Viaro Energy’s has successfully bought majority stakes in a series of North Sea fields held by Hartshead Resources (ASX: HHR).

Following approval of the £105 million deal by industry regulator the North Sea Transition Authority (NSTA), all the conditions for the previously announced farm-in have now been met.

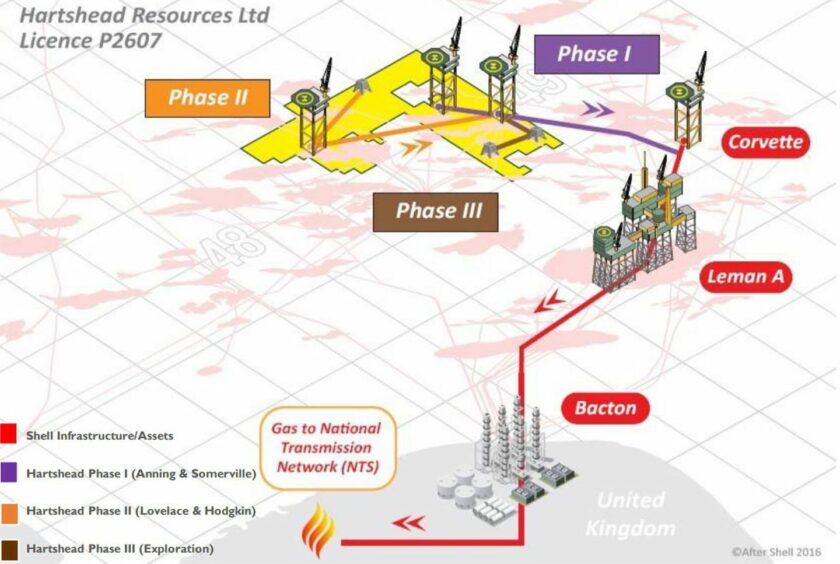

It means Viaro, through its Rockrose Energy subsidiary, is now a 60% owner of Licence P2607 in the Southern North Sea.

Crucially, the region holds the Anning and Somerville fields, as well as the Hodgkin and Lovelace plays.

All in all Australia-headquartered Hartshead believes the permit to hold 2P reserves of 301.5 billion cubic feet of gas, equivalent to around 52 million barrels of oil.

A final investment decision (FID) on Phase 1 of the project, which includes the redevelopment and drilling of Anning and Somerville, is slated for Q3 2023.

Six production wells are planned and are forecast to come on stream in early 2025, at gross peak production rates of 140 million cubic feet of gas a day (mmcfd).

That equates to net 84 mmcfd for Viaro, or 14,000 barrels of oil equivalent per day.

It is understood that Hartshead will retain operatorship for now, and transfer control over “at a mutually agreed future date”.

Announcing the deal on April 5, the firm hailed it as a “major milestone”, which materially de-risks the project and delivers a “clear pathway” to full financing and development.

Francesco Mazzagatti, chief executive of Viaro, said: “We are thankful to the NSTA for the swift approval of the transfer of a 60% stake in Licence P.2607 to our operating subsidiary RockRose, as I believe it shows serious commitment to the overall security of the UK’s domestic energy supply on both sides. Concluding an agreement like this can take several months, so I am pleased that we have managed to do it in just 4 weeks.

“The NSTA has made it a priority to support companies that materially contribute to the economic recovery of clean domestic oil and gas assets, and whose actions are in line with the government initiative to reduce carbon emissions. Viaro remains dedicated to these same goals, and the efficiency with which the Hartshead deal has been realised serves as proof of that.”

Viaro, owned by the namesake commodities group, has been on an acquisition spree of late, having bought up Spark Exploration – another UK-focused Australian firm – in March.

Last month, Mr Mazzagatti told Energy Voice the firm was at a “very advanced stage” for acquisition of “two large production assets”.

Recommended for you

© Supplied by Hartshead

© Supplied by Hartshead