Hisbiscus Petroleum reported its highest group quarterly production to date, even as revenues and output from its North Sea business fell on lower prices.

Malaysian-listed Hibiscus (KLS:HIBISCS) said the last quarter – labelled Q3 under its financial year – had seen “strong operational performance” resulting in average net production of more than 21,200 boe per day of oil, condensate and gas beating production seen in “all previous quarters.”

However, revenues from its North Sea business slipped around 13% on the previous three months to 84.8m ringgit (£14.9m), while daily production also fell from around 3,000 boepd to 2,699 boepd to the end of March 2023.

Pre-tax profits at the unit declined slightly to 29.5m ringgit (£5.2m), though the company said it held onto “healthy” profit margins above 70%.

Lower production meant the firm’s opex per boe rose sharply from $18.67 to above $24, however it said much of this was down to higher production level in the previous quarter due to flush production from wells that were previously shut-in due to a riser failure at the Anasuria FPSO.

It also pointed to additional costs incurred for maintenance work on the turret winch and engineering feasibility studies conducted on the vessel.

More broadly however, it said the Anasuria Cluster has managed much improved operational performance following the completion of the riser replacement last September.

The group also booked a net deferred tax liability of 12.3m ringgit (£2.2m) this quarter owing to the Energy Profits Levy (EPL), though suggested this was a temporary difference based on periodic re-assessment of future estimates on production levels and the likely development of both the Anasuria Area and the Marigold Area.

These charges are expected to reverse over the EPL’s lifetime out to 2028.

Longer-term, the firm maintained it “does not expect any income taxation liability arising from the EPL regime” and said it expects sufficient capital allowances in the current financial year to offset income chargeable to EPL.

Hibiscus said its intention remains to phase its UK capital expenditure program to “optimise the incentives” offered.

“It is also clear that the UK government is incentivising decarbonisation initiatives within the UK oil and gas sector and this is encouraging us to identify further opportunities that will reduce our overall carbon footprint,” it noted.

Last quarter the company said it was in discussions with pipeline owners to extend the scope of its current sales agreement for the Anasuria Cluster to include production from Teal West.

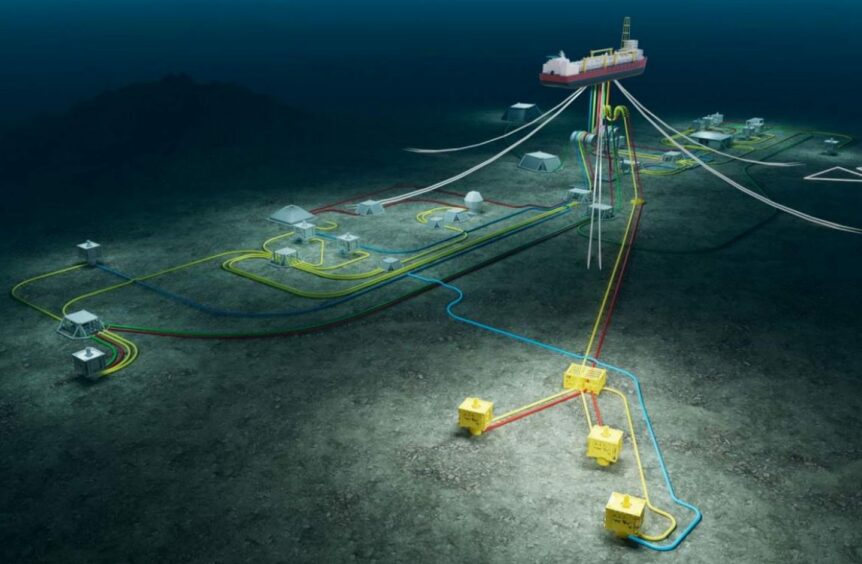

Meanwhile it is working on plans for the Marigold Area via a tieback to the Piper Bravo platform.

So far this financial year the group said it had invested just shy of 110 million ringgit (£19.3m) in the North Sea – £7.4m for Teal West, £6m for the Anasuria Cluster and £5.7m for the Marigold West and Sunflower fields.

Malaysian drilling record

Group-wide pre-tax profit for the quarter reached 150m ringgit (£26m), prompting the company to approve a second interim dividend of 0.75 sen per share.

During the quarter it also completed the longest well drilled ever in Malaysia, during work at the Bunga Orkid field in the northern area of the PM3 CAA PSC.

The well was drilled to a total depth of approximately 7 kilometres and produced at an initial rate of approximately 4,000 bbls of oil per day. In the interest of “prudent reservoir management” Hibiscus said the production rate is currently being held at about 3,000 barrels per day.

Commenting on the full-year outlook, managing director Kenneth Pereira said: “Our operational and technical capabilities have been showcased by the drilling and completion of the longest well in Malaysia, the BOC-29ST1, with a total measured depth of approximately 7km.

“In doing so, we have achieved a major technical milestone and positive performance outcome for our company and the wider Malaysian oil and gas industry.

“We were also successful in discovering gas during the drilling of the Bunga Lavatera-1 well in the PM3 CAA and unlocking approximately 1.6 MMboe in incremental net 2P gas reserves Our success in identifying and converting this prospect to a commercially viable opportunity gives us confidence that we have a good understanding of the PM3 CAA geology.”

Recommended for you