Wood Mackenzie, the respected energy consultancy, has said Labour’s decision to halt new licences would have “minimal impact” on North Sea investment.

As leader Sir Keir Starmer unpacked his set-piece speech outlining the policy in Edinburgh yesterday, industry leaders said it threatens thousands of jobs and would be “damaging for the industry, for consumers and for the UK’s net zero ambitions”.

But Wood Mackenzie, in a note sent Monday evening, said the actual impact would be viewed “as a largely symbolic gesture”, with Labour having confirmed that all activity on existing licences will be allowed to continue.

The vast majority of the North Sea’s remaining resources sit within existing licences, Wood Mackenzie highlighted. The rest are “sanction-ready” projects expected to be approved before Labour comes to power – like Rosebank and Cambo – which Starmer has said his party would respect.

Other factors are expected to be far more important in terms of driving investment decisions, like the North Sea windfall tax.

Principal analyst for Upstream Greg Roddick said that Mr Starmer’s announcement could even be interpreted as a softening of Labour’s previous position.

‘Largely symbolic’

According to Wood Mackenzie, the UK has yet-to-find prospective resources of just over one billion barrels of oil equivalent.

The remainder – about seven billion barrels, all told – are within existing fields and other “sanction-ready” projects.

“Labour has said changes would only impact the offer of new licences,” Mr. Roddick said.

“Opportunities in existing licences are more material and, in recent years, exploration drilling has already dropped to historic lows.”

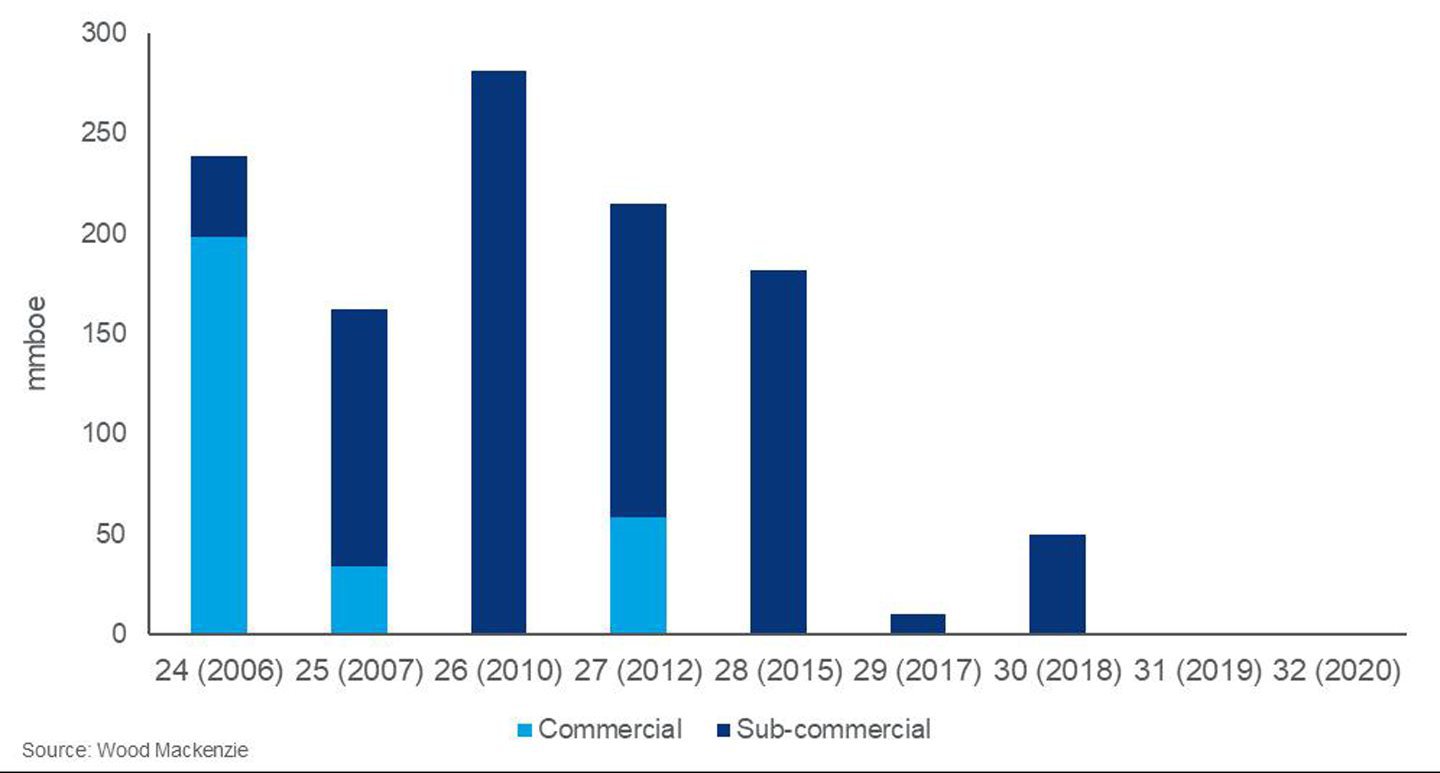

Underlining that point, it said the last new North Sea acreage to be awarded which has seen a commercial discovery was in 2012. (Pensacola – a discovery made this year and awarded in a 2014 licence – is still held as subcommercial by WoodMac as it goes through appraisal.)

He added: “In short, the industry has long had the opportunity to secure the most prospective UK acreage and has largely already done so.

“There is no guarantee that new, commercial discoveries will be found. Those that are will likely be small and are unlikely to reverse the trend given the maturity of the UK Continental Shelf.

“Given the challenging environment in the UK, open acreage would be considered much higher-risk and is unlikely to attract the attention of the industry’s leading explorers.”

Labour North Sea: Other factors more important

North Sea Oil & Gas Analyst Jessica Brewer said Labour’s decision to stop new exploration licences would not impact future investment decisions as much as other factors.

“The introduction of a windfall tax (the Energy Profits Levy) and the uncertainty around the Labour Party’s fiscal proposals will be the biggest hurdles facing investment in new oil and gas projects in the UK,” she said.

WoodMac estimates there are almost five billion barrels of oil equivalent to be produced from onstream and approved UK oil and gas fields.

Another two billion boe comes from pre-final investment decision (FID) projects, reserve growth and existing discoveries.

“Pre-FID greenfield projects (which add up to nearly 2 billion boe) are the most obvious development candidates, given many are ‘sanction ready’,” Ms. Brewer said.

“Labour has indicated new developments on existing licences will be respected. The outcome of fiscal policy will have a greater bearing on projects in the longer-term.”

On Monday, Sir Ian Wood said “The suggested ban on future oil and gas licenses is very concerning and economically and environmentally damaging.

“It makes absolutely no sense to reduce our reliance on domestic oil and gas production only to increase imports from overseas and place in jeopardy tens of thousands of jobs and yet this is exactly what will happen if this approach is taken.”

David Whitehouse, CEO of trade body Offshore Energies UK (OEUK), said the policy to end exploration after the next election was “too much too soon.”

Recommended for you

© Supplied by Wood Mackenzie

© Supplied by Wood Mackenzie