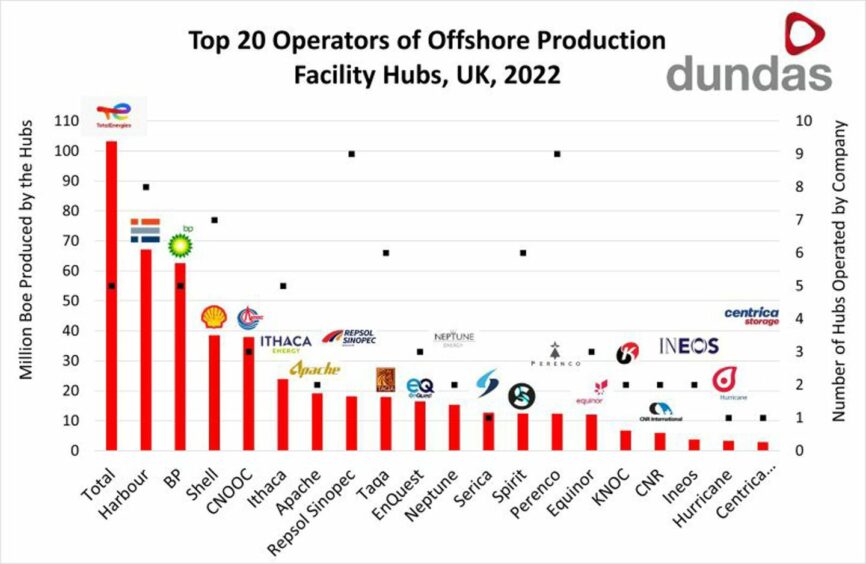

TotalEnergies retained its top spot for the most productive UK hubs in 2022, but Harbour Energy surged to overtake rivals in new data collated by Dundas Consultants.

Analysis by the Aberdeen oil and gas consultants shows that of the 254 E&P companies which hold stakes in UK oil and gas licences, just 20 firms operate UK production hubs responsible for handling 98% of all production last year.

Overall production in 2022 remained steady at 501 million barrels of oil equivalent (boe) – up just 0.7% on 2021 – largely as a result of a planned three-week maintenance outage at the Forties Pipeline System outage in 2021 which suppressed production.

TotalEnergies maintained its lead with the most boe produced across its roughly eight main hubs – including the prolific Elgin and Culzean assets – however Harbour overtook rival BP to clinch the second position.

Harbour remains the UK’s largest produced on a net boe basis, and reported a near 20% production boost in its 2022 results with production averaging 208,000 boepd.

Repsol Sinopec and Perenco tied in operating the most hubs with 9 apiece, with Harbour close behind with eight and Shell’s seven.

Fourth-placed CNOOC was also replaced at the fourth position by Shell, Dundas reported, while NEO Energy exited the top 20 placement altogether as it was overtaken by Centrica.

Previous analysis shows that the top 15 of these hubs alone represent almost 60% of all North Sea production by boe.

In practice though, Dundas notes that operations for some hubs are contracted out to non-E&P service companies, such as Altera, Petrofac, Bumi Armada, Bluewater, BW Offshore.

The report notes that the “excellent production efficiency performance” of last year is therefore mostly managed by the “relatively small” cohort of 20 key companies.

Podium finish

However, rankings at the end of this year may end up looking considerably different.

CNOOC has all but confirmed plans to exit the basin entirely, though the process has reportedly stalled.

The Chinese state-backed group holds interests in a number of North Sea assets, including Buzzard – one of the basin’s largest – as well as Golden Eagle, Scott and Telford.

Rumoured suitors for the assets include Equinor, though analysts have also suggested that Harbour, NEO Energy, Waldorf Production and Ithaca Energy could all be contenders, with Buzzard in particular making for an appealing acquisition target.

Despite its chart-topping status, Harbour too has said it will slash UK spending and jobs in light of the government’s Energy Profits Levy (EPL), while TotalEnergies reported it would cut £100m from its North Sea budget as a result of the additional taxes.

Recommended for you

© Supplied by Dundas Consultants

© Supplied by Dundas Consultants